Can quick commerce leapfrog e-commerce in India?

Even as quick commerce startups are retreating, consolidating or shutting down in many parts of the world, the model is showing encouraging signs in India. Consumers in urban cities are embracing the convenience of having groceries delivered to their doorstep in just 10 minutes. The companies making those deliveries — Blinkit, Zepto and Swiggy’s Instamart — are already charting a path to profitability.

Analysts are intrigued by the potential of 10-minute deliveries to disrupt e-commerce. Goldman Sachs recently estimated that Blinkit, which Zomato acquired in 2022 for less than $600 million, is already more valuable than its decacorn food delivery parent firm.

As of earlier this year, Blinkit held a 40% share of the quick commerce market, with Swiggy’s Instamart and Zepto close behind, according to HSBC. Flipkart, owned by Walmart, plans to enter the quick commerce space as soon as next month, further validating the industry’s potential.

Investors are also showing strong interest in the sector. Zomato boasts a valuation of $19.7 billion despite minimal profitability, processing around 3 million orders a day. In comparison, Chinese giant Meituan, which processes more than 25 times as many orders daily, has a market cap of $93 billion. Zepto, which achieved unicorn status less than a year ago, is finalizing new funding at a valuation exceeding $3 billion, according to people familiar with the matter.

Consumers are buying the quick commerce convenience, too. According to a recent Bernstein survey, the adoption was highest among millennials aged 18 to 35, with 60% of those in the 18 to 25 age bracket preferring quick commerce platforms over other channels. Even the 36+ age group is adopting digital channels, with over 30% preferring quick commerce.

While India’s rapid urbanization makes it a prime target for quick commerce, the industry’s unique operational model and infrastructure needs could limit its long-term growth and profitability. As competition intensifies, the impact of quick commerce is likely to be felt more acutely by India’s e-commerce giants. But what makes India’s retail market so attractive for quick commerce players, and what challenges lie ahead?

The opportunity for quick commerce in India

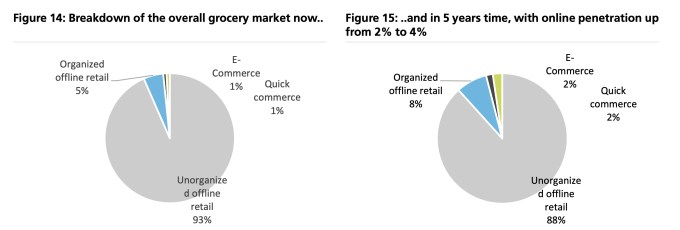

India’s e-commerce sales stood at $60 billion to $65 billion last year, according to industry estimates. That’s less than half of the sales generated by e-commerce firms on China’s last Singles Day and represents less than 7% of India’s overall retail market of more than $1 trillion.

Reliance Retail, India’s largest retail chain, clocked a revenue of about $36.7 billion in the financial year ending in March, with a valuation standing at $100 billion. The unorganized retail sector — the neighborhood stores (popularly known as kirana) that dot thousands of Indian cities, towns and villages — continues to dominate the market.

“The market is huge and, on paper, ripe for disruption. Nothing done so far has made a material dent in the industry. This is why any time a new model shows signs of functioning, all stakeholders shower them with love,” said a seasoned entrepreneur who helped build the supply chain for one of the leading retail ventures.

In other words, there’s no shortage of room for growth.

One of the factors behind the quick commerce’s fast adoption is the similarity it has with the kirana model that has worked in India for decades. Quick commerce firms have devised a new supply chain system, setting up hundreds of unassuming warehouses, or “dark stores,” strategically situated within kilometers of residential and business areas from where large numbers of orders are placed. This allows the firms to make deliveries within minutes of order purchase.

This approach differs from that of e-commerce players like Amazon and Flipkart, which have fewer but much larger warehouses in a city, generally situated in localities where rent is cheaper and farther from residential areas.

The unique characteristics of Indian households further contribute to the appeal of quick commerce. Indian kitchens typically stock a higher number of SKUs compared to their Western counterparts, necessitating frequent top-up purchases that are better serviced by local stores and quick commerce rather than modern retail. Additionally, limited storage space in most Indian homes makes monthly bulk grocery shopping less practical, and customers tend to favor fresh food purchases, which quick commerce can easily accommodate.

According to Bernstein, quick commerce platforms can price products 10% to 15% cheaper than mom-and-pop stores while maintaining about 15% gross margins due to the removal of intermediaries. Quick commerce dark stores have rapidly expanded their SKU count from 2,000 to 6,000, with plans to further increase it to 10,000 to 12,000. These stores are replenishing their stocks two to three times a day, according to store managers.

Battling e-commerce

Zepto, Blinkit and Swiggy’s Instamart are increasingly expanding beyond the grocery category, selling a variety of items, including clothing, toys, jewelry, skincare products and electronics. A TechCrunch analysis finds that the majority of items listed by Amazon India in its bestsellers list are available on quick commerce platforms.

Quick commerce has also become an important distribution channel for major food brands in India. Consumer goods giant Dabur India expects quick commerce to drive 25% to 30% of the company’s sales. Hindustan Unilever, the Indian arm of the U.K.’s Unilever, has identified quick commerce as an “opportunity we will not let go.” And for Nestle India, “Blinkit is becoming as important as Amazon.”

While quick commerce doesn’t need to expand beyond the grocery category, which itself is more than a half-trillion-dollar market in India, their expansion into electronics and fashion is likely to be limited. Electronics drive 40% to 50% of all sales on Amazon and Flipkart, according to analyst estimates. If quick commerce can crack this market, it will pose a significant and direct challenge to e-commerce giants. Goldman Sachs estimates that the total addressable market in grocery and non-grocery for quick commerce companies in the top 40-50 cities is about $150 billion.

However, the sale of smartphones and other high-ticket items is more of a gimmick and not something that can be done at a large scale, according to an e-commerce entrepreneur.

“It doesn’t make any sense. What quick commerce is good at is forward-commerce. But smartphones and other pricey items tend to have a not-so-insignificant return rate.… They don’t have the infrastructure to accommodate the reverse-logistics,” he said, requesting anonymity as he is one of the earliest investors in a leading quick commerce firm.

Quick commerce’s current infrastructure also doesn’t permit the sale of large appliances. This means you cannot purchase a refrigerator, air conditioner, or TV from quick commerce. “But that’s what some of these firms are suggesting, and analysts are lapping it up,” the investor said.

Falguni Nayar, founder of skincare platform Nykaa, highlighted at a recent conference that quick commerce is primarily taking share from kirana stores and would not be able to keep as much inventory and assortment as specialty platforms that educate customers.

The quick commerce story in India remains an urban phenomenon concentrated in the top 25 to 30 cities. Goldman Sachs wrote in a recent analysis that the demand in smaller cities likely makes it difficult for fresh grocery economics to work.

E-commerce giant Flipkart will launch its quick commerce service in limited cities as soon as next month, seeing an opportunity to woo customers of Amazon India. The majority of Flipkart’s customers are in smaller Indian cities and towns.

Amazon — increasingly scaling down on its investments in e-commerce in India — has so far shown no interest in quick commerce in the country. The company, which offers same-day delivery for some items to Prime members, has questioned the quality of products from firms making “fast” deliveries in some of its marketing campaigns.

As brands increasingly focus on quick commerce as their fastest-growing channel and more consumers embrace the convenience and value proposition of 10-minute deliveries, the stage is set for a fierce battle between quick commerce and e-commerce giants in India.