Super.com targets its $85M equity, debt raise into new savings super app

The current inflation environment has all of us looking for ways to cut costs and save some money.

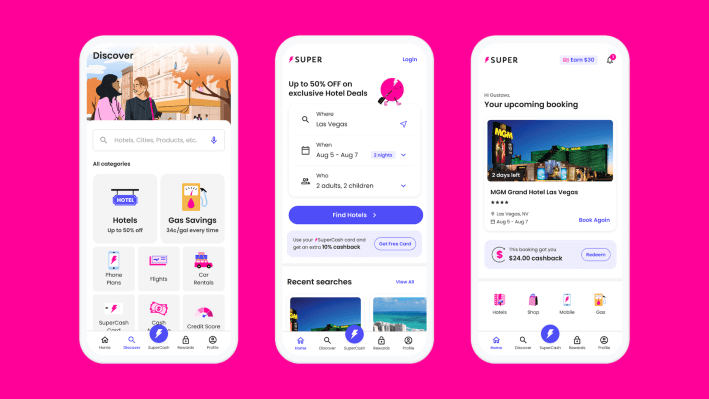

Super.com, formerly Snapcommerce, launched its cashback card SuperCash last October so that card users could build credit, amassing 5 million customers worldwide who have collectively saved over $150 million to date, according to CEO Hussein Fazal. Now it has its sights set on helping “everyday Americans” find deals and savings across multiple categories, including travel and shopping, via its super app.

Fazal told TechCrunch that Super.com is among some large companies, like PayPal, Uber and DoorDash, compiling more and more features under one app. Some, like Hyve, are also working on helping people save more. However, Fazal said his company is modeling its super app after WeChat by breaking into verticals like travel and fintech. WeChat has been able to grow its user base into the billions.

“Unlike other super apps, we are trying to have a theme that customers can gravitate toward, and we think savings is that theme,” Fazal said. “We are also launching now because we are seeing a great cross sell rate of people coming in to buy one product and end up buying another right now. That won’t always be the case.”

Helping the app grow is a new investment of $85 million, which includes $60 million in equity and $25 million in a credit facility. This gives the company nearly $200 million in total funding, Fazal said.

Inovia Capital led the round and was joined by new investors, including Shopify president Harley Finkelstein; Ancestry.com CEO Deb Liu; Allen Shim, former CFO of Slack; Golden State Warriors CFO Josh Proctor; Substack CEO Chris Best; Confluent CTO Neha Narkhede; Mike Lee, co-founder of MyFitnessPal; Hyphen Capital; EDC and Plaza Ventures. Existing investors, including Telstra Ventures, Acrew, Lion Capital and NBA superstar Steph Curry, also participated.

Fazal last raised funding in 2021 when the company was still Snapcommerce and said that the fundraising environment was indeed different, with investors more interested in top line growth this time around and, considering what the company is doing, will be a long-term sustainable business.

“There is a lot of focus on unit economic trends and what the business is going to look like,” Fazal said. “Investors are asking if they give this round if it will be enough money for the company to now be a standalone business.”

To him, he thinks Super.com is on its way to being one of those standalone businesses. The company grew double digits over the past year and is on track to do well over $1 billion in gross merchandise volume and over $100 million in net revenue in 2023.

Fazal said that focus on top line revenue and unit economics was why the company was able to “raise at nearly double its valuation” from the raise in 2021 and close the round with good terms and in this rather challenging fundraising environment.

He intends to deploy the new funding to product and engineering resources for the development of new features for SuperCash and the overall app. The company is also doing R&D on additional ways to offer savings, for example, essential items like gas and groceries where prices have been affected by the current inflation.

“We’ve seen phenomenal growth, triple-digit growth month over month in users and transactions as we have talked to a lot of customers to get data-driven research so that we are building something someone wants,” Fazal said. “Now we’re going to build America’s first savings app so that our customers can think of us for every purchase, whether it is while booking travel or buying groceries.”