We're going to have another chip shortage—despite the CHIPS Act

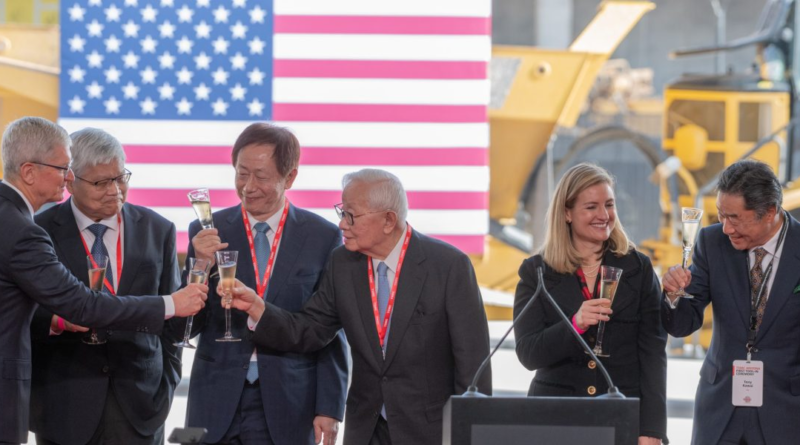

The sprawling $280 billion CHIPS and Science Act is finally here, with applications for funding opening on Feb. 28. U.S. president Joe Biden has already claimed the Act as one of his signature achievements, giving it prime place in his recent State of the Union last month. And it’s not just Washington throwing money at semiconductors: The European Union, Japan and India are also launching their own semiconductor subsidy programs.

So now that governments are pledging hundreds of billions of dollars to shore up their chip supply chains, will we see another chip shortage in the future?

The unfortunate answer is: Yes, we will.

Chip shortages result from a mismatch between supply and demand that cannot be addressed quickly either by chip manufacturers by scaling up production or by markets by adapting to the chip production profile. The challenge of resolving the two isn’t going away—and may even grow in size.

Semiconductor demand is unpredictable. The consensus is that future chip demand will be driven by A.I., electric and autonomous vehicles, the Internet of Things, and 5G/6G. Yet the exact nature, speed and magnitude of that increase in demand is still unknown.

We can’t predict what kind of A.I. will dominate in the next few years. The development of autonomous vehicles is slower than predicted. 5G deployment rates are greatly affected by geopolitics—and the future of 6G is even murkier. Entirely new product segments could emerge: See Bitcoin mining, which no one could have predicted being a significant driver of semiconductor demand.

This uncertainty makes demand planning hard for chips of different types—logic vs. memory, digital vs. analog, high voltage vs. low power, and so on—and raises the specter of a shortage.

Supply is also unpredictable. Chip foundries are typically run at close-to-full utilization. That makes chip fabrication notoriously susceptible to natural disasters (earthquakes, flooding, etc.), accidents (fires, power cuts, etc.), sabotage, and geopolitical and military crises (such as tensions between the U.S. and China, or between Beijing and Taipei, or even between Japan and Korea)

In theory, sufficient redundancy and excess capacity could overcome these disruptions. But the amount of investment needed to build a large enough buffer would be prohibitively high. It would also take years for capacity building, in technology and human resources, to support this investment. And chip fabrication is a low margin business: It won’t sustain much excess capacity or redundancy for long.

Nor can we assume that current chip investments will inevitably succeed. The economics of chip production is harsh, and most countries and companies won’t be able to make the one-time and recurring investments needed to support chip fabrication, especially at the cutting edge. Furthermore, most of these investments will be immediately undercut by low-cost chips from regions of the world that benefit from large subsidies, cheap labor, and looser regulations.

As such, only a small number of winners will emerge. Countries and companies with failed investments will balk at future investments, again raising the likelihood of a supply shortage. The political will for future investments may also fade as officials realize that chip fabrication employs fewer workers than they might hope (especially as automation improves).

Current spending is primarily focused on fabrication, just one component of a very complex semiconductor supply chain. Other aspects of the supply chain could become a bottleneck.

Packaging, for example, is already constrained. After chips are manufactured, they are put into a protective casing (“package”) for reliability, which also provides an interface to communicate with other chips. Recent supply chain woes and increase in chip demand has led to shortages of the required equipment and upstream materials required for packaging, increasing the lead time for most kinds of packaging by several months.

It’s also getting harder to resolve shortages when they occur, and more expensive to scale up production of advanced technology with each passing year. That means longer and deeper disruptions.

It will even be tough to scale up production of even less-advanced chips. Today’s cheap semiconductors are made using advanced equipment that has already been paid off, meaning pure profit for the manufacturers involved. But anyone considering expanding production of less powerful semiconductors will be stuck trying to pay off still expensive tools and machinery with a cheap product.

The growing complexity and reach of the semiconductor industry means that supply and demand mismatches will be more common. And the high costs of entry and scaling productions will make it harder to address these problems, even proactively.

That means that any company that deals with semiconductors has to be ready for chip shortages to be the new norm. They can create a buffer through stockpiles or having multiple suppliers. They can monitor the supply chain, ideally in real-time, to forecast and plan for disruptions. And they can prepare management and engineering techniques to quickly adapt to changing circumstances.

That’s all easier said than done, and these decisions will have trade-offs in terms of cost and efficiency.

But the cost of not doing anything will be much higher. Finding the right balance between competitiveness and resilience has to be the goal for any company using semiconductors.

Rakesh Kumar is a Professor in the Electrical and Computer Engineering department at the University of Illinois and author of Reluctant Technophiles: India’s Complicated Relationship with Technology.

The opinions expressed in Fortune.com Commentary pieces are solely the views of their authors, and do not reflect the opinions and beliefs of Fortune.

Learn how to navigate and strengthen trust in your business with The Trust Factor, a weekly newsletter examining what leaders need to succeed. Sign up here.