5 lessons robotics founders can learn from the AV industry

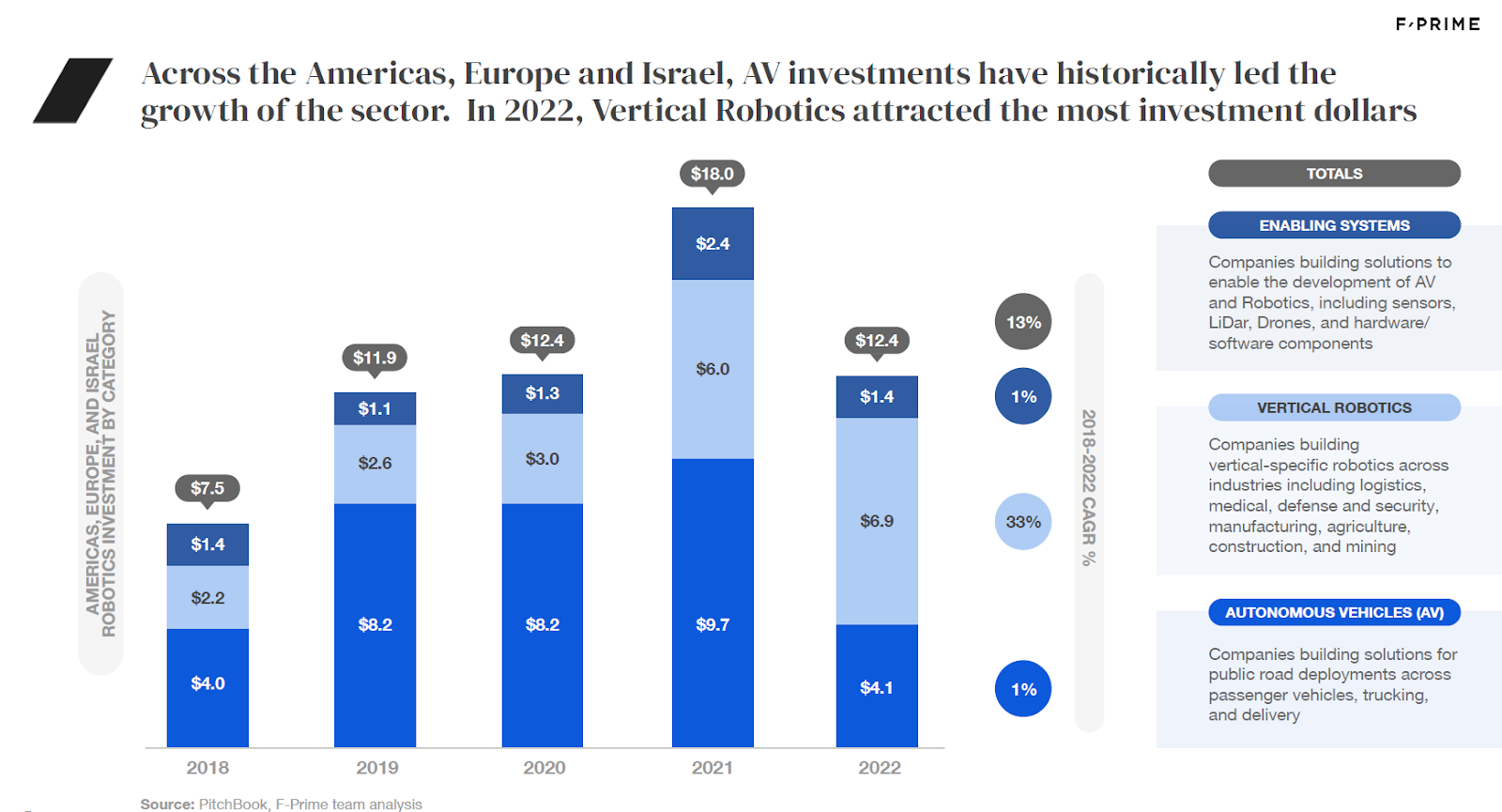

Throughout the late 2010s and early 2020s, the autonomous vehicle industry captured the imagination of the startup community and the public. However, the category’s meteoric rise preceded an even more meteoric fall over the last 18 to 24 months. From 2018 to 2021, investments in the AV sector across the U.S. and Europe increased by nearly 2.5x, eventually peaking at close to $10 billion in 2021. Then, in 2022, investments fell to $4 billion, with 2023 likely to see further precipitous declines.

Meanwhile, the broader robotics ecosystem has continued to flourish, with companies focused on mostly industrial “vertical” use cases now commanding the bulk of investment dollars. In 2022, these companies attracted $7 billion in investments, defying the broader slowdown in VC investment by growing 15% over the previous year.

We recently analyzed the trends shaping the industry in our State of Robotics report, and identified five lessons that the next generation of robotics founders can take from the successes and failures of the AV industry.

F-Prime State of Robotics Report. Image Credits: F-Prime Capital

VC excitement for hardware businesses is higher than ever

In the U.S. and Europe, more than $60 billion have been invested in robotics and AV alone over five years, with the AV sector leading the way. AI is making hardware much smarter, which is enabling companies to generate the kind of high-margin recurring revenues typically associated with software businesses.

AI also creates opportunities to disrupt traditional industries with massive addressable markets. For example, across the logistics ecosystem, AV companies such as Aurora are disrupting the trucking industry, while companies like Locus and RightHand Robotics (an F-Prime portfolio company) are transforming how fulfillment operations are done.

For founders, this surge in interest means there are more robotics investors than ever, ranging from newcomers in the category to those with an extensive track record in the space. Even top-tier investors such as Sequoia and Andreessen Horowitz are starting to make investments in the category, an encouraging bellwether for overall VC interest in robotics.

Nevertheless, hardware-oriented investments are not the right fit for all investors, and it’s best to seek out those who have made a commitment to robotics and understand what it takes to be successful.