Privacy assistant Jumbo tears down its paywall

Jumbo, an app that lets you control your privacy on the web, is hitting the reset button — sort of. While the company is still focused on privacy and security, users can now download and use all features for free as the premium subscription is gone. In addition to this pricing update, Jumbo’s newest version now includes free identity theft insurance for people based in the U.S.

“Something we didn’t anticipate and that we’re tying to fix today is that a paid product creates an important barrier to entry,” Jumbo founder and CEO Pierre Valade told me. Valade previously founded Sunrise, a popular calendar app that was acquired by Microsoft.

Jumbo’s flagship feature is a dashboard that lets you control your privacy settings across various online services. You can use the app to connect to your Facebook, LinkedIn or Instagram account and adjust privacy settings, such as the visibility of posts you’re tagged in.

For social networks in particular, Jumbo can delete and archive old posts. For instance, you can use the app to delete tweets that are older than a certain threshold. Jumbo saves everything on your phone in a local storage area called the Vault.

And Jumbo stands out from other privacy assistants as it doesn’t rely on APIs to control your online accounts. Instead, Jumbo works more or less like a web browser in the background. Everything happens on your device (which is great for privacy) and the startup isn’t limited to what’s possible with official APIs.

The best business model on the internet is B2B software as a service. Pierre Valade

In many ways, Jumbo exposes privacy settings to people who don’t know that these settings exist and don’t understand what they’re supposed to do. Sure, anyone can already check Google’s account page and delete Google Maps activities, past web searches and YouTube keywords.

But Jumbo centralizes all these settings in a simple consumer app. It regularly scans your account activity and even tells you that you should probably enable two-factor authentication to improve your account’s security.

At first, Jumbo thought that consumer subscription was the only business model that could turn Jumbo into a sustainable business without any compromise. It’s easy to understand how companies make money when there’s a paid subscription.

“We reached 25,000 paid subscribers and we realized that it was quite small for a consumer subscription business,” Valade said. “And there was another issue — churn.”

Every year, around 40% of Jumbo users would keep their subscription active. If you’ve run a subscription business, you know that this isn’t a bad churn rate. But it means that the company had to spend money on marketing and paid installs to compensate this churn rate. Even with paid subscriptions, Jumbo wasn’t turning a profit.

Hence, today’s pivot. Going forward, Jumbo will be a free consumer app with a business offering coming later this year.

This hasn’t been an easy decision. Jumbo is a smaller company today, with around 25 employees — the marketing team has been laid off. Valade told me that at some point he thought about calling it a day and selling the company to the highest bidder.

“We realized that we were limiting our growth rate because we offer a paid product. The best business model on the internet is B2B software as a service,” Valade said.

The startup raised some fresh funding in a $17 million round led by Index Ventures with some existing investors and several angel investors also participating. The company has reached a post-money valuation of $77 million.

Image Credits: Jumbo

A viral loop around identity theft

Tearing down the paywall is one thing, but how will people hear about Jumbo now? Pierre Valade is adding identity theft insurance to the app, and turning this insurance product into a social feature.

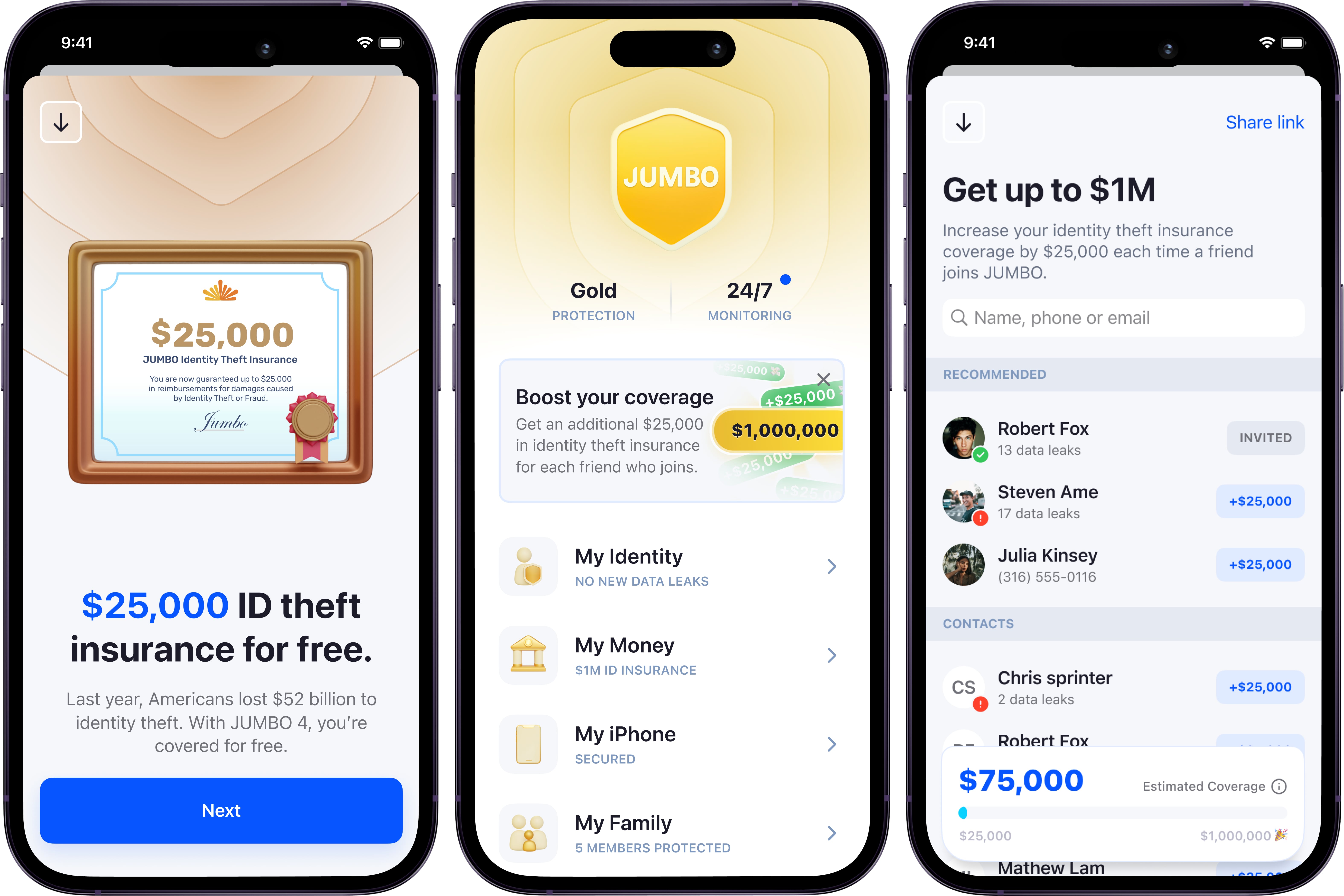

When you download the app, Jumbo now offers identity theft insurance for free in the U.S. with up to $25,000 in coverage through IdentityForce. Identity theft is a big issue in the U.S. with malicious people opening unauthorized credit cards under someone else’s name and other wrongdoings that can cost you a lot of money.

Currently, identity theft insurance products are mostly paid products. For example, Norton offers LifeLock for $125 per year while IDShield plans start at $15 per month.

I’m really focused on demonstrating that the free product can truly grow significantly faster than before. Pierre Valade

Jumbo’s new insurance product pairs well with the rest of the app as Jumbo alerts you in case of a new data breach that may contain some personal information (using SpyCloud’s data). Usually, when you’re aware of a new data breach, you don’t really know what you’re supposed to do.

Every time you invite a friend or a family member to Jumbo, it increases your insurance coverage by $25,000 with a hard cap at $1,000,000. Essentially, it encourages Jumbo users to invite other people to the app.

As for the business offering? “Today, we don’t really know the feature set [for businesses]. Right now, I’m really focused on demonstrating that the free product can truly grow significantly faster than before,” Valade told me.

Some companies could pay for Jumbo to encourage their employees to set up two-factor authentication on their personal accounts, for instance. I asked about other business-oriented security startups like Riot. “We sell simplicity,” he told me. “Phishing training is not really consumer friendly.”

Let’s see how this B2B pivot will play out, as Jumbo is still very much a consumer app for now. But it seems like Valade feels better about his startup’s positioning now.

“We were frustrated with the fact that we had to oversell the product to consumers,” he said. “You end up scaring people in order to convince them, and we were becoming uncomfortable with that.”