Nvidia shares tumble over 6% amid geopolitical fears in chip sector

Global chip stocks from AI giant Nvidia to manufacturers like Taiwan Semiconductors (TSMC) and ASML tumbled Wednesday. The drop came as the Biden administration weighed tighter export controls to stymie China and former President Donald Trump made comments that sparked fresh doubt about America’s commitment to defend Taiwan. Shares of Nvidia, the third-largest company in the U.S. by market capitalization, were down over 6% as of Wednesday afternoon.

The U.S. stock of Nvidia’s main supplier, TSMC, was down over 7%. Shares of Tokyo Electron and Netherlands-based ASML dropped 11% and 12%, respectively, as the U.S. ramped up the pressure to prevent both companies from continuing to provide China with advanced semiconductor technology.

Concerns over the chip sector mounted in part due to reports the Biden administration may invoke the foreign direct product rule, a measure that allows the country to impose severe controls on any foreign-manufactured products that incorporate even the smallest amount of American technology. The administration told allies, particularly in Tokyo and the Hague, that the rule’s implementation was a likely outcome unless those countries tightened their own chip-policies toward China, according to Bloomberg.

Negative sentiment was already swirling after Trump said, “Taiwan should pay us for defense,” in an interview with Bloomberg Businessweek published on Tuesday. The comments from the Republican presidential nominee, whose odds of beating Biden in November jumped on the world’s largest prediction market after Saturday’s assassination attempt, loom large because of the self-governing island’s semiconductor dominance.

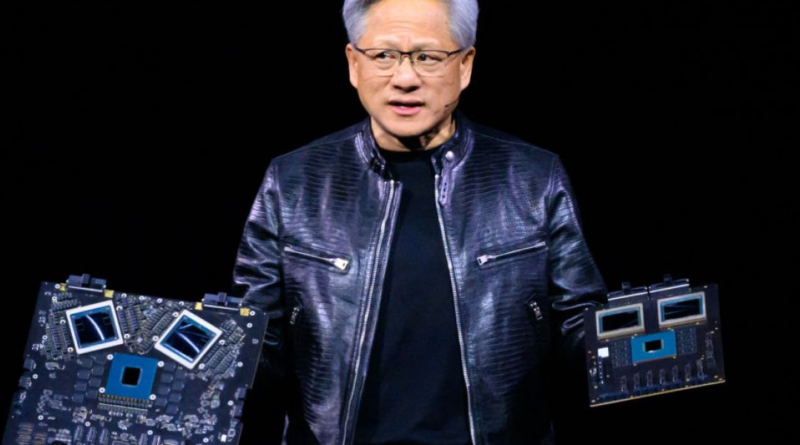

Around 92% of the world’s most advanced chip manufacturing capacity is located in Taiwan, according to the U.S International Trade Commission. TSMC, the world’s largest chip manufacturer, is the predominant supplier for Nvidia’s H100GPUs — the chips at the heart of the AI boom.

Unlike other designers, Nvidia does not manufacture any of its own chips. Shares of GlobalFoundries, a potential beneficiary of continued efforts to bolster onshore U.S. chip production, were up almost 7% at the time of publication.