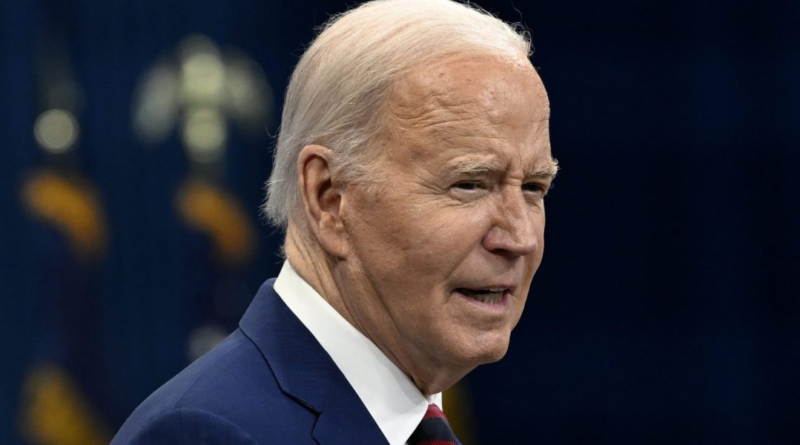

Biden proposes student-debt relief for more than 20 million additional borrowers as Gen Z becomes key vote in 2024 election

President Joe Biden unveiled plans on Monday to provide student-debt relief to tens of millions of additional borrowers as young voters come into focus with the 2024 election season heating up.

The White House estimates that the proposal would boost the number of borrowers getting relief to 30 million, which includes the 4 million who have already been approved for debt cancelation during the Biden administration.

The plan would be enacted via rule-making under the Higher Education Act from 1965. That’s after the Supreme Court last year struck down Biden’s earlier student-debt relief plan that used the Heroes Act of 2003 and was meant for 40 million borrowers.

While the latest proposal would enter a public-comment period and likely face legal challenges, White House Press Secretary Karine Jean-Pierre said in a briefing that it could be implemented as soon as this fall.

Such a timeline could put it before the Nov. 5 presidential election. After getting strong support from young voters in 2020, Biden’s approval from that demographic has waned, according to recent polls. Last week, a NPR/PBS Newshour/Marist College poll found that former President Donald Trump is leading Biden by 2 points among Millennial and Gen-Z voters.

Underscoring the political implications of the new debt-relief plan, Biden and Vice President Kamala Harris traveled to the key battleground states of Wisconsin and Pennsylvania, respectively, to announce it.

Under the proposal, the administration estimates that 25 million borrowers would see some of their accrued interest eliminated (including 23 million who would have all of it eliminated), 4 million would get the full amount of their student debt canceled, and more than 10 million with with at least $5,000 in debt would get some relief.

“We’re delivering as much relief as possible for as many borrowers as possible as quickly as possible,” Education Secretary Miguel Cardona told reporters.

Senior administration officials who were granted anonymity to brief reporters ahead of Biden’s announcement said that there would be some overlap, with a borrower qualifying more than one type of relief in certain cases.

Here are some details on how the different student debt-relief programs would work, according to information provided by the administration.

Up to $20,000 accrued from unpaid interest after borrowers began repaying their student loans would be canceled, though some lower-income borrowers can qualify for more.

In addition, Biden’s plan would automatically cancel debt for borrowers eligible for relief through forgiveness plans, such as Saving on a Valuable Education (SAVE) or the Public Service Loan Foregiveness (PSLF), but who haven’t successfully applied yet.

The administration would also cancel student debt for borrowers who started repaying loans 20 or more years ago as well as for borrowers who have loans from schools that took advantage of students or closed and failed to provide “sufficient value,” meaning graduates couldn’t afford loan payments or earned what a high school graduate made.

And over the coming months, Biden plans to announce addition proposals to cancel student debt for borrowers suffering from hardships that prevent them from repaying loans. That could include people at high risk of defaulting on student debt or people with other expenses like medical debt or child care.