Mila Kunis and Ashton Kutcher’s ‘Stoner Cats’ NFTs get smoked by the SEC

It’s been a disastrous week for Mila Kunis and Ashton Kutcher, and it’s only Wednesday. The SEC has charged the Hollywood power couple’s NFT-based web series, “Stoner Cats,” calling the NFTs unregistered securities.

Per the SEC, “Stoner Cats is an adult animated television show about house cats that become sentient after being exposed to their owner’s medical marijuana.” By buying one of 10,000 NFTs worth around $800 each, fans could get exclusive access to the six-episode animated series, which features celebrities like Jane Fonda, Chris Rock and Seth MacFarlane. Even Ethereum co-founder Vitalik Buterin was in the show.

Every time one of these NFTs was resold, the original owner would earn a 2.5% royalty. In marketing the NFTs, Stoner Cats emphasized that “the more successful the show, the more successful your NFT will be.”

The Stoner Cats’ social media accounts continued to promote the resale of these NFTs, and since they strongly suggested a return on investment, the SEC declared the Stoner Cats NFTs to be unregistered securities.

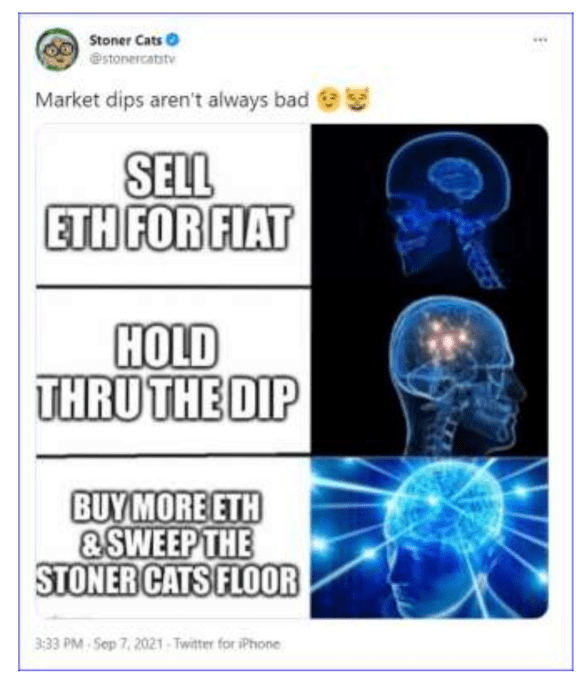

Another great quote from this formal SEC document: “@StonerCatsTV tweeted on September 7, 2021 a meme suggesting that the smartest thing to do during a dip in the crypto markets would be to ‘Buy more ETH & sweep the Stoner Cats floor.’”

The order cites the following meme:

Image Credits: Stoner Cats on Twitter

Stoner Cats settled with the SEC and will pay a $1 million fine. There will also be a Fair Fund that will return money to people who were financially harmed by purchasing the NFTs. The company must also destroy all NFTs in its possession.

The SEC has been cracking down on celebrity-endorsed crypto projects. Last year, Kim Kardashian reached a $1.26 million settlement with the SEC over failing to properly disclose that she was being paid to promote a crypto asset security sold by EthereumMax.

“Regardless of whether your offering involves beavers, chinchillas or animal-based NFTs, under the federal securities laws, it’s the economic reality of the offering – not the labels you put on it or the underlying objects – that guides the determination of what’s an investment contract and therefore a security,” said Gurbir S. Grewal, director of the SEC’s Division of Enforcement, in a statement.