8 business expenses startups waste money on

Launching a startup or new business is no small feat, no matter what type of business you are running. Nine out of 10 startups fail, and the top reason (38%) is because they ran out of cash or failed to raise new capital, according to CBInsights.

If something isn’t working in your current business model, you’ll need to quickly pivot, which may mean finding areas for cost-cutting and optimization. This doesn’t necessarily mean you need to do layoffs, start outsourcing, or make other big changes—small adjustments can be surprisingly effective at improving the situation.

One area you’ll definitely want to look at is short-term and long-term business expenses. You’ll need to invest in solutions to improve your business. After all, they say you need to “spend money to make money.” But how can you know if you’re using your budget effectively?

While you’ll want to get the best results without cutting corners, there may be areas where your resources could be better leveraged elsewhere. Here are eight business expenses startups and entrepreneurs often waste money on, along with some ideas on how you can reduce business startup costs for a more efficient use of funds.

Eight business expenses startups waste money on

1. Marketing without metrics

There’s no doubt that smart marketing is a necessary investment for your company, and can lead to better business results. Customers need to know who you are, and should be informed about your offer so they can make a purchase decision.

However, it’s important to spend your marketing budget in the most effective way. While larger companies may be well-positioned to run brand-building campaigns that are more of a long-term investment, as a startup or early-stage business operating on a limited budget, you’ll want to focus on conversions and ROI.

This means:

- Measuring your marketing efforts: With access to accurate data and analytics, you’ll be able to see what’s working and what isn’t.

- Iteration and A/B testing: A/B testing, also known as split testing, is a marketing technique that involves testing multiple versions of a campaign against one another to see which one performs better. You should be continuously testing and optimizing your campaigns, making improvements according to the feedback you receive.

Avoiding vanity metrics: More social media followers doesn’t always equate to more sales. Decide which metrics are most important to you, then use this information to optimize your campaigns.

2. The wrong accounting solutions

To build a lasting business, it’s crucial to keep on top of your finances. Today’s venture capital concept makes it easy to grow a business that might not be around in five or 10 years’ time—many startups are unprofitable and unable to run without cash infusions.

It’s worth hiring a great accountant or CFO early on to make sure your business is running in a sustainable and efficient way. You can also use accounting software tools to facilitate your finance management. Check out our list of the 12 best software tools for finance managers to get some ideas.

Stay on track of your budget and spending

3. Too many software solutions

SaaS (software as a service) solutions are key to running a modern business, since they can make nearly any business process easier. However, using too many software tools (or the wrong ones) can end up wasting time rather than saving time, since employees will have to switch back and forth between them as they complete tasks.

It’s important to use the right tools, not to overextend your budget, and to look for redundancies so you can streamline your tech stack.

Start by reviewing the software subscriptions you currently have, and seeing if there are any that could be cut or downgraded to a more basic package. Ask yourself:

- Does the team know how to use all our tools?

- Do we need additional training to get the most out of our tools?

- Do we have multiple tools with the same functionalities?

- Do we have tools that aren’t being used at all?

- Are there tools we actually need that we don’t currently have the budget for?

- If so, how could we free up enough budget to get those?

Do our current tools offer integrations with other software providers to make our lives easier?

4. Not keeping track of expense reimbursements

Are you accidentally overspending on expense reimbursements? Without a clear expense reimbursement policy, colleagues may end up spending too much, and it will be difficult to stick to your budget.

To make sure expense reimbursements stay within your control, you’ll need to create and enforce a policy so that everyone understands what to do. You can use TravelPerk’s expense reimbursement policy template to help you create your policy.

5. Booking business travel on consumer websites

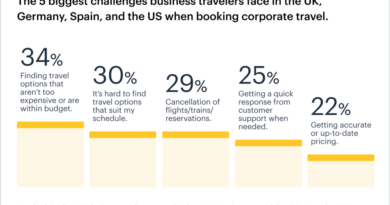

Business travel can be super important for startup founders. When you’re just starting out, you’ll need to meet investors and have face-to-face meetings with potential customers and buyers. A face-to-face request is 34 times more successful than an email, according to research published in the Harvard Business Review, so it’s worth spending the time and money to meet in person.

But between hotel bookings, flight tickets, train tickets, rental car fees, and other travel costs, business travel can definitely get expensive. And if you’re booking on websites designed for consumer travel, you’re likely to be overspending—you won’t have access to corporate discounts, or tools to help you keep track of and control your budget.

To save money when booking business travel, invest in a modern travel management tool like TravelPerk. With TravelPerk, you’ll have access to the world’s largest travel inventory, and can benefit from exclusive corporate travel discounts. You can also set up an automated travel policy with in-app approvals, so travelers can have the freedom to book on their own, while you have the control of knowing that they’re booking within policy.

TravelPerk’s reporting feature will help you keep track of where money is going. You can also use the software to claim back VAT when possible, so you won’t leave any money on the table.

Do you spend a lot of money on perks like luxury parties, expensive team building activities, or office equipment and games? If so, are you sure you’re getting enough ROI to justify your expenditures?

Many companies invest in perks to build company culture and improve employee engagement and retention. However, it’s not necessary to spend a lot of money to do this.

Research from Bonusly found that a solid onboarding process, effective management, consistent feedback, and employee recognition were some of the main factors driving engagement. It’s worth exploring new ways to improve your business operations—such as management training or updates to your performance review process—to see if you can raise employee engagement in a more cost-effective way.

Save even more money on your business expenses

7. Overspending on “swag” and branded items

Did you know that, on average, companies spend over $185k annually on swag inventory alone? And that 74% of companies are currently spending money on low-value swag items (such as keychains and pens), rather than high-value items?

Branded swag can be a great way to get your name out there and make customers feel appreciated, but it doesn’t always offer optimal ROI. Especially if you’re buying low-value swag items, these can be quite easily forgotten once your conference or event has ended.

To save money on swag, think of how you can maximize your budget and the value you obtain from it. Instead of giving out low-value swag at large-scale events, why not invest in a smaller number of high-value items, and give these to clients in exchange for case studies or feedback?

The client will gain a memorable and unique item while you benefit from their feedback, making this a win-win. Think of swag as a sustainable way to grow your business, rather than a one-time expense.

8. Premature scaling

While you may feel the pressure to quickly scale your startup, it’s important not to do this too quickly. Premature scaling can cause you to incur startup expenses and debts you cannot pay, leading your business to fail.

Some examples of premature scaling would include:

- Purchasing office space, real estate, office supplies, or inventory you can’t afford

- Developing new products or scaling customer acquisition before you’ve found product-market fit

- Over-hiring new full-time employees, or prioritizing quantity/speed over quality and business needs when hiring

In the long run, it pays to take the time to do thorough market research, find product-market fit, and develop effective hiring processes and well-defined job roles to build strong, lean teams. Over time, you can scale slowly as you see what’s working and what’s not.

For more ideas on how to streamline your startup’s budget, check out our list of money-saving ideas for small business owners.