Bfree, a Nigerian startup enabling lenders recover debt ethically, gets $3M backing

Bfree, a tech-enabled debt collection startup based in Nigeria, was founded to automate and introduce ethical debt recovery processes after its founders witnessed the use and adverse effects of aggressive retrieval techniques, such as incessant calling and debt-shaming, by predatory digital lenders.

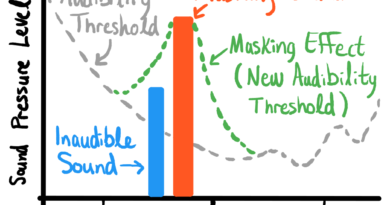

After its launch in 2020, the startup introduced a number of scalable debt recovery methods including a self-service platform, which allows borrowers to set up new payment plans, and conversational AI tools (chatbots and callbots), as part of its collections-as-a-service offering. These tools ensure humane after-sales services for borrowers, and action based on behavioral and financial data.

Over the years, its customer-base has grown to include some of the major banks in Ghana, Kenya and Nigeria, where it plans to continue scaling, backed by the $2.95 million fresh funding it has just secured in a round led by Capria Ventures. Angaza Capital, GreenHouse Capital, Launch Africa, Modus Africa, Axian CVC and a number of angel investors, also participated in the round that brought the total funding raised to $6.5 million, including last year’s undisclosed $1.1 million bridge round.

Julian Flosbach (CEO), who co-founded the startup with Chukwudi Enyi (COO) and Moses Nmor (CPO), told TechCrunch that while Bfree started out with digital lenders, which he says are quick to adopt its products, they currently only work with a handful of them, as their key focus is on banks, which contribute up to 70% in revenues.

“Because of the immense pressure to increase our margins, we essentially had to either increase pricing or let go of a lot of smaller customers,” said Flosbach, adding that it makes business sense to work with banks because of their large loan portfolios compared to digital lenders. The startup currently serves 14 customers, although it has worked with 45 since launch.

Bfree says 92% of its interactions with customers are fully automated, but has maintained a call center, manned by a small team, for when customers call or for follow-ups that require phone calls. It also launched a loan collection management SaaS dubbed Workflow, which targets companies with in-house collection teams or those that are not keen to outsource.

The startup is arguably the only tech-enabled credit recovery company across Africa, where collectors continue to heavily rely on traditional options like call centers to follow-up on settlements.

Bfree to create secondary market for loans

Its current loan portfolio stands at over $400 million, out of which it has managed to collect 12.5%.

The startup also plans to create a secondary debt market, to allow third-party investors like hedge funds, looking to diversify their investments, to buy non-performing loans (NLPs) from banks in Africa. Debt buyers purchase loans from banks at a fraction of the debt’s face value, and make profits from collection. Banks sell NLPs to minimize their risk, manage loan portfolios and free up funds.

“We collect so much data of borrowers, especially defaulting borrowers. We were able for the first time to actually develop an algorithm that can value these assets. We can predict how much is a loan that has not been paid back, let’s say for 90 days; how likely is it going to be paid back over the next one year. Then we go to banks and buy these assets and take them off their balance sheets, allowing them to offload the risk,” said Flosbach.

He added that they also have an analytics solution for banks to help them gain insights into secondary debt markets.

Commenting on the investment, Susana García-Robles, managing partner at Capria Ventures, a Global South specialist VC firm investing in applied Generative AI, said: “The advent of generative AI provides a pathway for more efficient scaling, enabling the company to expand across the continent at a reduced cost. Bfree is well-positioned to play a crucial role in improving accessibility and mitigating risk in financial services.

“We foresee the growing prominence of credit management and are confident that Bfree will spearhead the creation of a secondary market on the continent for distressed assets. Bfree has secured significant partnerships with top-tier banks and fintechs, affirming the effectiveness of its product and reinforcing our belief in its potential to transform credit collection in Africa,” said García-Robles.

As the startup diversifies its offerings, it has also slowed down its aggressive expansion plans announced two years ago, when venture capital flowed freely and “growth at all costs” was the mantra, to concentrate on its three key markets in Africa. This is upon the awareness of varying market dynamics, and the realization that every market needs different approaches and products.