ZayZoon, which lends employees money for a fee, raises $34.5M

ZayZoon, a fintech firm that got its start charging employees $5 to get paid sooner, has raised $34.5 million in a Series B round co-led by Framework, EDC with participation from ATB Financial.

CEO Dary Tuer says that the funds, which bring ZayZoon’s total raised to $75 million, will be put toward “doubling down” on ZayZoon’s growth and accelerating the development of new features on its product roadmap.

“ZayZoon is on a mission to save 10 million employees 10 billion dollars. We will achieve that with a relentless focus on helping employees that are struggling to make ends meet,” Tuer told TechCrunch in an email interview. “At the same time, small- and mid-sized businesses are faced with their own financial challenges while struggling to recruit talent. ZayZoon helps employers recruit and reduce turnover while keeping employees away from predatory loans and unnecessary bank fees.”

Tuer co-founded Calgary-based ZayZoon with Tate Hackert and Jamie Ha in 2014. Tuer, a serial entrepreneur, came on to scale Hackert’s initial proof of concept, and Tuer and Hackert met Ha, an investment banker, at a local startup event that ZayZoon was participating in.

Hackert had the idea for the business several years before meeting Tuer and Ha. After making money working on a commercial fishing rig, Hackert — then 16 years old — lent cash through Craigslist and the Canadian classified ads site Kijiji to help employees bridge the gaps between paychecks.

In the nearly ten years since its founding, Tuer claims that ZayZoon has become one of the fastest-growing apps of its kind, acquiring more than 10,000 business customers across the U.S. and partnering with more than 160 payroll providers.

“ZayZoon provides employees with access to their earned wages whenever they need them, instead of having to wait until payday,” Tuer said. “This helps them stay away from payday loans or deal with unnecessary bank fees.”

ZayZoon falls into the category of fintechs known as earned wage access (EWA), which largely operate on the same premise. For a fee — in ZayZoon’s case, $5 — employees can request a portion of their regular paycheck early. ZayZoon lets employees withdraw a minimum of $20 and a maximum of $200 each pay period.

ZayZoon and other EWA companies pitch their products as a way to help customers avoid high-interest loans and credit cards. But the reality is often less rosy then their marketing suggests.

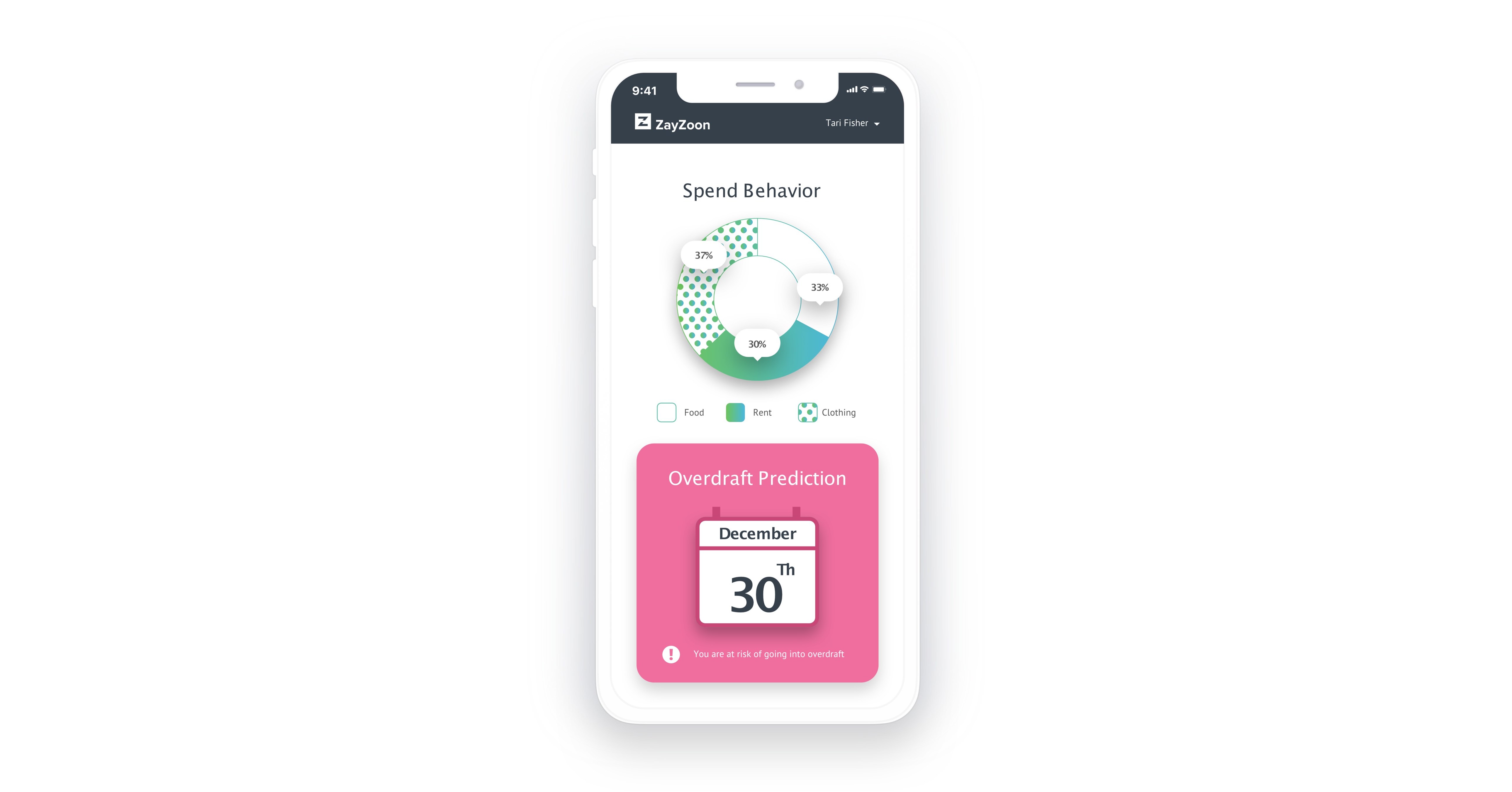

Image Credits: ZayZoon

Some consumer groups argue that EWA programs like ZayZoon’s should be classified as loans under the U.S. Truth in Lending Act, which provides protections such as requiring lenders to give advance notice before increasing certain charges. Users aren’t under a legal obligation to repay ZayZoon and ZayZoon won’t take action to collect payments. But because ZayZoon makes automatic withdrawals from users’ connected bank accounts, it can still force users into overdraft while effectively charging interest through its fees.

ZayZoon offers a no-fee payout option. However, it requires employees to accept payments in the form of gifts cards for retail partners such as CVS and Target and to agree to share their personal information, including their name, date of birth, gender and address, for advertising purposes. (Workers can email ZayZoon’s customer support to request that their data be deleted, but there isn’t an in-app mechanism to make this easy.)

A $5 per-pay-period fee might not sound like very much. But it can add up, especially for a low-income worker — and the consequences can be disastrous. Just $100 fewer in savings can make families more likely to pursue predatory lending and forgo utility bill payments, one 2020 study showed. And an estimated one in five families in the U.S. has less than two weeks of liquid savings.

ZayZoon, like its rivals Refyne, Branch, DailyPay and Even, claim that they’re a retention tool for businesses. But it remains unclear whether EWA programs are a net positive for companies. Taking Walmart as an example, the retail giant had high hopes of boosting retention by giving employees access to earned wages early. Instead, it found that employees using the early wage access service tended to quit faster.

EWA usage is on the rise, regardless. A 2021 report from research firm Aite-Novarica estimated that workers accessed $9.5 billion via EWA apps in 2020, up from $6.3 billion in 2019 and $3.2 billion in 2018.

As their popularity among workers — particularly those with lower credit scores — grows, regulators are beginning to step in. In June, Nevada enacted a law that requires early wage access providers to be audited and examined by the state. The following month, Missouri passed a law that requires EWA companies to register with the state, pay a $1,000 registration fee and retain payment records for a minimum of two years.

ZayZoon, which is one of the larger EWA startups with 102 employees, isn’t letting the increased scrutiny get in the way of expansion.

“We are in regular discussions with the institutional investment community and decided to execute on an opportunistic raise,” Tuer said. “Strengthening our balance sheet will help us cement ZayZoon’s place as a category leader.”