Onyx Private believes affluent professionals need their own bank, so it’s building one

Digital bank Onyx Private announced today $4.1 million in new funding to provide private banking and investment services specifically tailored to high earning Millennials and Gen Zers.

Village Global, Y Combinator, Global Founders Capital, One Way Ventures, 186 Ventures and Olive Tree Capital participated in the investment.

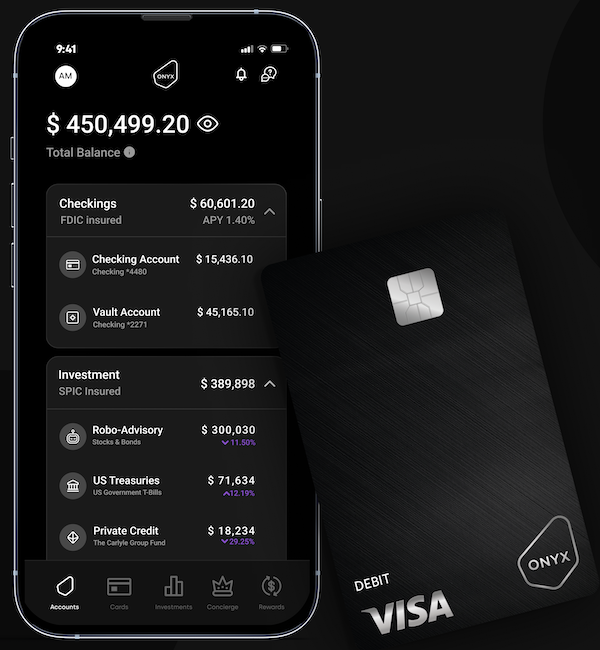

In partnership with Piermont Bank, Onyx Private offers digital banking services, including checking accounts, a debit card and cash back on payments and purchases. On the investment side, the fintech develops investment portfolios from high-yield, fixed-income portfolios, like cash-sweep accounts and U.S. treasury bills, with $100 minimums and low fees.

There is an application process to join Onyx Private and customers can choose between a free plan or a premium plan that is $50 per month or $40 per month if you pay the membership in one payment.

Investment services are administered by Helium Advisors and the brokerage account is through Pershing, a clearing house owned by the Bank of New York Mellon.

In addition, the company offers a “lifestyle concierge” service, via a digital personal assistant, to help with booking events, dining, hotels and flights, and even purchasing luxury gifts, like jewelry.

Victor Santos, Douglas Lopes and Tiago Passinato launched the company in 2022. Santos, who came to the United States as a child, previously co-founded banQi, a Brazilian neobank focused on financial inclusion that was acquired by Via Varejo in May 2020.

Onyx Private’s banking dashboard and card. Image Credits: Onyx Private

While creating products for low-income individuals, Santos told TechCrunch he and his co-founders realized there was a gap in the market: plenty of options for the very wealthy or low and middle class, but not many for those in between.

“These are people who are not necessarily rich, but are affluent professionals, like lawyers, doctors or people who work in tech,” Santos said. “The goal for Onyx is to build a more modern, more accessible private bank and democratize the tools that today are only available to the ‘ultra rich.’”

Since its launch nearly a year ago, Onyx Private has grown 30% month over month and is processing over $4 million in transaction payment value per month. The company is nearing $5 million in TPV with a goal to 5x that volume until the end of the year, Santos said.

Up next, Santos, Lopes and Passinato envision Onyx Private to be “the next-generation UBS,” and the new funding will go toward that goal. The company has plans to put some capital into new product lines and to unveil an in-app human financial advisor in the next year that will provide financial, estate planning and tax advice. Much of its growth so far has been from referrals; however, the company will now invest in marketing.

“There’s a lot of pressure on these new banks focused on low income, and what we think is powerful is that our average revenue per user and the average balance of our user is 10 to 12 times more than these traditional neobanks,” Santos said. “We are small but it goes to show that it’s a much different demographic and there’s a higher willingness to pay for premium services from that demographic.”