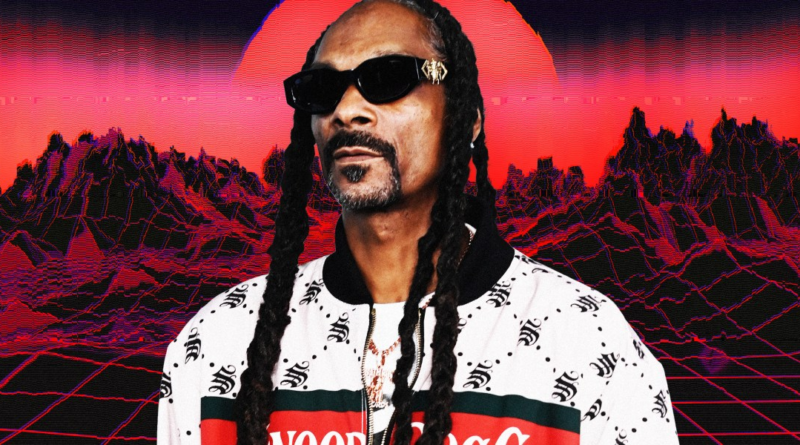

Snoop Dogg's metaverse stands out among the rapper's brands—for being uncool

Snoop Dogg is a master of marketing. The 51-year-old rapper and businessman, whose real name is Calvin Broadus Jr., has leveraged his onstage persona to spin up profitable business ventures that include everything from his own cannabis brand, Leafs by Snoop, to a pet accessory business called Snoop Doggie Doggs.

His net worth, according to the latest available data from Forbes, is about $124 million. Snoop emphasized in a 2021 New York Times interview that when it came to the business side of things, “It’s got to be fun. And it’s going to make funds. So long as the word ‘fun’ is involved, it’s cool.”

But in the case of the metaverse, Snoop may have met his match when it comes to making things cool. The rapper embraced the new Web3 world—which still exists largely in theory—with big bets on projects like the Sandbox, and became potentially its biggest evangelist outside of Meta’s Mark Zuckerberg. But after a short-lived burst of hype, Snoop’s would-be digital empire is looking about as hip as a failed shopping mall.

Playing in the Sandbox

The Sandbox, one of the most prominent projects in the metaverse, first partnered with Snoop in September 2021. After having orchestrated several smaller collaborations, including with video game company Atari and the Cloudco Entertainment–owned Care Bears brand, Snoop lent the startup early legitimacy.

The Sandbox hosted five sold-out presales for land in its metaverse, and later hosted a sixth that unloaded about 80% of its land despite technical issues—all before it launched its first public sale on Feb. 11, 2021. At that time, a piece of metaverse real estate in the Sandbox could be yours for about $400.

As part of Snoop’s partnership with the Sandbox, he got his own space in the game called the Snoopverse. The company rushed to offer up more than 800 digital plots of land near his large estate, some of which included special access to the Snoopverse.

By the time of the first Snoop Dogg land sale, the cheapest plot in the Sandbox would set an investor back at least 15 times what it originally cost in February after the price of SAND, the platform’s cryptocurrency, skyrocketed to a high of almost $7.

The company held its first Snoop-related sale of 192 parcels on Dec. 2, 2021, and within a day someone had paid $450,000 to become his neighbor. To justify a nearly $20,000 higher price tag for so-called “premium plots,” the company also threw in several free Snoop NFTs.

“The real enticing point is the fact that you’re going to have access to somebody’s party, you’re going to have access to somebody’s group,” said Jason Chung, an attorney and the director of the e-sports and gaming initiative at the NYU SPS Tisch Institute for Global Sport. “That’s really what was for sale.”

By the end of December 2021, the Sandbox claimed it had sold $1.66 million worth of metaverse land in just a few weeks, in part because of the Snoop-related sales, according to VentureBeat.

But as the once-white-hot blockchain industry slumped into so-called Crypto Winter, the exorbitant prices that some investors paid to own virtual property near Snoop cratered.

“Regular” plots of land had sold for about $6,773 when the Sandbox’s native cryptocurrency, SAND, was near its all-time-high of about $6.70, according to CoinMarketCap. At today’s price, about 42 cents, each of those plots is worth just $424, a whopping 94% decrease. The “premium” parcels, offered up at about $31,300 in 2021, are now worth about $2,000.

Several of the parcels recently have received lowball offers, below the price floor, which means a bidder is offering an amount in crypto lower than what the cheapest plot of land is being offered for on third-party exchanges. The lowest-priced piece of land was being offered by a seller at $559 as of Thursday, a far cry from the $13,200 price floor around the time of the first Snoop-related land sale, according to data from CoinGecko.

The anonymous NFT investor who paid nearly half a million dollars to become Snoop’s neighbor could have gotten the same plot today for just under $30,000. Another Snoop NFT collection released in February, “The Doggies,” a series of 10,000 avatar NFTs modeled after Snoop that users could play as in the Sandbox, were sold for $500 when they debuted. Their price floor at time of publication was hovering near $80.

A spokesperson for the Sandbox acknowledged the market slowdown, adding that “the utility provided” by virtual land parcels “has given it strong resilience,” and that the “success we’ve had on our LAND offerings throughout the first half of 2023 is a testament to this.”

Snoop’s metaverse investment is a dog

Investors who rushed in to be near Snoop in the Sandbox have gotten soaked, but the performance of the rapper’s own Web3 portfolio is hardly any better.

Because of the anonymous nature of the blockchain, where a decentralized crypto wallet can stand alone without being associated with an individual, it’s difficult to identify with certainty the the full extent of Snoop’s personal Web3 holdings. Crypto data firm DappRadar, for instance, identifies two wallets as tied to Snoop, but some have cast doubt on whether one of the accounts, associated with anonymous crypto investor Cozomo de’ Medici, is his at all.

Still, DappRadar data for the non–Cozomo de’ Medici wallet tied to Snoop suggests he currently owns about $540,000 dollars in crypto and NFTs. This is nearly half of the $1.2 million his wallet was worth just in January, according to DappRadar. The rapper owns an estimated 6,976 different NFTs across 346 collections. At least 21 collections are worth less than what he originally paid, and his purchases in just three collections, including the most popular NFT series Bored Ape Yacht Club, have earned him any money. The vast majority of his NFTs were airdropped or transferred to him. By reviewing DappRadar’s data on profit and loss numbers for the NFTs in Snoop’s crypto wallet, Fortune found that of the collections where he has lost money, he has an estimated average loss of 81%.

The rapper owns an estate made up of what would otherwise be 144 plots of land in the Sandbox. Fortune reached out to Snoop, who did not respond to requests for comment on this story, but a Sandbox spokesperson said the company controls Snoop’s virtual plots because it’s “leading the development of his experiences” and needs “access to the LAND to publish them.”

Some still believe

Although 2021 led to a mania of speculation for metaverse land, this year investors and users alike have shifted their attention to A.I. and other technologies, causing the price of virtual land to collapse.

“Ultimately, it wasn’t fun enough,” said NYU’s Chung. “It wasn’t advanced enough, and it wasn’t something that was ready for prime time.”

As for the investors who bought land in metaverse platforms like the Sandbox and Decentraland, the future of those plots is unclear. According to a report by DappRadar, there were only 8,000 sales of digital land in June, and transaction volume in all of the second quarter was about $58 million. This was an 81% decrease from the first three months of the year, in which trading of digital land included more than 140,000 sales and reached $311 million in transaction volume.

Two big reasons virtual land became so highly priced were its artificial scarcity and the fact that many of the parcels were near others owned by companies or celebrities like Snoop, Steve Aoki, or Paris Hilton.

Martha Bennett, principal analyst at Forrester Research, said these motivations in themselves were flawed. If land is scarce and the price goes too high on one platform, she said to Fortune, what’s to stop a consumer from switching to another? And does proximity really matter in cases where you can simply transport from one area to another, as is common in video games?

Still, Bennett added that the staying power of virtual worlds is clear, although incorporating crypto may not be necessary.

“Let’s take Roblox—you’ve got 60 million daily active users there,” she said. “You’re lucky to get a few hundred, or a few thousand, on those Web3-connected environments.”

The price of metaverse land is now a fraction of what it was worth at its peak, and it’s unclear if it will ever rebound. There is a spot of hope for owners in the Sandbox, at least: The company announced this month that by the end of 2023, it plans to open the game up to its estimated 23,000 virtual land owners and enable them to publicly launch their own experiences, like games, on their land.

Up until now, the game has only been open on select occasions for “alpha seasons.” Adding more users could create a renewed interest in virtual land, which could drive up prices.

Other metaverse land buyers said they’re less concerned with the decline. Ruben Santa, a senior UX designer at YouTube, bought a plot of land close to the Snoopverse for tens of thousands of dollars in 2022. As of Wednesday, the best offer for his parcel on OpenSea was less than $1,000.

Despite that, Santa said he cares less about the devaluation than he does its potential. “I don’t check how much my land is worth today versus how much it was worth last month,” he said.

He was convinced to buy it in part because he saw the potential for Snoop to bring new music-related immersive experiences to the metaverse, such as digital concerts. Santa is holding on to it because he may eventually build something on it, or use it—or flip it—for a profit. Maybe one day brands will pay him to post billboards there, or he could rent some or all of it to another user, he said.

“I didn’t invest because I said, ‘I want to buy this land, and then I want to sell it next week and make a buck,’” he said. “I invested because I saw a long-term vision of what this platform can become.”

Salvaging some cool

Elsewhere in Web3, some of Snoop’s efforts have paid off. After being turned down once by its former owner, eOne Music, the rapper finally bought the first label that signed him, Death Row Records, from its new owner, MNRK Music Group, in February 2022. Just days after buying it, the label released its first line of NFTs, B.O.D.R. Stash Boxes, which included a mix of NFTs from the artist and launch partner Gala Games. The sale raked in at least $45 million in less than a week.

The rapper has since said that he wants to make Death Row “an NFT label” and bring artists into the metaverse. Just this month, Snoop also launched a new collection called Passport Series that evolves as he progresses on his tour this year.

Cait Lamberton, a marketing professor at the University of Pennslyania, said Snoop’s reputation is not likely to take a hit for his association with NFTs or metaverse land, despite the recent market declines.

“I think there are so many enormous brands playing in this space right now that no one will be faulted for experimenting there,” she said. “In the end, that’s really all we’re doing right now.”