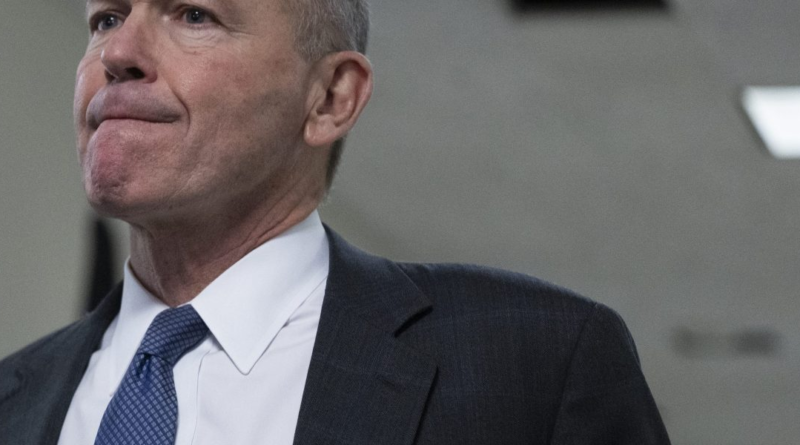

Dave Calhoun needs the next Boeing CEO to be a success and he has more than $45 million riding on it

Departing Boeing CEO Dave Calhoun will walk away from the airline manufacturer with a $24 million payday, but he stands to collect about $45.5 million more if the next CEO at Boeing, Stephanie Pope, can boost the stock price nearly 37%.

Boeing hasn’t announced when Calhoun’s last day will be or how his departure will be classified—if he’s retiring or being dismissed for cause—but he’ll bring millions into retirement. The only catch is how long he’ll have to wait.

Calhoun holds 175,435 options that are currently underwater, meaning the price of Boeing’s stock, $191.14, is lower than the exercise price of his options. Calhoun holds 107,195 options priced at $258.83 that expire in February 2031, and 68,240 shares priced at $260.98 that expire in February 2032, said Ben Silverman, vice president of research at insider stock sales analysis firm Verity. The total $45.5 million Calhoun can collect from his options will depend on how the next CEO, Stephanie Pope, fares in the job, giving Calhoun a huge stake in Pope’s success. If Calhoun’s exit is treated as a retirement, which is likely, only a portion of his outstanding restricted stock will vest immediately, noted Silverman. That stock is valued at $5 million based on today’s price.

For Calhoun, the multiple millions he might see in the future will depend on how things go for Boeing from here on out. He’ll see another payday of 25,000 shares in February 2027 and the remaining 75,506 in 10 annual installments that are scheduled to start the year after Calhoun separates from the company, said Silverman. Based on today’s stock price, he could see $4.8 million from the first tranche, and $14.4 million over 10 years from the remaining stock. Calhoun outright owns 69,812 shares currently and he holds 25,767 phantom shares—stock units that are treated like stock—that he accrued for board service and that will be distributed to him as common stock upon his separation from the company, according to Silverman’s analysis.

So far, Calhoun’s exit looks to be a far cry from the CEO who preceded him. Dennis Muilenburg, who was fired by the Boeing board after two fatal crashes and a 10-month grounding of all the company’s 737 Max jets, collected $80 million on his way out the door but did not pick up a severance package.

A Boeing spokesperson said in a statement to Fortune that the company will be outlining Calhoun’s compensation in company filings in the coming weeks. The board could opt to grant Calhoun a larger package but it stands to face heavy criticism if it looks to be overpaying a departing CEO who is leaving under a dark cloud of doubt. Calhoun’s total pay in 2022, based on the company’s 2023 disclosures, was $22.4 million, including $8.5 million in options, $8.5 million in stock and $3.4 million in an annual cash bonus. The Boeing board punished Calhoun for poor performance in 2022, paying out zero for long-term performance after the executive team failed to hit goals. Calhoun was also prohibited from selling or transferring shares he got after exercising his option grants until he left Boeing.

Calhoun joined the Boeing board as a director in 2009 and became board chair in October 2019. The board elected him president and CEO on Dec. 23, 2019. At the time, the board set Calhoun’s base salary at $1.4 million with an annual bonus of $2.5 million, plus additional long-term incentives including $7 million if he could get the 737 MAX safely returned to service. The company also gave him a supplemental award with a three-year vesting period valued at $10 million. In 2020, Calhoun, like other CEOs, skipped out on taking salary after Covid-19 hit. His total compensation his first year was mainly stock valued at $21 million.

Calhoun never sold his Boeing shares during his time at the company, said Silverman in a statement to Fortune. He bought 25,000 shares in an investment worth about $4 million in November 2022, and he purchased 800 shares in an investment worth about $34,000 six weeks after he joined the board in 2009.