Nvidia sidles past tech rival Amazon with 46% stock price surge so far this year

Nvidia Corp.’s red-hot rally to start 2024 has Wall Street rushing to keep up, with at least five firms hiking price targets on the artificial intelligence-darling this month.

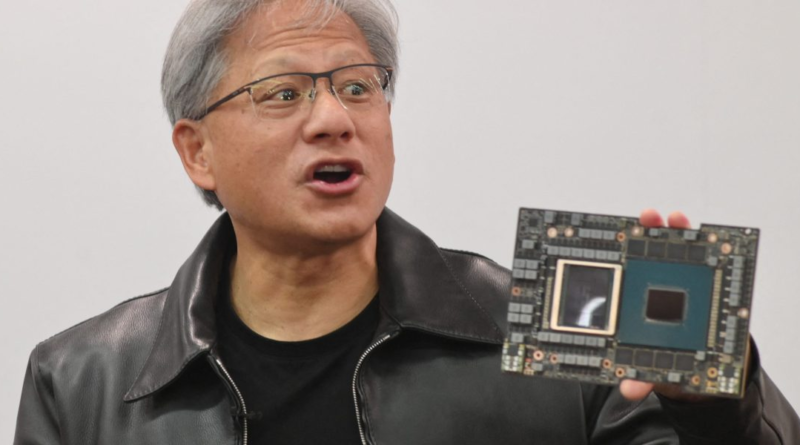

The chip giant’s shares have surged 46% this year and added about $560 billion in market value. The strength, along with the insatiable demand for its accelerators that power AI tasks, led UBS Group AG and Mizuho Securities to follow counterparts at Morgan Stanley, Bank of America Corp. and Goldman Sachs Group Inc. in boosting price targets ahead of the company’s earnings results due Feb. 21.

This week, UBS lifted its target to $850 from $580, and also increased its estimates for earnings per share. Meanwhile, Mizuho raised its target to $825 from $625. Demand for Nvidia’s H100 AI accelerators continues to outstrip supply, Mizuho’s Vijay Rakesh wrote in a client note, calling the stock the best AI play.

Nvidia dipped 0.2% on Tuesday, closing at about $721. But it outperformed its big-tech counterparts, which came under pressure after a report showed US consumer prices rose last month by more than forecast. The Nasdaq 100 Index fell 1.6%.

The stock of the Santa Clara, California-based company, the top performer on both the S&P 500 and Nasdaq 100 indexes this year, has become one of the most-loved on Wall Street. It has 58 buys, five holds and only a single sell rating among analysts tracked by Bloomberg.

Analysts on average have boosted 2024 revenue estimates by more than 100% over the last 12 months, according to data compiled by Bloomberg.

And yet, they’re struggling to keep pace with the stock’s advance, which has pushed its market cap above that of Amazon.com Inc. Wall Street’s average 12-month price target of about $690 is some 4.4% below Tuesday’s close.