Ford tries zagging in the EV arms race

Ford CEO Jim Farley called it a “personal bullet train.” Doug Field, the automaker’s chief advanced product development and technology officer, described it as “groundbreaking.”

Ford’s next-generation full-sized SUV EV might turn out to be both — if the automaker’s claimed advances in physics and energy loss translate into the real world.

Ford’s next-generation EV platform, which will be the basis of the T3 electric truck and three-row SUV that are going into production in 2025, signals a new strategy for the automaker. As some of its competitors try to cram even bigger batteries in trucks and SUVs, Ford is hyper focused on finding ways to reduce the pack size while still maintaining performance and range.

Companies have long turned to aerodynamics and other efficiency tricks to boost fuel economy, and now range, in EVs. But another trend is afoot in the U.S. market: automakers trying to meet consumer demand for trucks and SUVs while shifting to EVs are turning to bigger batteries.

“There’s a bit of an arms race in the industry to shove bigger and bigger batteries into large EVs to try and make them like ICE (internal combustion engine) vehicles,” Field said Monday during the company’s Capital Markets Day. “But the real battleground in electrification is about efficiency. Efficiency is like God’s work. When we really understand the physics around energy loss in an EV, we optimize it rather than compromise it.”

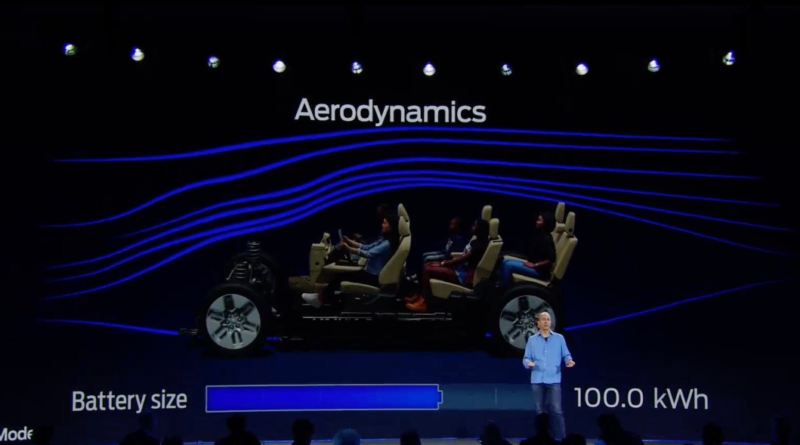

For Ford engineers, that meant using computer simulations to find ways to improve efficiency. Field said engineers and designers have done everything from using tires with lower rolling resistance and maximizing the propulsion system, to changing the ride height and aerodynamics of the vehicle.

The end result, according to Field, is a three-row family vehicle with 350 miles of range that can still cover 300 miles even when it’s traveling at 70 miles per hour. The battery is one-third smaller and lighter, and thousands of dollars less expensive, he added. A slide shared during the presentation shows the outline of the next-gen electric SUV with a 100 kilowatt-hour battery pack. For comparison, the GMC Hummer EV has a 212.7 kilowatt-hour capacity battery pack and can travel an estimated 329 miles on a single charge.

Selling large three-row EV SUVs with smaller, lighter batteries could help boost Ford’s automotive margins. It could also help shore up supply chain issues because smaller batteries theoretically use fewer raw materials, a point Field emphasized.

“With the same amount of scarce battery raw materials we can bring our product to three customers instead of two,” he said. “And those three customers are getting get a new and a better product.”

Automotive margins and the supply chain are two areas where Ford desperately wants — and needs — to improve. CEO Jim Farley said in February that production inefficiencies, supply chain struggles and rising material costs led to lower margins, noting the company left $2 billion in profits on the table in 2022.

In an effort to turn that around, Ford has restructured its company into three distinct units: its commercial business Ford Pro, its traditional internal combustion engine and hybrid business Ford Blue and Ford Model e, which focuses on connectivity and electric vehicles.

Ford has also made efficiency an obsession.

So this obsession in EVs is more than engineering, it’s like a religion,” Field said. “The teams have put together these little pocket cards that say, what are the trade offs of efficiency? How much do I get for every little piece of weight that I take out of the vehicle? What do I get for better tires? What do I get for more efficiency and propulsion?”

Other EV companies have taken this hyper focused approach to efficiency. Lucid Motors, for instance, spent years developing a miniaturized powertrain, and Tesla is the leader when looking at EVs that travel the farthest per gallon of gasoline equivalent — arguably a better metric to look at than range.

Of course, maximum efficiency only gets an automaker so far. Ford, and any other rival trying to find a niche in the EV sector, has to produce a vehicle consumers want.