Millennials and Gen Zers are worried about outliving their savings and are turning to hot-stock tips. But a comprehensive retirement plan drives better outcomes

Retirement planning for millennials and Gen Zers looks much different than it did for older generations. Pensions and Social Security were once the norm. Today, they’re the exception. Social Security will likely make up a smaller percentage of retirement funding for younger Americans, according to our latest, Planning & Progress Study.

Our weighted survey of 2,740 U.S. adults aged 18 or older found that younger generations face yet another challenge when preparing for retirement. Four in 10 millennials and Gen Zers believe they will live to age 100–twice the proportion of baby boomers who think the same. That extra time will cost money–and they know it.

In fact, individuals in their 20s said think they need to save $1.2 million to retire. Those in their 30s expect to need $1.44 million to retire comfortably someday, far more than older age groups. On average, respondents in their 20s said they had $35,800 saved for retirement and those in their 30s had $67,400 in savings.

Surprisingly, Gen Zers (65%) and millennials (54%) were more optimistic about reaching their financial target than older generations. Gen Xers were the most pessimistic, with 55% expecting to fail to achieve their financial goals.

These stark societal and economic deltas have many millennials and Gen Zers turning to social media “experts” for financial guidance. Unfortunately, they are encountering misinformation, get-rich-quick schemes, and meme stock tips that are often risky and unreliable.

While their elders’ experiences and amateur social media advice can’t provide the financial roadmap they seek, three longstanding financial principles may provide sound advice younger generations can apply to position themselves for financial security now and in the future.

An investment strategy is more reliable than any hot-stock tip

People love talking about stock tips. It seems like every time I am at a cocktail party, this conversation comes up. For day-trading DIY investors, hot-stock content can be interesting and even entertaining, akin to betting against the house in Las Vegas. But for many young Americans, this can be distracting from the more important need of building financial security. Instead of playing the stock game, which can be devastating for an unknowledgeable investor, they should be asking themselves how they can use the markets to work for them.

Constructing a diversified portfolio is like betting with the house. A sound approach to wealth management is about setting the most effective and reliable course for growing a person’s net worth–keeping in mind their unique goals, time horizon, and risk tolerance. Once established, individuals can choose the investment strategy that works best for them and their financial goals, and which are part of a diversified portfolio guided by a professional financial advisor.

Most often, a comprehensive financial plan drives better financial outcomes than investments alone

Protecting the wealth you’ve accumulated from risk is just as important as acquiring it. Inflation, taxes, a layoff, healthcare costs, a disability event, or a long-term care need can quickly dissolve the wealth that individuals have built over time–unless they have a plan in place to address these scenarios.

Maintaining a steady and stable stream of income in retirement is imperative to long-term success. A recent EY study proved that a comprehensive financial plan that combines investments, permanent life insurance, and annuities drove better financial outcomes more often than an investments-only strategy.

Financial advisors create financial plans for the individual

People are unique and deserve financial plans tailored to their individual needs. Many people don’t have the time to explore the nuances of financial planning and wealth management to create their own financial plans. They don’t know where they are going or how to get there. In response, many people cobble together a myriad of financial vehicles, cross their fingers, and hope for the best without stopping to think about how they all fit together. That’s where a financial advisor can help.

Financial advisors work alongside individuals, architecting plans to build financial security for today and tomorrow. They can design a plan around an individual’s priorities, charting a course to achieve their goals while protecting everything they’ve worked so hard for. This plan brings together all aspects of a person’s financial life and includes a wide range of options and strategies tailored to the person’s life and goals. Advisors can help with the big picture, allowing individuals to focus on what they do best.

Younger Americans should remember that although the times may be different than those of their parents or grandparents, the path to financial security remains the same. They can benefit from a financial plan that balances their current and future priorities. If they do, they can make the best financial choices for themselves today and every day after.

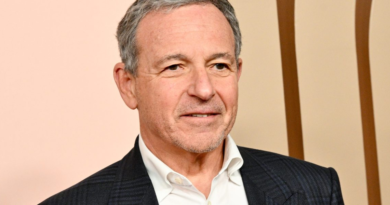

John Schlifske is the chairman and CEO of Northwestern Mutual and a member of the company’s board of trustees.

More must-read commentary published by Fortune:

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.