Snyk scores another $196M as valuation drops 12% to $7.4B

Snyk hasn’t been afraid to take money over the years, scoring an ever larger investment haul with each passing round, and with each one has come a correspondingly large valuation increase. This time, that particular streak ended, but Snyk snagged another $196.5 million investment with its valuation down about 12% to $7.4 billion since its previous round in September 2021.

That previous round was $530 million with $300 million in primary funding and the remaining $230 million in secondary funding to pay off early investors and employees, anxious to see some return on their equity. The primary money came on an $8.5 billion valuation, $1.1 billion higher than today’s round.

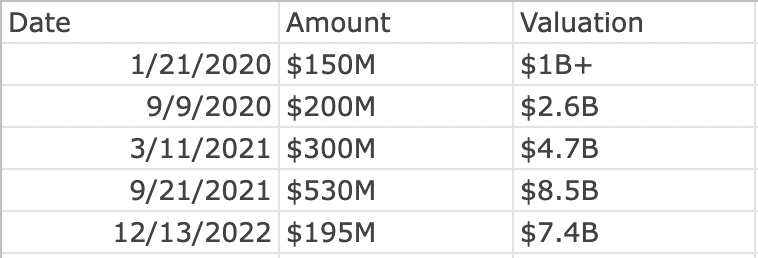

It’s worth noting, however, that even with that down round, the previous round was up $3.8 billion over the March round. You can see the company’s ascent up until this round in the chart below:

Snyk CEO Peter McKay says getting the right terms was more essential than increasing the valuation, especially in the current market. “So, it was more important that we get the right terms than that I absolutely have to get to $8.6 billion. If the market is saying you’re at 7.4, then we’re at 7.4,” he said.

Part of it is that even though the company is growing, the market has changed since the last round. “Despite the headwinds that I think everybody sees in the market, we were able to still grow over 100% in new logos and in revenue, so we’re very pleased,” he said.

The company still has most of the money from last year’s round in the bank, but they saw an opportunity to get more cash, which could help them as they try to grow the platform, both organically and via acquisitions.

“What you do with a market like this is you focus on efficiency in your business, you focus on getting to free cash flow faster. You make sure your balance sheet is as strong as it can be. And you be opportunistic,” he said.

He sees that Snyk’s market around developer security remains fragmented, and he sees an opportunity to consolidate by buying companies when it makes sense and taking advantage of what he sees as a very large TAM. McKay says that the company has tripled in size since its last round of funding from 400 employees to 1,200, but he sees ways for the company to be more efficient for investors in other ways, shooting to get to cash flow break even by 2024 as a prime example.

Most security startups either grow into a platform or they get absorbed by one, and Snyk apparently wants to be a platform player at this point. This cash should help the company as it waits out the stock market for a more friendly IPO environment.

“We really haven’t set any time. We think that there’ll be a wave [of IPOs] in the first half of 2023. We’ll watch and see how they do and based on that, maybe we’ll make a decision on what we do…I don’t even want to speculate on a time because who knows when that is? Nobody has that answer,” he said.

Today’s investment was funded by new investors Evolution Equity Partners, G Squared, Irving Investors and Qatar Investment Authority. Existing investors Boldstart Ventures, Sands Capital and Tiger Global also participated. The company has now raised $1.075 billion.