Bitcoin-based app Strike expands in Philippines to grow cross-border payment solutions

Strike, a Bitcoin-based payment network and financial app, is expanding to the Philippines to grow cross-border payments and remittance markets.

“The Philippines is one of the biggest remitting markets in the world, especially from the United States,” Jack Mallers, CEO of Strike, said to TechCrunch. In 2021, about $12.7 billion in cash remittances was sent from U.S.-based Filipinos to the Philippines, according to Statista data.

“As far as the technology we build, it’s one of the lowest-hanging fruits — international payments are a huge pain and always have been. There’s been incremental innovation from SWIFT and Western Union, but it’s still incredibly difficult.”

Even across Western countries, traditional cross-border money transfers services are slower as bank transfers can take multiple days for funds to move from one account to another.

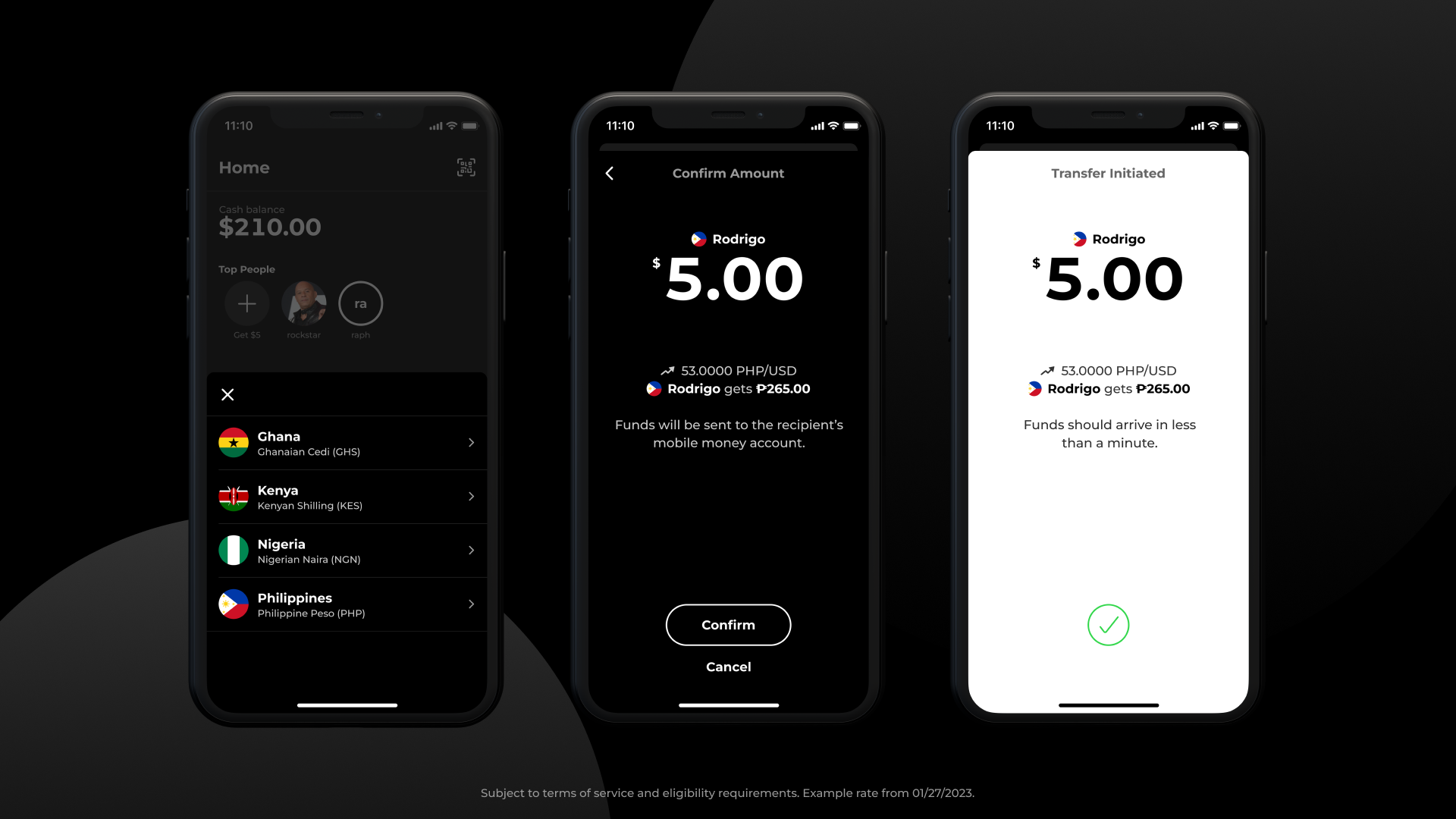

Strike uses instantaneous, low-cost micropayments through the Lightning Network, a layer-2 payment protocol on top of Bitcoin, which allows millions to billions of transactions per second to transpire across the platform. The app’s platform also allows users to transfer U.S. dollars to local fiat currencies, like the Philippine peso, for less than 1 cent per transaction, Mallers noted.

Image Credits: Strike (opens in a new window)

“None of our users have to touch Bitcoin,” Mallers said. The app uses Bitcoin to transfer money from one user’s account to another, regardless of its price. “The aspiration of the business is to hide Bitcoin under the hood” so users could benefit from its payment network, he added.

For example, if a customer wants to take $5 and send it to a country like the Philippines, the Bitcoin is converted over the Lightning Network and reconverted into the local currency “in the order of seconds to minutes as opposed to days or weeks,” Mallers said.

Aside from the Philippines, Strike plans on expanding further in the Latin American and African regions as well due to the “extreme amount of demand,” Mallers shared. “We’re seeing partners pop up all over the world.”

Now, Strike is gaining demand and partners seeking out integrations from everywhere between the U.K. and throughout Europe all the way to “20 new countries we’ll potentially add in February in Africa,” Mallers added.

Earlier this month, Strike partnered with payments provider Fiserv, the parent company of Clover (the fancy white digital register at many small businesses today), to expand its services.

Last year, it raised $80 million in a Series B round to drive its efforts to grow payment solutions for merchants, marketplaces and financial institutions, the company said. Strike also joined forces with Visa in August 2022 to launch a rewards card that pairs with its application.

In general, the company’s partnerships and announcement point to its focus on growing the remittance market through its application and other alternative avenues, like Clover.

“The goal is to make cross-border payments and global payments cheaper and faster,” Mallers said. “But also more accessible. There’s huge value here for financial inclusion.”

Some Strike users will send amounts as little as 10 cents to their families, Mallers shared. But through a traditional financial system, the fees would outweigh the benefits, he added. “We can process a 10-cent payment…and you don’t have to log into Chase for an international wire transfer.”

Going forward, there are opportunities to improve the existing remittance markets while also unlocking new markets, he added. “You’ll start to see a renaissance of tools really closing that big delta gap and you’ll start seeing more financial institutions like Square and CashApp take advantage of this.”

Over the next decade, Mallers thinks remittance networks and applications like Lightning and Strike will expand opportunities from the 2 billion to 3 billion people that are “generally included in the global international payments system” to all 8 billion.

“That’ll be like a renaissance moment,” Mallers said. “It’s a really huge deal.”