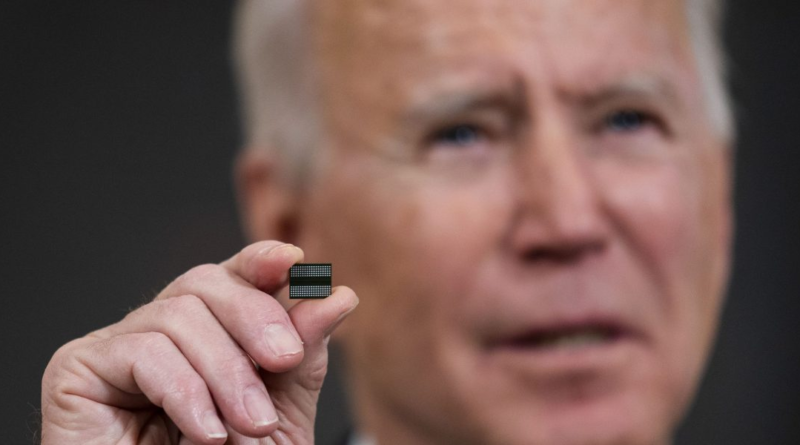

The Chip Wars are heating up, with Biden subsidies poised to make an impact after a slow first year

A year and a half after President Joe Biden signed the $53 billion CHIPS and Science Act into law, the U.S. share of global semiconductor manufacturing has actually decreased, and the government has spent less than half a percent of the money it committed to revitalizing the American microchip industry.

But the tide is turning. The Biden administration this morning announced it would direct $5 billion in CHIPS Act money toward a new training facility to boost workforce participation in a semiconductor industry dominated by foreign talent. That’s an indicator of much more to come: After a lengthy review period, the government will start giving out billions more over the coming months, primarily in the form of grants to domestic chip manufacturers such as Intel.

In any case, experts say, it’s too early to ring the alarm bells on what was always designed to be a long-term policy.

“It’s like complaining [during] the eighth month of a pregnancy that nothing has appeared yet,” said Georgetown global innovation policy professor Charles Wessner in an interview with Fortune. Wessner, a senior advisor at the Center for Strategic and International Studies, called the CHIPS Act “an unprecedented program, both in its focus and its scale … I would venture that they’ve actually made great progress.”

The act aims to reverse a three-decade decline in American semiconductor manufacturing: The United States produced just 12% of the world’s chips in 2020, down from 37% in 1990. East Asian manufacturers such as Taiwan’s TSMC and South Korea’s Samsung have emerged as leaders, with a near-complete duopoly on the advanced microprocessors that power high-consumption tech like virtual reality and artificial intelligence.

The CHIPS Act is the Biden administration’s effort to turn the tide. It committed $53 billion toward subsidizing labor force development, semiconductor R&D, and building chip factories back in August 2022. But as of last month, almost a year and a half later, the government has doled out only about $200 million in grants—0.4% of the money it’s committed. That’s largely the product of a lengthy application process requiring chipmakers to wade through months of red tape in order to secure funds.

Big-name projects have also been pushed back: TSMC announced last month that its $40 billion plant outside Phoenix would delay production a second time, potentially until 2028. And America’s share of the global semiconductor market has continued falling, with no signs of a rebound: from 12% in 2020 to a projected 9.8% in 2024, per a SEMI study.

Still, in one key way, the policy has already earned its worth: The private-sector investment the CHIPS Act has already attracted dwarfs the government’s stake.

“The chip industry is very simple,” said Wessner. “If you want to play, you have to pay—you have to provide incentives. We’re incentivizing small amounts, relatively … The good news is that $50 billion [in federal money] has already attracted $200 billion in commitments from the private sector … The federal money isn’t an incentive, it’s a catalyst. We’re not paying for the whole thing by any stretch.”

The CHIPS Act spawned similar policies worldwide. Japan, South Korea, and the EU all enacted laws promoting domestic semiconductor manufacturing last year. And China is putting a whopping $140 billion behind building its own chips as it bets hard on electric vehicles and AI.

In China, the impacts are already showing up: Nikkei reported last September that with the help of government aid, over 80% of Chinese semiconductor manufacturers increased their R&D expenses in the first half of 2023.

“Are we making progress on these? Yes. Would everyone like it to be going faster? Yes,” said Wessner. “When you have a weapons program in the Defense Department, and it doesn’t work, and it costs three times what it’s supposed to cost, we reboot and we keep working on it—because we want the weapon. You have to take the same perspective here.”

The semiconductor world was thrown for a loop yesterday when the Wall Street Journal reported that OpenAI CEO Sam Altman is seeking up to $7 trillion (yes, trillion) in capital to reshape the global semiconductor supply chain and expand computing capacity to meet the demands of AI. Even if Altman secures the money—the UAE’s sovereign wealth fund and Japanese conglomerate SoftBank have been floated as potential investors—he’ll run into the same problem the Biden administration has been dealing with: Building up semiconductor infrastructure takes time.

“There are two things that we usually criticize [the government] for,” said Wessner. “The first is that it’s taking too long. And secondly, that the grants were made too hastily. You can write that [article] in another couple months.”