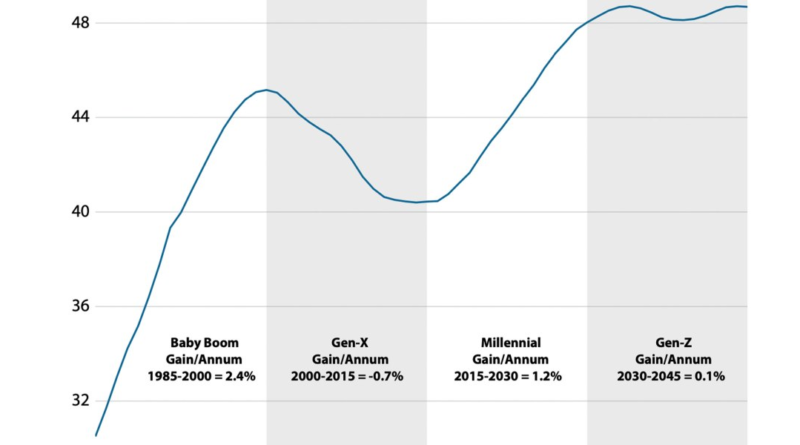

This chart shows why millennials, the biggest generation in American history, will keep housing prices skyhigh for years to come

Despite mortgage rates that have more than doubled and sky-high prices, the housing market just keeps chugging along, avoiding the crash that some economists feared. You can partly thank millennials, the generation that’s usually blamed for the country’s financial ills.

Though millennials have taken the brunt of the blow as housing affordability deteriorates, they are also the largest generation in U.S. history. And while much has been made of their inability to afford housing, they will continue to lead the country’s “household formation,” which equates to housing demand, for the foreseeable future, according to a recently published analysis from Ned Davis Research’s chief eonomist Alejandra Grindal and research analyst London Stockton.

In fact, millennials’ household formations are expected to grow through at least the end of the decade, the economist and analyst write, citing data from the U.S. Census Bureau. That will help keep the housing market from crashing—after all, those households need a roof over their heads.

Millions of millennials are entering into prime homebuying age this decade. The generation already comprises the largest share of the “homebuying pie,” according to Redfin, purchasing around 60% of homes bought with mortgages over the last few years. Bank of America economists previously suggested that sales activity would likely be supported by millennials reaching their homebuying age, which could “help the housing market retain some of its momentum without falling apart.” And Mark Fleming, chief economist at financial services firm First American, recently said “demographic demand against a severely limited supply of homes for sale” will continue to prop up home prices.

Of course, there’s another part of the equation: “The crux of the issue is supply,” Ned Davis’s report reads. And that’s where the enormous size of the millennial generation comes into play again.

Tight supply will keep prices high

Despite mortgage rates that have surpassed 8% (before settling down a bit now), home prices that continue to rise nationally, and housing affordability at its worst point since the 1980s, the housing bubble won’t burst because there are so few homes available, according to the report.

In the aftermath of the 2008 financial crisis, “new home construction was anemic, especially compared to the years leading to the housing crisis,” the report reads. That pre-crisis era of excess supply turned into a shortage that can be felt across the country to this day. “We estimate a shortage of 2.1 million housing units currently,” the authors write. The difference in new residential construction following the financial crisis versus the decade or so before is larger in the U.S. than in other major developed economies including Japan, the U.K., and Canada. And homebuilders are unlikely to increase housing production anytime soon, partly due to high building costs. Even if they did, though, the wave of millennial homebuyers is just too huge.

The research firm also points to the so-called lock-in effect, first coined by the economist John Quigley in the early 1980s, when mortgage rates reached 18%. The low rates secured by many over the past several years—Goldman Sachs recently estimated that 98% of outstanding borrowers had a below-market mortgage rate—are presently keeping people in their homes much longer for fear of a much higher monthly payment if they were to sell and lose their rock-bottom rate. That’s worsening supply in an already underbuilt housing market.

The lock-in effect “will eventually fade as we move further away from the mortgage rate lows observed earlier this decade and when mortgage rates fall,” the analysis reads. “But it will take some time.”

And while this is particularly bad for existing home sales and general housing affordability, it reduces the risk of an economic downturn because it has kept household debt service ratios, which represent household debt payments to disposable incomes, low.

Older generations are still ahead

Despite millennials’ coming of age, homeownership is still most prevalent in older age groups, the analysis says. Since the financial crisis, homeownership is highest among those 65 and over—which clearly plays a role in the current housing environment, given that they are less sensitive to higher mortgage rates.

Previously, Bank of America strategists wrote that baby boomers won the housing market and millennials got screwed: Boomers benefited from a massive wealth transfer from the public to private sector, hold more than half of all wealth, and locked in some of the best mortgage rates (to be sure, boomers largely entered the housing market in the 1980s when mortgage rates were in the double digits, but they’ve had several years to refinance).

“Everyone locked in 3% mortgage rates, except millennials,” BofA wrote. “Most boomers locked in low mortgage rates, where the effective mortgage rate remains below pre-COVID levels. The only group that took out mortgage debt meaningfully since 2021 is millennials, seeing a 20% jump.”

And yet, millennials’ current and anticipated demand for housing seems to be partly keeping the housing market afloat.

“Baby boomers and millennials have and will continue to play a large role in supply and demand dynamics,” within the housing market, the Ned Davis Research report reads.