Indian fintech CRED’s earnings surge 3.5x to $168 million

CRED grew its operating revenue by a staggering 255% to $168.1 million in the financial year ending March as the fintech startup, which garners an unusually high level of attention, finds rising adoption of its lending and commerce offerings among India’s affluent individuals.

The Bengaluru-headquartered startup had a total income of about $50 million in the financial year ending March last year and $11.4 million in the prior year. CRED curbed its losses, excluding ESOP cost, by about 10% to $125.7 million in the financial year ending March.

CRED – which is backed by GIC, Tiger Global, Insight Partners, and Peak XV – said hiring and maintaining top talent remains a priority for the startup, something that has contributed to an increase in employee benefit expenses. Its ESOP cost in the financial year ending March grew to about $36 million.

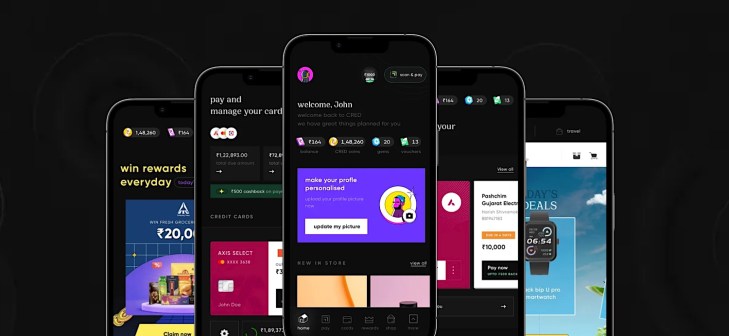

The improvements in financials comes as CRED expands its e-commerce, wealth management and lending offerings to customers. It launched vehicle management offering Garage last week that allows CRED members to access concierge, parking, insurance, document management and other services.

The startup said the total payment value on its platform surged 77% to $52 billion. It had about $250 million in cash and bank balance at the end of March this year.

CRED, whose monthly transacting users grew by over 50% in the financial year, allows its members to pay their credit card, utility bills as well as make transactions to merchants and friends. The startup said it processes a third of all credit card payments in India by volume. An average user of CRED, which is also the fourth largest in UPI, engages in over 20 sessions on the app in a month.

The startup said it’s increasingly lowering its marketing and business promotion expenses – down 27% from $117 million in the financial year ending March last year – and it has also pared down its customer acquisition cost.

“Our focus on rewarding good behavior strengthened growth momentum in FY 22-23, with new products and features contributing to higher engagement with members,” said Kunal Shah, founder of CRED, in a prepared statement.

“Five years since launch, we believe that CRED – and prudent financial behavior – are becoming a habit for the top 1% and has resulted in strong financial performance. We will continue this momentum to get close to overall profitability and meaningful revenue scale.”