This Week in Apps: Twitter alternative winners and losers, BeReal declines, iOS web apps to get notifications

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app economy in 2023 hit a few snags, as consumer spending last year dropped for the first time by 2% to $167 billion, according to data.ai’s “State of Mobile” report. However, downloads are continuing to grow, up 11% year-over-year in 2022 to reach 255 billion. Consumers are also spending more time in mobile apps than ever before. On Android devices alone, hours spent in 2022 grew 9%, reaching 4.1 trillion.

This Week in Apps offers a way to keep up with this fast-moving industry in one place with the latest from the world of apps, including news, updates, startup fundings, mergers and acquisitions, and much more.

Do you want This Week in Apps in your inbox every Saturday? Sign up here: techcrunch.com/newsletters

This week’s theme seems to be a decline in growth for some much-buzzed-about apps, including a group of Twitter alternatives, AI photo apps and even the BeReal. Let’s dive in.

How are the Twitter alternatives faring now?

Image Credits: Bryce Durbin / TechCrunch

Was there a Twitter exodus or just a Twitter pause? Did it even matter? This week, TechCrunch dug into new data in order to take a look at how a range of “Twitter alternatives” have fared in the months following Elon Musk’s acquisition of the popular microblogging network, now that the burst of new installs driven by his takeover has tapered off. The data indicates that many apps continue to grow to a lesser degree while other apps have seen growth decline. But it also shows that Twitter itself was never significantly impacted, at least in terms of new app installs.

Of course, app installs is only one window into this data. But private companies don’t often share figures related to active usage, so tracking consumer demand through app downloads is one way to determine market interest. What’s interesting here is that we found Twitter installs have trended back up after earlier declines. Downloads grew from 16.6 million installs in October to 18.6 million in November as Musk took over, then dropped in December to 16.9 million. Last month, they again jumped back to 18.6 million installs, giving Twitter the same 24.8% growth rate it had in November.

Meanwhile, other Twitter alternatives have seen drop-offs in growth. While our report examined Reddit and Discord, neither of these seem to have had their fortunes directly tied to Twitter’s ups and downs, as it turned out. Other alternatives like Hive, GETTR and Tribel have seen their growth slow. Tribel, for instance, only added 1,100 new downloads in January. Tumblr certainly had a November bump driven by the Twitter exodus as well but is still up slightly higher in December (510,000 installs) and January (480,000) compared with September and October.

Mastodon’s installs were down quite a bit from November’s peak of 2.9 million monthly downloads. It still managed to gain 180,000 new installs in January — that’s 169,000 more installs than it had in September 2022. So it’s not in decline yet.

If anything, the biggest boost to the wider Twitter alternative app ecosystem hinges on new user awareness of the Fediverse and Mastodon. Even if the Mastodon app itself hasn’t transformed into a dominant force, it’s early days. Fediverse growth could ultimately be a trend that plays out over a longer period of time than just a few months post-Twitter acquisition, as more apps join the decentralization movement.

Web apps will get to act more like real apps on iPhone

Image Credits: WebKit blog (opens in a new window)

One of the more notable changes coming out of the iOS 16.4 beta is the news that Apple will now allow mobile web applications to function more like native applications by providing them access to iOS’s push notification system. That means web apps that get added to a user’s Home Screen can request permission to receive push notifications if the user opts in — for instance by tapping on a subscribe button to receive updates, as a post on the WebKit blog explains. This would then allow the end user to manage their push notifications for the app in their Settings, just as they would for any other native iOS or iPadOS app.

The notifications would work just like native notifications, too, appearing in all areas where you’d expect to see them, like the Notification Center, Lock Screen and on a paired Apple Watch. The web apps’ icon can also display a badge with a badge count and will work with Focus Modes. What’s more, users can even add multiple versions of the same web app to their Home Screen, each with their own settings — something that can be useful for separating work and personal use of some apps or multiple accounts, the post notes.

Push notifications tied to web browsers is not new technology, but it’s interesting to see Apple embrace the feature now that it’s under pressure to demonstrate that it’s not engaging in anti-competitive behavior. With this change, the company can point to web apps as an alternative to its App Store, claiming they have the same ability to target and reach iPhone and iPad users as native apps do.

Are we still Being Real?

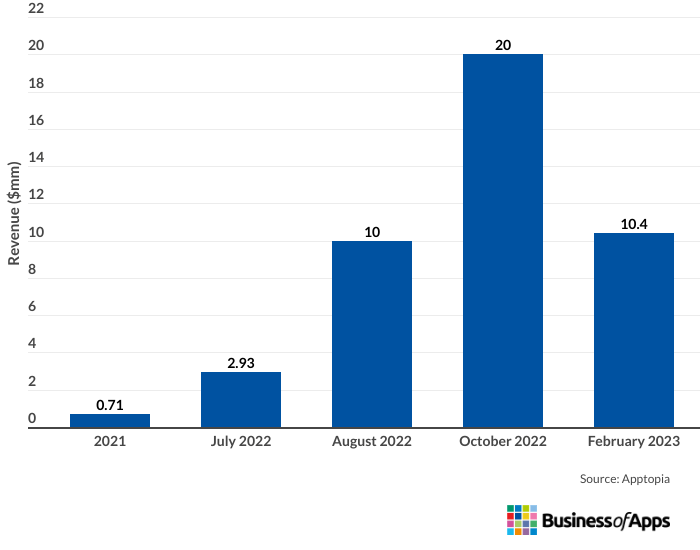

Is the shine wearing off BeReal? Interesting data out this week from Apptopia (via Business of Apps) indicates that BeReal may have already peaked. The app is estimated to have hit 20 million daily active users in October 2022, but that’s since dropped to 10.4 million. In addition, its monthly downloads fell from 12 million in September 2022 to 3.3 million in January, the report noted, citing data from AppMagic.

TechCrunch previously reported there were indications that BeReal wasn’t gaining enough ground to maintain its high ranks after going viral. The app in October was said to be seeing only 9% of its Android users open it daily. The app demands little of its users’ time — its push notification prompts a one-time use per day, and the majority weren’t even giving it that. Some may have felt that data was unfair or unhelpful, particularly given BeReal’s traction with U.S. teens and young adults, most of whom are on iPhone. But in combination with the new data, it’s perhaps more of a concern.

The company has faced challenges as its once-daily notification gimmick has been ripped off by Instagram, Snapchat and BeReal. Meanwhile, the app itself has remained unchanged. There’s nothing to addict or re-engage users — which is kind of the point. The founders’ goal is to create a new type of social experience that doesn’t demand huge chunks of time and strives for authenticity. But they also haven’t laid out a vision for its future, despite a $60 million Series B — a number that suggests a grand plan should be in store or at least monetization. It’s not a lifestyle business, after all. It’s unclear where BeReal is going next at this point.

The AI photo app trend has fizzled

Speaking of apps in decline, that’s where the AI photo app trend has ended up.

Over the past several months, AI-powered photo apps had been going viral on the App Store as consumers explored AI-powered experiences like Lensa AI’s “magic avatars” feature and other apps promising to turn text into images using AI tech. But new data indicates consumer interest in AI photo apps has fallen as quickly as it rose.

At their height of popularity, the top AI photo apps topped 4.3 million daily downloads and ~$1.8 million per day in consumer spending via in-app purchases. As of this past week, the same group of apps saw only around 952,000 combined downloads and around $507,000 in consumer spending, and the numbers continue to fall.

Consumers seemed to respond to the ethical concerns being raised around the apps. As TechCrunch had reported at the time, some people began to leave comments on AI photos and profile pictures posted on social media to tell people not to use an app that steals from artists. This backlash likely quelled some of the demand for AI art. After all, it’s not much fun to use an AI pic for your profile if you’re essentially being accused of theft when doing so.

Apple

- Apple released iOS 16.3.1, iPadOS 16.3.1 and macOS Ventura 13.2.1 to patch a WebKit vulnerability. On its security update page, Apple wrote that it “is aware of a report that this issue may have been actively exploited.”

- Apple released iOS 16.4’s first beta, which brings a number of new features, including 31 new emojis like the pink heart and shaking face; the ability for web apps on iPhone and iPad to access push notifications and display badges; support for rich content previews of Mastodon posts in iMessage; and new features for Apple Podcasts including a new “Channels” section and CarPlay updates.

- The first macOS Ventura 13.3 beta was released as well, along with tvOS 16.4 and watchOS 9.4.

- Apple is making it easier for registered developers to install iOS betas by allowing them to register their accounts in order to be opted into a new option that lets them install betas directly from Software Updates. The system will replace the profiles previously required. But this change means only registered developers can install the developer beta — those who aren’t registered can only install the public beta instead.

- Apple officially released iOS 16 adoption figures, demonstrating it’s higher than iOS 15 with 81% of all iPhones from 2019 and on running the newest software. In addition, 72% of all iPhones are running iOS 16. Not as many iPads have updated, though, as only 50% of all iPads are running iPadOS 16, while 53% of those introduced in the last four years are.

Google/Android

- Google said a small percentage of Android 13 devices will be enrolled in the beta trials of its new privacy sandbox, an interest-based ad-targeting system. Initial ad partners for the trial include TechCrunch’s parent Yahoo, mobile games maker Rovio, mobility firm Wolt, cross-platform games engine Unity and mobile marketing platforms AppsFlyer, InMobi Exchange and Adjust.

- Google announced that Play Games Services (PGS) is rolling out next-generation Player IDs. With this change, says Google, “the first time a user plays a game, they will always be assigned a unique next-generation Player ID that will remain consistent regardless of the device or platform a user plays a game on, but which will vary from game to game.”

- Samsung’s Galaxy S23 Android phone’s new Message Guard feature is said to prevent zero-click exploits via messaging apps.

Social

- At its investor day, Snap announced that Snapchat now has 750 million+ monthly active users, up 25% from April 2022 and noted 150 million of those users are in North America. Among a bevy of metrics it shared, it also said its Snapchat+ $3.99/month subscription now has 2.5 million subscribers. The company said it would focus more on its Direct Response ads business going forward, invest in AR and continue M&A. It spoke little about its Spectacles and declined to answer a question on how the latest in AI would impact its business.

- TikTok may be developing a paywalled product where creators could charge $1 or more for videos. It’s also said to be working on a revamped Creator Fund which would pay creators with 100,000+ followers.

- Popular Mastodon client Ivory got something Twitter users waited eons for: an edit button.

- Twitter began allowing cannabis ads on its platform in U.S. states where it’s legal. The ads will promote brands and offer info but not facilitate direct sales. The move comes after many larger Twitter advertisers put their campaigns on pause, forcing Twitter to recoup its business elsewhere.

- Instagram launched Instagram Channels, a broadcast chat feature that allows creators to share public, one-to-many messages with fans and followers. The feature supports both text and images and is initially available to creators in the U.S.

- TikTok added new dedicated feeds alongside its For You and Following feeds that let users browse videos by categories like “Sports,” “Fashion,” “Gaming” and “Food.”

AR

Image Credits: Snap

- Snapchat said it’s adding ray tracing support to its AR Lens Studio for developers globally. The technical capability allows for realistic renderings of light and shine on AR artifacts. Snap is partnering with Tiffany & Co. to let users try on and purchase bracelets using AR using this new feature.

Commerce

- Following Facebook, Instagram will shut down its live shopping feature on March 16, 2023 to instead put its focus on ads that allow users to discover businesses and Shops on the app. With the change, Instagram users will no longer be able to tag products while livestreaming — a capability that has been broadly available to U.S. businesses and creators since 2020.

- Meanwhile, TikTok has more brands testing out its own in-app commerce features with TikTok Shop in the U.S. While the tests have been underway since November, TikTok confirmed more companies like PacSun, Revolve and Willow Boutique, as well as beauty brand KimChi Chic, are now on board, follow an Ad Age report.

Media and Entertainment

- Big news in the world of YouTube as Susan Wojcicki announced she’s stepping down as YouTube CEO after nine years. The exec, Google’s 16th employee, has worked at the company for nearly 25 years, having led YouTube through the launch of new products like YouTube Premium YouTube TV, and other creator products and services, as well as through challenges around moderation issues and increased lawmaker scrutiny of Big Tech.

- Spotify was caught in a backlash after audiobook narrators discovered a clause that let Apple use audiobooks from Findaway Voices to train its synthetic voices. Spotify acquired Findaway in June 2022. Apple launched audiobooks narrated by synthetic voices just last month.

- TikTok is launching TikTok Trivia, a livestream trivia quiz game that has a $500,000 prize pool. The game will be hosted daily between February 22 and 26 and will be open to users in the U.S. aged 18 or older. During the first three days, TikTok Trivia will have two live sessions per day that are each an hour long. The first session will begin at 8 p.m. ET, and will have 12 questions. Winners split a $30,000 reward. The second session is at 9 p.m. ET., and winners split a $70,000 reward. After completing “survival rounds” the last group standing will split a $100,000 reward.

Gaming

- China’s games industry shrank for the first time in years, according to the country’s top gaming industry association. The market grossed 265.9 billion yuan ($39 billion) from video gaming sales in 2022, a 10.33% drop year-over-year. The decline was due to a number of factors, including its video game crackdowns, pause on issuing permits and the now lengthier process to become compliant.

- The Google Home app can now control the Xbox Series S or Series X, allowing the app to serve as a touch remote for the console.

- The Information reported on how Amazon’s Luna gaming service is losing steam, noting that its library has shrunk by about 30% since October, and dozens more titles were on track to exit in the weeks ahead.

- Roblox is testing a tool that lets players use natural language to create or change the appearance of their avatars and environment.

Dating

- Match-owned dating app Hinge rolled out its new $50/month subscription called HingeX, which offers continually boosted profiles, getting likes seen first, enhanced recommendations and all the other perks of the next tier down, Hinge+ (previously Hinge Preferred).

- Relationship app Flamme, previously known as Sparks, introduced a new AI-powered Ask Me Anything tool which caters to couples looking to introduce new and fun experiences to their lives, and also improve communication in their relationship.

- TechCrunch rounded up a new group of dating app startups, Candid, Ditto and IRLY, that are incorporating video in different ways, including for profiles, calls and even as a sort of TikTok for dating.

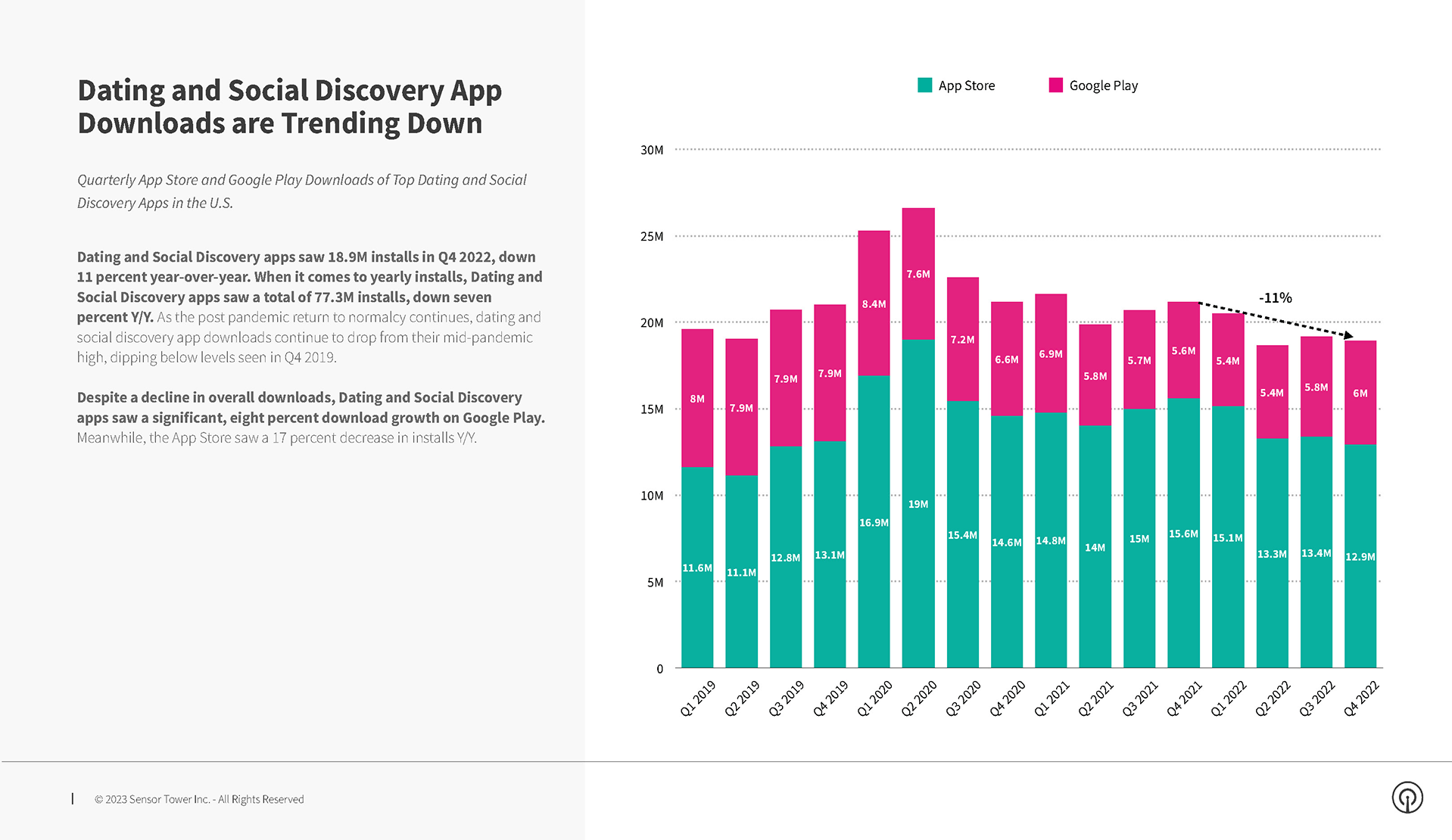

- Dating app installs have fallen, Sensor Tower reported around Valentine’s Day. Download levels returned to those seen in 2019 and 2021, and then dropped further in 2022, making last year the lowest number of installs over the past four years, even as revenues grew, peaking at $374 million in gross revenue in Q1 2022. Social discovery apps, however, have been a more dynamic group with most of the top 10 swapping places from 2021-2022.

Image Credits: Sensor Tower

Etc.

- Tile introduced a new anti-theft mode that requires biometric data, a government ID and new Terms of Service that allow the company to share users’ personal info with law enforcement. The changes are meant to serve as a deterrent to the criminal use of trackers for things like stalking and theft. But the company says it won’t wait for a subpoena to turn over data to police — which may deter consumer adoption too.

- Two-year-old crypto app Bakkt is shutting down on March 16. The company had partnered with Starbucks, Best Buy and Choice Hotels on its efforts to tie crypto with digital assets, like gift cards, loyalty points and airline miles.

- Google Photos’ app began crashing after the release of iOS 16.3.1, requiring a quick update to fix.

- Google rolled out new features including partial custom tabs and auto-filling passwords to make in-app browsing on Android a better experience.

- Reddit is reportedly looking to IPO later this year, The Information said, but it will likely be worth less than the $15 billion it had hoped for when it originally filed in Dec. 2021.

- Firefox for Android gained an extension that allows users to listen to articles read aloud, and others for hiding email addresses and removing tracking elements before sharing a URL.

- The Wall Street Journal offered an update on the Department of Justice’s antitrust investigation against Apple, noting the government had now added more litigators to the investigation and increased its consultations with companies related to issues at hand in recent months.

- The Washington Post featured an interview with TikTok CEO Shou Zi Chew who’s trying to convince U.S. lawmakers that TikTok is not a national security threat.

- Singapore-based neobank Aspire raised $100 million in Series C funding from investors including Lightspeed, Sequoia Capital SEA, PayPal, Tencent, LGT Capital Partners, and others. Over the past 12 months, the startup tripled its annualized TPV to $12 billion and now reaches over 15,000 businesses in Southeast Asia.

- Triller closed on its acquisition of influencer marketing firm Julius for an undisclosed sum. New York-based Julius had raised a total of $23.8 million. It’s unclear how Triller has the funds after dealing with multiple lawsuits from UMG, Sony Music and Verzuz in recent months.