Israel-Iran conflict adds to Fed's caution on rate cuts as oil prices may disrupt inflation fight—but China and OPEC+ could ease pressure, Capital Economics says

Increased tension in the Middle East following Iran’s attack on Israel likely gives the Federal Reserve even more cause to go slow on rate cuts, as a spike in oil prices could disrupt the central bank’s battle against inflation, according to Capital Economics.

After Israel and its allies shot down nearly all the missiles and drones Iran launched on Saturday, all eyes are on how Prime Minister Benjamin Netanyahu and his government will respond and whether it will lead to a cycle of more retaliatory attacks.

“The key risks for the global economy are whether this now escalates into a broader regional conflict, and what the response is in energy markets,” wrote Neil Shearing, Capital Economics’ group chief economist, in a note Sunday. “A rise in oil prices would complicate efforts to bring inflation back to target in advanced economies, but will only have a material impact on central bank decisions if higher energy prices bleed into core inflation.”

While Iran’s attack marked its first direct military assault on Israel, the White House signaled it’s seeking to prevent hostilities from spreading. President Joe Biden reportedly told Netanyahu the U.S. would not participate in any offensive action against Iran, after pledging “ironclad” support for Israel’s defense.

Meanwhile, Wall Street analysts are bracing for oil prices to jump in the wake of the attack, with many expecting a surge above $100 a barrel. That’s after Brent crude had already shot up 20% in the year to date to exceed $90.

“Energy markets remain the key transmission mechanism from regional tension/conflict to the rest of the world economy,” Shearing said, noting that Russian attacks on Ukrainian storage facilities also sent European natural gas prices higher in the past week.

He cited a general rule of thumb that says a 10% increase in oil prices translates to 0.1-0.2 percentage points of additional headline inflation in advanced economies.

While that means oil’s jump in the past month will lift inflation by about 0.1 percentage point, that’s unlikely to sway central bank policy decisions, he added. Instead, oil prices would have to stage a larger and more sustained increase to move the needle on monetary policy, specifically if any spike spills over into core inflation.

But Shearing also highlighted potential counterweights to rising energy costs. For example, China’s expansion of its production capacity in recent years is weighing on export prices and creating disinflationary pressure in the goods market, he explained.

In addition, “cracks are already starting to appear in the OPEC+ group” as the UAE and other producers are demanding the oil group raise production limits, Shearing said. That would boost supply and ease pressure on crude prices.

“As things stand our sense is that events in the Middle East will add to the reasons for the Fed to adopt a more cautious approach to rate cuts, but they won’t prevent it from cutting altogether,” he concluded. “We expect the first move in September. And, assuming that the energy prices don’t spiral over the next month or so, we think that both the ECB and BoE will cut in June.”

Signs of sticky inflation have already dampened hopes that the Fed would soon begin cutting rates. Central bankers have also been hammering that point too.

San Francisco Fed President Mary Daly, who is typically dovish, said on Friday that there’s no urgency to lower rates. Meanwhile, Atlanta Fed President Raphael Bostic said recently he could easily see one rate cut being appropriate, and Minneapolis Fed President Neel Kashkari warned there wouldn’t be any interest rate cuts this year if inflation didn’t improve.

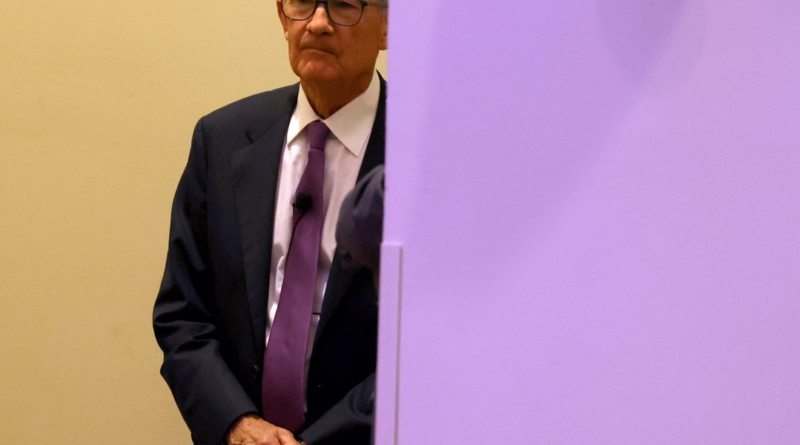

For his part, Federal Reserve Chair Jerome Powell has been clear that rate cuts would only come when inflation went down. Even in January when the inflation rate dropped to 3.1% from 3.4% the month before, Powell said he needed to see it go lower for longer.