Top real estate mogul sees ‘500 or more’ fewer banks in two years

Ever since four regional banks holding a combined $532 billion in assets—headlined by Silicon Valley Bank—failed in March 2023, regional banks have been under scrutiny from regulators. And given the commercial real estate (CRE) industry’s issues, a key focus has been on banks with the most exposure to the volatile sector.

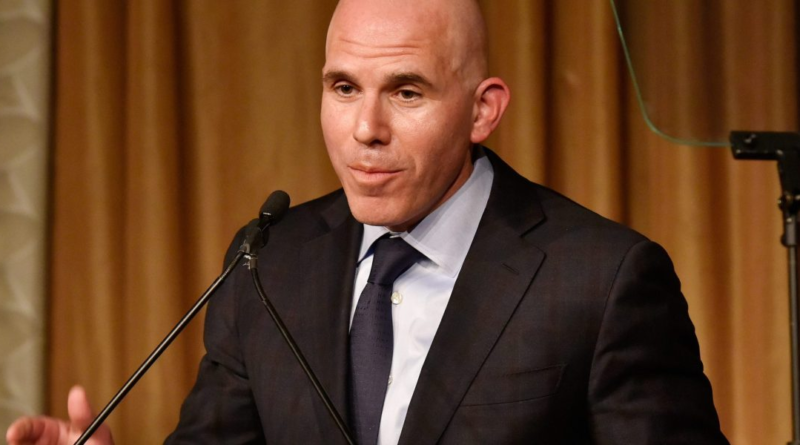

In a white paper released today, RXR Realty CEO Scott Rechler described how regional banks will face a “slow-moving train wreck” as waves of commercial real estate loans mature over the next few years. Rechler has faith that many commercial real estate owners, operators, and lenders will figure out a way to overcome the challenges facing them, but he’s more skeptical about regional banks. “I think there’s going to be…500 or more fewer banks in the U.S. over the next two years,” he said. “I’m not saying they’re all going to fail, but they’re going to be forced into consolidation if they don’t fail.”

“They don’t have a business model that’s going to enable them to stand alone, and be competitive, and retain deposits and service customers the way that they have,” he added.

Regulators’ fears about regional banks with exposure to CRE aren’t unfounded, New York Community Bancorp. (NYCB) being the prime example. Shares of NYCB have plummeted roughly 78% from their July 2023 peak due to concerns over their CRE exposure. The pain accelerated after NYCB reported a surprise fourth-quarter loss and slashed its dividend on Jan. 31, 2023 because it had to put away more money to cover its CRE holdings.

For Rechler, regional banks’ CRE exposure could even end up being a “systemic issue.”

“I think when you hear the Treasury or the regulators talk about, ‘Well, with real estate, this isn’t a systemic issue.’ I think they’re really focused on the large systemically important, too-big-to-fail banks,” he said. “But when you look at the regional banks around the country, they have a significant allocation of their loans to commercial real estate. A lot of it to multifamily developers that are going to have loans that are upside down.”

Rechler went on to describe the dreaded “doom loop” that many regional banks may face. As Fortune previously reported, if depositors start to worry that regional banks with excessive CRE exposure could be in trouble, they may begin withdrawing funds. This loss of deposits, coupled with the increasing cost of compliance and insurance for CRE lenders due to regulatory pressure, could lead to more bank failures.

If more banks fail or are consolidated, they will complete the so-called doom loop by lowering the availability of CRE loans, hurting the industry. “The crisis will be exacerbated unless we take steps to unclog the financial plumbing and create some liquidity and price discovery in the market,” Rechler warned.

Still, William Blair’s macro analyst Richard de Chazal noted that the banking system, overall, remains “highly capitalized” and has had “much more conservative” lending practices than during previous eras of distress. “Hence, at this point it would be a large leap to suggest that the entire banking system is at risk from CRE exposure as was the case with the residential housing market in the 2008-2009 crisis,” he wrote in a March 1 note.

Only time will tell who is right about CRE’s impact on the banking system, but if it’s Rechler, expect a slightly tamer repeat of the savings and loan crisis of the 80’s and early 90’s, when nearly 3,000 banks went under. “I think this is gonna be something more structural in nature, like in the early 90s, with reference to savings and loan crisis, which was a sort of regime change [where] every capital structure and every valuation reset,” Rechler said.