Maverick Protocol raises $9 million to challenge decentralized exchanges like Uniswap

Uniswap, a decentralized exchange where users buy and sell crypto, has long been the standard bearer in the world of decentralized finance, or DeFi. However, Maverick Protocol, an upstart decentralized exchange, looks to challenge Uniswap’s dominance.

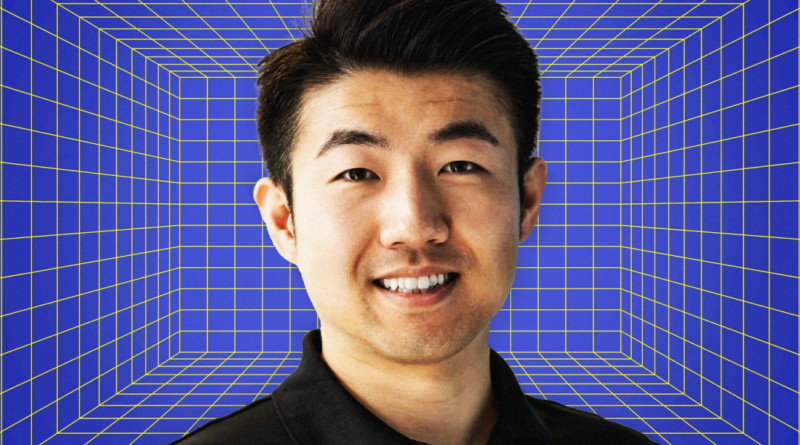

On Wednesday, Maverick announced that it’s raised $9 million in a seed round led by Founders Fund. Other participants include Binance Labs, Coinbase Ventures, Pantera Capital, and Apollo Crypto. Alvin Xu, a cofounder of Maverick Protocol, declined to provide a valuation.

The company’s “surgical approach to decentralized finance” will help the DeFi industry grow, Joey Krug, a partner at Founders Fund, said in a statement.

The injection of capital into Maverick comes as crypto enthusiasts look elsewhere to buy and exchange tokens after the Securities and Exchange Commission filed bombshell lawsuits last week against two of the largest crypto exchanges in the market, Binance and Coinbase.

Both firms saw significant outflows of crypto, and trading volume on decentralized exchanges—or protocols where no one entity owns the trading platform—jumped from $1.2 billion the day before the Binance suit was filed to $3.1 billion the day of the suit, according to DefiLlama. (The SEC filed the charges in the early afternoon.)

Xu has been in crypto since 2018, when he landed a gig at the TRON foundation and then BitTorrent. (Justin Sun, the founder of TRON, bought BitTorrent in 2018.) Xu was most recently at ConsenSys, one of the key developers that builds on Ethereum, where he worked on MetaMask, one of the most popular wallets in the ecosystem.

In 2021, he left to start work on Maverick Protocol, an automated market maker. Traditionally, behemoths like Citadel act as market makers, or firms that help match buy and sell orders on stocks. In the world of crypto, trading is 24/7. Hence, Uniswap, one of the most popular protocols in DeFi, fully automates market making for those looking to buy and sell a swath of tokens.

Xu believes his new protocol can challenge Uniswap’s dominance. “That’s definitely our goal,” he told Fortune. “But Uniswap has this huge first-mover advantage, which is very significant in the crypto world.”

He and his team, currently nine employees, launched Maverick in March. While they have their sights on Uniswap and other automated market makers, they ultimately hope the likes of Maverick will overtake the likes of Binance or Coinbase. “The goal really is to compete with centralized exchanges,” he told Fortune, “but I think it’s still early.”

Learn more about all things crypto with short, easy-to-read lesson cards. Click here for Fortune’s Crypto Crash Course.