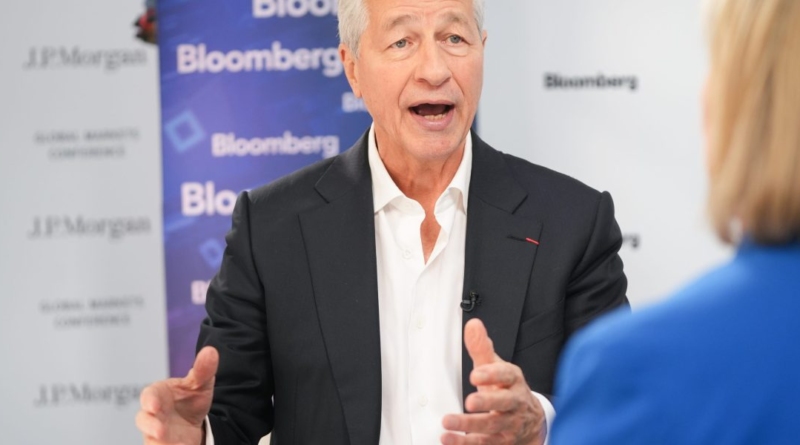

Jamie Dimon is so over spectators questioning whether his possible move from CEO to chairman would be bad for JPMorgan: 'How the hell do they know? There's no magic to it'

It might be impossible to imagine JPMorgan without Jamie Dimon at the helm—after all, he’s led the company for almost two decades. But the Wall Street veteran has now signaled he will leave the CEO’s office in the next five years, perhaps taking on the role of chairman to help oversee the company through a time of transition.

Impatient potential successors may not have their answer anytime soon though, as Dimon pushed back on assumptions that a set timeline is in place and that he is privy to the knowledge of when he might retire from his corner office.

Instead, the 68-year-old said on Wednesday he is beholden to the board—both when it comes to when he will leave the CEO seat and whether he’ll stay on in another capacity.

Speaking at AllianceBernstein’s Strategic Decisions conference this week, Dimon said: “It’s totally up to the board. You can ask me all you want but the timetable is less than five years—that could be four, that could be three, could be three and a half, could be four and a half, could be two and a half.

“The board will decide. We’ve got some great succession—you all know them all so you can evaluate them yourself.”

Famously, Dimon would always respond “in the next five years” when asked when he was planning to leave the CEO seat at JPMorgan. But the company’s 2024 proxy statement not only confirmed planning is well underway for the event but also rattled off the list of candidates—these “known” individuals—who could fill Dimon’s considerable shoes.

The board’s statement reads: “One of the board’s top priorities is to plan for an orderly CEO transition in the medium term … the board is spending significant time on developing operating committee members who are well-known to shareholders as strong potential CEO candidates.”

Mentioned in relation to the role are Jennifer Piepszak and Troy Rohrbaugh, who were named co-CEOs of the expanded commercial and investment bank in a raft of role changes earlier this year, and Marianne Lake who became the sole CEO of consumer and community banking.

Also in the running is Mary Erdoes, who remains CEO of asset and wealth management. Daniel Pinto—president and chief operating officer—”is immediately ready to fulfill the responsibilities of the CEO” in the near-term should the need arise, the statement adds.

JP without Dimon?

While Dimon will take a step back as CEO, a move into the chairman role has been teased. However, Fortune 500 businesses will be well aware of the issues that can arise between a CEO and chairman, particularly when an influential character like Dimon is involved.

But the billionaire fired back at such speculation, saying: “I love it when these people make binary statements of: ‘It’s good, it’s bad.’ How the hell do they know? That’s why you have a board. The board should decide what’s in the best interest of the company.”

There are plenty of examples of businesses which have had separate CEOs and chairmen that didn’t work out, he added, but countered the focus should be on: “Does the company function properly? Does it have good governance?

“One of the most importance governance things—and I’ve been doing this since Bank One—every single meeting we have [with the board] they meet all the senior people, they know them all well, but at all the meetings I leave at one point and they do stuff without me. It’s run by the lead director which basically has the same authority as a chairman … I mean like who cares? We were overstating the importance of this issue at one point.”

And despite the instances where a CEO and chairman haven’t seen eye to eye, there are also examples where this partnership has really worked. “There’s some examples … where it was a great partnership and they went on for years,” Dimon, a Harvard alumni, said. “There’s no magic to it but the board should do the right thing—if the chairman is getting in the way of the new CEO they should go. If the chairman is helping the new CEO in a million different ways they should stay.”

Engrained character

As America’s biggest bank handling $3.4 trillion in assets—up 24% compared to last year—shareholders and Wall Street peers are understandably concerned with how JPMorgan will perform without Dimon at its helm.

The CEO paid a record $36 million for his work in 2023 is steadfast in his belief that the quality of management up and down the ranks is superior. He added: “I think we have extraordinary management… You know how capable a lot of these people are, and I think there’s an extraordinary discipline.”

The training, culture, and character of JPMorgan isn’t going to “go away overnight” because Dimon leaves, he continued. Moreover, these qualities shouldn’t just be embedded at leadership at the top of the tree it should be embedded in “every trading desk, every branch, every business, innovation.

“We’ve been doing this for a long time so hopefully it’s engrained in people—and in the board.”