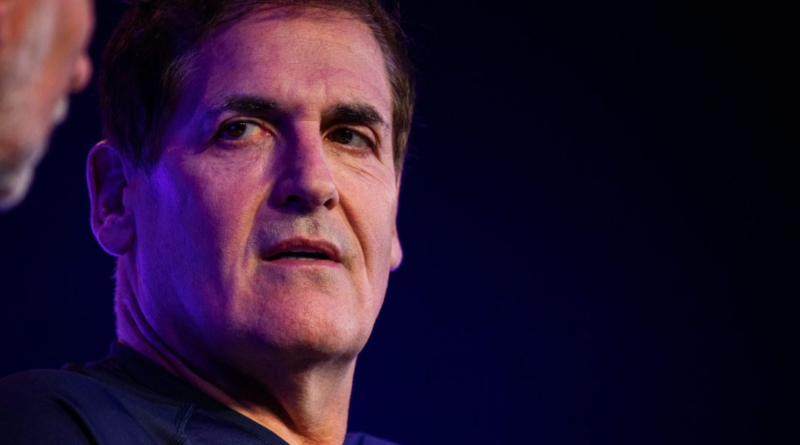

Mark Cuban urges Fed to buy Silicon Valley Bank debt ‘immediately,’ says it’s ‘not the wealthy taking the hit’

Mark Cuban wants the Fed to buy Silicon Valley Bank’s debt, pronto. Not doing so, he believes, will shake confidence in the financial sector—and hurt tech startups and their employees.

On Friday, the bank failed following a bank run that saw investors and depositors trying to withdraw $42 billion on Thursday alone. Many are now worrying about what ramifications will play out next week.

One widespread concern is that many technology ventures that banked with SVB will be unable to pay their employees, starting next week.

Cuban tweeted on Friday night, “The Fed should IMMEDIATELY buy all the securities/debt the bank owns at near par, which should be enough to cover most deposits.”

He shared a tech entrepreneur’s confession about difficulties caused by the bank’s failure, adding, “This is who the Fed needs to think about.”

In that confession, Champ Bennett, cofounder of a small A.I. video production startup called Capsule, tweeted: “This is somewhat embarrassing to reveal publicly, but I feel obligated to tell our story to combat some misconceptions…30 days ago our small team was celebrating closing a $5M fundraise that would enable us to make a bet on our future. Today we are unable to access those funds due to the SVB shutdown. What happens next is anyone’s guess, but it doesn’t look good.”

Cuban himself was once a cofounder of a small video-oriented startup. That venture, Broadcast.com, was eventually acquired by Yahoo for $5.7 billion during the dot-com boom.

The tragedy of the SVB failure, he tweeted, is that it’s “not the wealthy taking the hit. It’s the thousands of companies who borrowed from SVB and were required to keep their cash in SVB. Those entrepreneurs and their employees and vendors are feeling the pain. And they are who the Fed should protect.”

The billionaire added, “And for the record I have zero personal funds there, although several of my portfolio companies do. Probably all in about 8 to 10m dollars. So I can help them. But it’s the other 200b and how many employees and vendors? I’m concerned about them.”

SVB’s assets are now under the control of the Federal Deposit Insurance Corporation. Customers will have access to their insured deposits on Monday, says the agency, but FDIC insurance tops out at $250,000. Many startups kept far more than that with the bank.

The FDIC said it will pay uninsured depositors an “advance dividend within the next week,” but it’s unclear what that will amount to and exactly when it will arrive. If it’s too small, Cuban warned in a Twitter Spaces on Friday night, there would be a contagion effect.

Greg Martin, founding partner of the investment firm Liquid Stock, told Bloomberg that in the worst-case scenario next week, tens of thousands of workers won’t get paid.

Former Treasury Secretary Larry Summers chimed in, too. “There are dozens, if not hundreds, of startups that were planning to use that cash to meet their payroll next week,” he said on Bloomberg Television’s Wall Street Week. “If that’s not able to happen, the consequences really will be quite severe for our innovation system.”

Elon Musk, for his part, indicated on Friday night that he was “open to the idea” of buying Silicon Valley Bank as he lays the groundwork for Twitter payments.

Fortune‘s CFO Daily newsletter is the must-read analysis every finance professional needs to get ahead. Sign up today.