Digital Onboarding grabs $58M to help banks with profitable customer engagement

Digital Onboarding, a SaaS company specializing in helping financial institutions strengthen relationships with customers, secured $58 million in growth capital from Volition Capital to continue developing its digital engagement platform.

Ted Brown and Jonathan Crossman co-founded the company in 2015 under the name SalesBrief and focused on the B2B sales cycle. In 2017, they pivoted after entering Digital Federal Credit Union’s fintech accelerator. They changed the name to Digital Onboarding and began selling its engagement platform to banks and credit unions in January of 2018.

Communications from financial institutions, which are under strict regulations, is often paper-based, especially when opening a new account. This often leads to between 25% and 40% of new checking accounts closed within the first year, said Brown, CEO of Digital Onboarding, citing a statistic from the 2023 Future of Finance Report.

“A lot of the valuable parts of the relationship were taken away by neobanks getting people to swipe a debit card,” Brown told TechCrunch.

Financial institutions then spend hundreds of dollars in marketing and awareness to get a customer to open an account that doesn’t get used, resulting in both lost money and a lost relationship, Brown said.

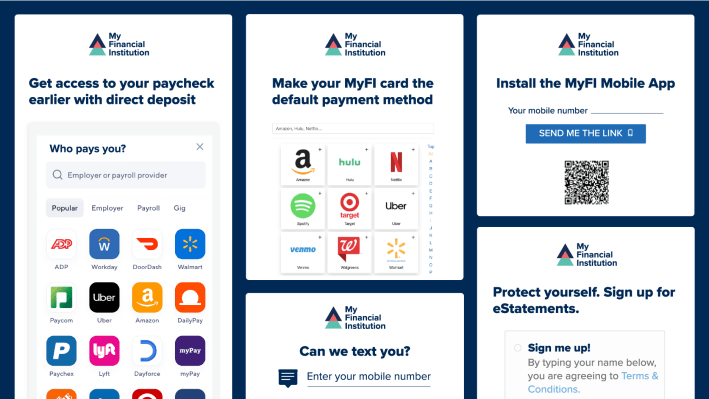

To reduce those losses and keep customers around longer, Digital Onboarding’s technology provides banks and credit unions with a digital aspect to the paper welcome kit in the form of targeted, journey-based communication and action-oriented microsites.

In addition, it offers a library of campaigns and a set of proprietary and third-party widgets that can be added to those microsites or on bank landing pages, and within third-party digital banking applications.

Digital Onboarding is working with more than 140 financial institution customers. Brown was mum on revenue growth other than to say the company has been able to grow quickly despite an average sales cycle of five months.

He did say that the $58 million growth investment was “opportunistic.” The company was on a path to profitability and had raised $7.5 million in venture capital previously, including a Series A in 2020.

“We have very few competitors in the space, and only about a quarter to a third of our market knows about us,” Brown said. “With this funding, we also have an opportunity to accelerate our product roadmap and have 140 very happy customers who would buy more from us if we have more to sell.”

Digital Onboarding also plans to invest in additional segmentation and profile management, marketing attribution, machine learning and embedded fintech functionality. In addition, Brown expects to double the company’s lean headcount by the end of 2024.