2022 global smartphone shipments were the lowest in nearly a decade

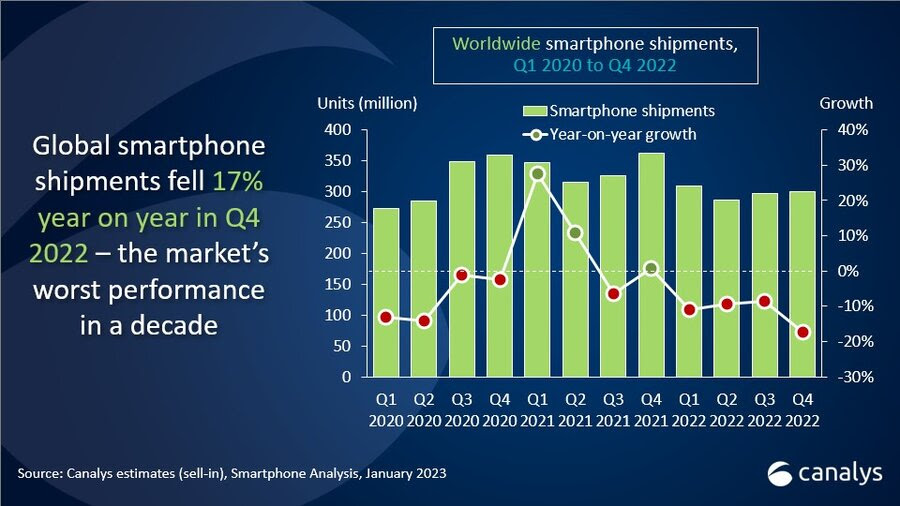

One of these days I’ll have some positive news to share about the global smartphone market. Today is not that day. The industry capped off another dismal year with a 17% year over year drop for Q4. That number puts the full year’s shipping figures 11% below 2021, per new numbers from Canalys, which refer to it as “an extremely challenging year for all vendors.”

It’s been one thing after another from the industry. Slowing figures pre-dated 2020, while the pandemic and its various knock-on effects have continued tossing up roadblocks. For 2022, the same macroeconomic headwinds that have impacted practically every facet of life took their own toll on the industry. Notably, the figures for the quarter and the year were at their lowest in nearly a decade. The firm tells TechCrunch, “we have to go back to 2013 to find lower numbers — and back then the market situation was very different as the technology was a lot more emerging.”

Image Credits: Canalys

Apple returned to the top spot for Q4, at a quarter of the total market. Samsung held onto No. 2, but still captured the top spot for the entirety of 2022.

“The channel is highly cautious with taking on new inventory, contributing to low shipments in Q4,” analyst Runar Bjørhovde said in a new release. “Backed by strong promotional incentives from vendors and channels, the holiday sales season helped reduce inventory levels. While low-to-mid-range demand fell fast in previous quarters, high-end demand began to show weakness in Q4. The market’s performance in Q4 2022 stands in stark contrast to Q4 2021, which saw surging demand and easing supply issues.”

It’s a long way of saying the industry saw a bit of a rebound when supply chain constraints began to ease up, but additional external forces reversed those positive trends — and then some. The firm doesn’t expect much in the way of rebound for the remainder of 2023, either, predicting that growth will be “flat to marginal,” as economic uncertainty and inflation remains.

Unemployment, interest rate hikes and other issues are expected to have an adverse effect on “mid-to-high-end-dominated markets,” including North America and parts of Europe. That should, to some extent, be counteracted by a bump from China, as the world’s largest smartphone market continues the reopening process.