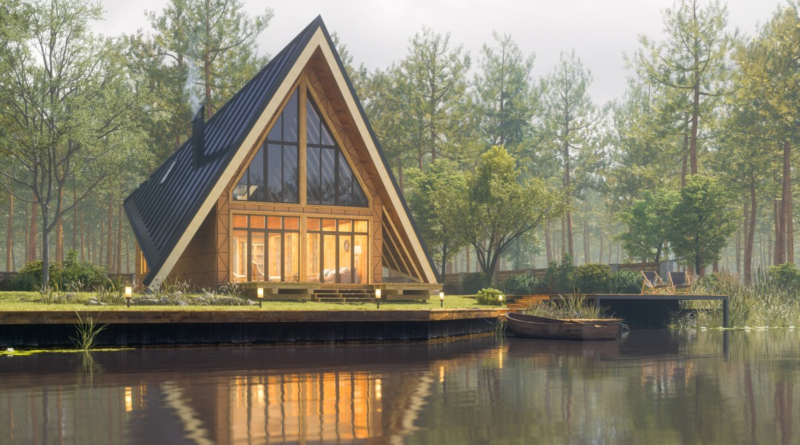

Summer, which helps customers buy — and rent out — vacation homes, raises $18M

Multiple studies show that younger generations aren’t buying homes as quickly as their generational predecessors. Yet a relatively new startup, Summer, thinks it can convince this cohort to snatch up a second property to rent out on marketplaces such as Airbnb.

Summer claims to use “data and analytics” to help customers, which it refers to as “members,” predict short-term rental revenue and find a rental property that fits their needs and goals.

“Summer’s platform layers in AI and analytics to build our short-term rental revenue estimate, which is the Zestimate equivalent for short-term rental revenue,” Paul Kromidas, Summer’s CEO and founder, told TechCrunch via email. Prior to founding Summer, Kromidas was a product and strategy lead at Airbnb, where he helped create Airbnb’s Luxe product. “There are various risks and barriers that surround buying and renting out short term rentals, and Summer is aiming to alleviate this challenge,” Kromidas continued.

Summer offers three routes to membership: “gradual” or “immediate” ownership or bringing an existing, owned property to the Summer platform.

Members who opt for the gradual ownership path choose a property from Summer’s portfolio, send a listing to Summer to see if it’s a fit or work with Summer’s acquisition team to find a property on the market that meets their criteria (and aligns with Summer’s business model). Summer takes care of submitting offers, handling the closing paperwork, and performing home inspections and due diligence in addition to interior designing and furnishing the property.

In exchange, Summer collects an initial payment as low as 15% of the home price and charges a monthly membership fee. Summer members get credits that can be put toward stays at their own vacation home or any home within the Summer network.

Having to book a stay at one’s own home might sound like an odd concept. But Summer argues that the perks make up for it. Summer manages the property — including booking rental guests — and puts both the initial payment and monthly membership payments toward the owner’s eventual purchase of said property.

At any point over two years, if a member decides to buy their Summer-managed property, 100% of the initial payment and the monthly membership fee is credited toward their purchase. If they choose to not buy, after two years, they get their initial payment back.

Members who choose to immediately purchase a property with Summer first submit their offer to Summer. If it’s accepted, Summer oversees the paperwork to completion, handles home design (and any construction, if necessary) and arranges for an in-house property manager to line up short-term bookings.

Or — for homeowners who’ve fully purchased a second home — they can have Summer manage their property, listing it on rental platforms and marketing the listing on social media.

Kromidas claims that Summer homes (I imagine the pun was intended) generate “more yield” than competitors and benefit from “co-branded national marketing” and “fast ramp time.”

“Summer’s products are made for those who are looking to buy a new home or get more utilization and liquidity out of a current vacation home,” he said. “We’ve been able to meet the market whether there’s increased demand for buying or renting.”

Indeed, Summer offers an intriguing proposition — completely hands-off vacation property management, including messaging guests and responding to reviews — for the few in a position to swallow the upfront costs. But it, like its competitors in the short-term rental market (see Pacaso, AvantStay, Kindred, etc.), the company faces roadblocks as various jurisdictions crack down on short-term rentals.

A recent bill signed by Honolulu Mayor Rick Blangiardi requires property owners to book their rental units for a minimum of 90 days. Elsewhere, New York City has begun enforcing tighter restrictions on short-term listings. Aspen, Colorado is proposing new taxes on rental property owners. And Chattanooga, Tennessee has paused new applications for non-owner-occupied units.

Rental platforms like Summer also face criticism for gobbling up housing supply and driving up prices. But the headwinds don’t appear to be discouraging investors.

Summer today announced that it raised $18 million in a funding round led by backers including QED and Viola Group alongside a $50 million debt facility from Setpoint Capital. The proceeds bring Summer’s total equity raised to around $30 million and will be put toward platform R&D, expanding into new markets and branding efforts, Kromidas says.

Summer’s not the only short-term rental company raising cash. In an analysis, Crunchbase found that between July 2021 and April 2022, 17 rental-related U.S. companies raised a collective $1.3 billion from VC firms.

Kromidas declined to say how many customers Summer has or even hint at the startup’s annual recurring revenue.