House committee chair blasts SEC's Gensler on defining Ether: 'You won't answer my question, and you're the head of that agency'

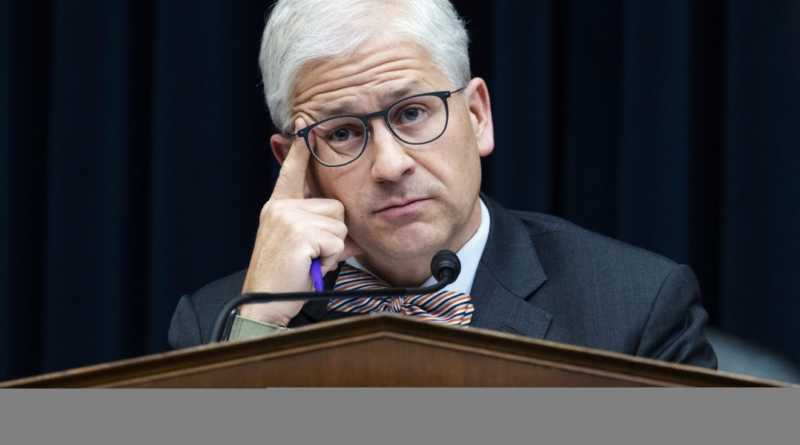

U.S. Rep. Patrick McHenry (R-N.C.) began with a brief timeline.

“Back in 2018,” said the chair of the House Financial Services Committee, at a Tuesday hearing, “then-SEC Corporation Finance Director Bill Hinman stated that he believed Ether was not a security. Last month, CFTC Chair [Rostin] Behnam expressed his view that Ether is a commodity. The state attorney general of New York asserted in a court filing last month that Ether is a security. Clearly, an asset cannot be both a commodity and security. Do you agree?”

Gary Gensler, chair of the Securities and Exchange Commission, smirked.

“Actually,” he responded, “all securities are commodities under the Commodity Exchange Act. It’s that we are excluded commodities. But I would agree that a security cannot be also an excluded commodity and an included commodity.”

Gensler, whose agency whiffed on Terra and Celsius and FTX, has long insisted that all cryptocurrencies—except Bitcoin—are securities, and that exchanges must register to deal in them. Firms including Kraken have said that position is disingenuous. The SEC and Commodity Futures Trading Commission still can’t agree on who gets to enforce what, and that may force U.S. companies to relocate.

McHenry, an advocate of establishing rules for stablecoins, pushed onward.

“Okay. How would you categorize Ether then?”

“I think,” continued Gensler, “that the general sweep of what Congress did, not just in the ’30s but as—”

“I’m asking you, sitting in your chair now, to make an assessment under the laws as [they] exist: Is Ether a commodity or a security?”

“Without speaking to any one—”

“I know, you’ve repeatedly said you’re not going to speak to one, except you’ve spoken to one: Bitcoin. So I’m asking you to speak to a second one, [with] the second-largest market cap.”

For two years, Democrats gave @GaryGensler a pass for his disastrous agenda. It’s time for accountability. From his destructive climate disclosure rule to his regulation by enforcement of digital assets, Chair Gensler’s agenda has weakened capital markets & stifled innovation. https://t.co/coo8kvmpYe

— Patrick McHenry (@PatrickMcHenry) April 18, 2023

“In speaking to the tokens,” replied Gensler, “there’s 10 to 12,000. If there’s a group of entrepreneurs—”

“I’m asking you about one.”

“…”

“I’m asking you a specific question, Chair Gensler. I said this in private. This should be no shock to you I’m asking this question: Is Ether a commodity or a security?”

Another nonanswer from Gensler that includes “the facts and the law” gets interrupted.

“I’m asking you about ‘the facts and the law,’ sitting in your seat, and the judgment you are making.”

“Mr. Chair,” Gensler answered, “I think you would not want me to prejudge—”

“But you have prejudged on this. You’ve taken 50 enforcement actions. We’re finding out as we go, as you file suit, as people get Wells Notices on what is a security in your view and your agency’s view. I’m asking you a very simple question about the second-largest digital asset. What is your view?”

Another nonanswer. Another interruption by a frustrated McHenry.

“All right. So let me just ask a second question: Do you think it serves the market for an object to be viewed by the commodities regulator as a commodity and the securities regulator to be viewed as a security? Do you think that provides safety and soundness for the products? Do you think that provides consumer protection? Do you think it serves the value of innovation? I think ‘no’ should be a very simple answer for you here. That uncertainty is bad, is it not?”

“And I think,” Gensler responded, “Congress has said that there’s one agency—the Securities and Exchange Commission—under this committee—”

“And you won’t answer my question, and you’re the head of that agency. So give me a break. Come on.”

Coinbase CEO Brian Armstrong was asked on Tuesday at an event in London whether he’d consider moving his firm from San Francisco to the U.K. owing to U.S. regulations—or the lack thereof.

“Anything is on the table,” he responded, as reported by Bloomberg. “Including, you know, relocating or whatever is necessary.”

McHenry later asked Gensler if they could at least agree on how the existing lack of clarity was affecting the marketplace.

“I think that the clarity is there,” Gensler said. “The law is clear.”

Answered McHenry: “Let me be explicit about this: The market doesn’t see it.”