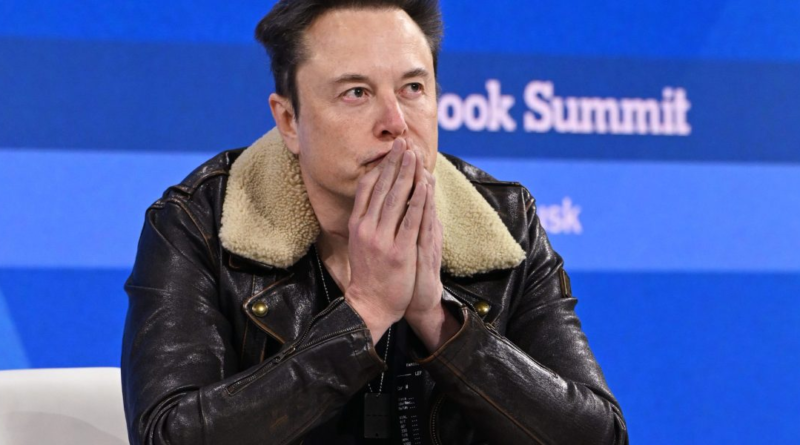

Elon Musk and Tesla are caught in a ‘Category 5 demand storm’—and robo-taxis aren’t the answer, longtime Tesla bull says

Demand issues and rising competition, both domestically and abroad, have weighed on Tesla in recent quarters. Shares of Elon Musk’s EV giant are now down more than 30% year to date, and 58% from their 2021 all-time high. And after reporting vehicle delivery numbers that were 13% below Wall Street’s consensus estimates earlier this month, in what some analysts labeled a “nightmare” quarter, headwinds have become so severe for Tesla that even Wall Street’s most well-known bulls are starting to get nervous.

Wedbush Securities tech analyst Dan Ives, who has been a Tesla bull since he started covering the company in 2018, argued in a Thursday research note that Elon Musk and company are going through a “Category 5 demand storm” in the EV market.

He said Tesla is currently stuck between “two waves of growth”—the first led by spiking high-end EV sales, and a second, which should come from mass-market EVs and robo-taxis. But despite this narrative, “patience is starting to wear very thin among investors.”

That comes after Reuters reported last week that Tesla had abandoned plans to build a mass-market, sub-$30,000 EV called the Model 2. Musk responded to the Reuters report in a post on X, saying simply that “Reuters is lying (again),” without clarifying.

Amid the recent demand concerns, Musk also announced on April 5 that Tesla will unveil its vaunted robo-taxi at the end of the summer. In the 2023 Musk biography, by Walter Isaacson, the billionaire CEO detailed just how critical he believes robo-taxis will be for his company. “This is the product that makes Tesla a $10 trillion company,” Musk said. “People will be talking about this moment in a hundred years.”

But while Musk is ready to launch his robo-taxis this year, Ives argued that they are simply “not the near-term answer to fill this growth gap”—while the Model 2 mass-market EV is. “It would be a risky gamble if Tesla moved away from the Model 2 and went straight to robo-taxis,” he wrote.

Ives predicted there won’t be fully autonomous robo-taxis until 2030 and noted that roughly 60% of Tesla’s earnings growth over the next few years was expected to come from the Model 2, which was supposed to hit the streets in 2025 or early 2026.

“The future of Tesla is a bit murky now … Musk needs to give the clear road map and strategic vision for the Street, with Model 2 a key component,” he wrote.

Ives has told Fortune multiple times in recent years that he often has to do a lot of “hand-holding” with investors when it comes to growth stocks like Tesla. He assures these skittish investors that the long-term vision of the company is intact when things go wrong and says his more bearish peers are overreacting to near-term issues.

But this time is a bit different.

“Unlike other times, Street criticism is warranted as growth has been sluggish and margins showing compression with China a horror show and competition increasing from all angles,” the veteran analyst warned.

Ives wasn’t the only Wall Street analyst questioning Tesla’s current path this week, either. Bank of America Research automotive analysts, led by John Murphy, said in a Wednesday research note that Tesla is going through a ”volatile time in the maturation curve” as it moves from relying on higher-end EV sales to mass-market models and robo-taxis.

Murphy and his team believe that demand issues and rising inventories mean Tesla might be forced to cut prices yet again for its EV models unless it’s able to tap into a new market, and that could lead to “mounting profit pressure.”

“The introduction of a low-priced model (Model 2) remains far away (2026). This leaves pricing as the main lever to stimulate demand (which we note has not worked very well so far),” they wrote.

If price cuts don’t help Tesla juice demand, Murphy and company warned that there could even be production cuts for some high-volume models this year. That would be bad news for a company like Tesla that relies on growth to justify its high valuation. As Wedbush’s Ives put it: “For Musk, this is a fork in the road. [It’s] time to get Tesla through this turbulent period, otherwise dark days could be ahead.”