Europe could be on the cusp of a golden era in robotics. Here’s why

The United States and China have long been ahead of the pack when it comes to robotics funding. However, data from 2022 is showing that these innovation hubs may have some serious competition as the investment landscape in Europe is starting to outstrip robotics’ biggest players.

The quest for technological supremacy has often been seen as a two-horse race between the U.S. and China. Over the years, we’ve only seen this investment tug-of-war intensify as both economies have vied for dominion to become an innovation superpower. Whilst in the past robotics has seen a similar dynamic, based on 2022 data, investors are starting to place their bets on an up-and-coming contender: Europe.

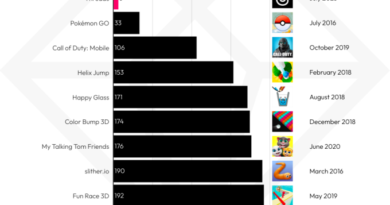

In 2022, nearly $8.5 billion in funding flowed into robotics companies worldwide — a staggering 42% less than the year prior – in line with the overall global downturn in VC investment. Yet despite the change in economic situation, with total USD investment volume into robotics falling by over 50% for both the U.S. and China between 2021 and 2022, Europe has seen a far more modest decline, only dropping 5% in the same period. Although it’s still early, we’re convinced it’s just the beginning of how Europe is finally beginning to find its place within the modern robotics ecosystem.

Europe emerges as a serious contender with a strong rate of growth

Whilst in the past robotics has seen a similar dynamic, based on 2022 data, investors are starting to place their bets on an up-and-coming contender: Europe.

When we compare Europe’s rate of growth in investment volume within robotics to the U.S. and Chinese markets, we observe a few key trends driving the continent’s recent power play in the robotics market.

With a CAGR of 28% in the period from 2018 to 2022, Europe is already surging ahead compared to global growth figures at 2%. This growth is primarily being led by Germany, which has seen a 77% growth spurt of investment volumes into the robotic space.

Close neighbor France has seen a 54% increase in robotic investment amounts. Meanwhile, robotics powerhouses China and the U.S. have experienced a decline in growth, with robotics investment falling 5% and 2% respectively since 2018.

China and the U.S. experience a 60% slow-down in growth/late-stage funding

To better understand these market shifts, we need to take a deep dive into the funding landscape and explore the state of play by funding rounds.

Slicing our data into grants, early-stage (pre-seed to Series A) and growth/late stage (Series B and onwards), we observed a major slow-down across U.S. and China robotics funding across growth and late-stage investment rounds.

Both the U.S. and China saw a decline of growth/late-stage robotic investment volume by 60% compared to 2021. Meanwhile, looking at the European market, the total investment volume for growth and late-stage deals was only slightly less than those of 2021.

Surprisingly, China has seen an 4% uptick in early-stage investments, whilst Europe and U.S. followed a similar downward trend – a potential sign for new ventures brewing. The trends in the growth/late -stage funding environments, accounting for the lion’s share in terms of investment volume, helps understand the relative stability in Europe.

Comparison in investment volume between 2021 and 2022 across geographies. Image: Picus Capital with data from Crunchbase

Under the surface, 2022 saw more European robotic firms consistently raise capital — 20 growth/late-stage rounds — and fewer outliers driving investment volume. By comparison, European robotics investments in 2021 were more prominently driven by outliers across 13 growth/late-stage rounds with an average round size of $108M USD. Meanwhile, the U.S. and China have seen a decline across a number of deals and mean & median investment amounts.

Growth/late-stage funding is complex. Nevertheless, we think that one dynamic influencing the change in investment volume discrepancy between U.S., China, and Europe is the shift in priorities for growth and late-stage funds – from growth to profitability. The continued funding into European robotic companies at these stages indicate that these companies are able to meet growth stage criteria better than U.S. companies. This is what we believe will also continue to be relevant throughout 2023.