Thoma Bravo closes $5.3 billion Darktrace acquisition weeks after founding investor Mike Lynch’s death

Thoma Bravo has completed its $5.3 billion acquisition of British cybersecurity group Darktrace, ending a tumultuous takeover rocked by the resignation of its CEO and the death of early backer Mike Lynch.

The private equity giant confirmed on Tuesday that it had agreed to buy Darktrace, taking the company off the London Stock Exchange in a take-private deal.

The closure ends a tense couple of months for Darktrace as it sought to close a bumper deal agreed in April. The acquisition gained more public awareness following Lynch’s death in August.

Lynch died alongside six other passengers when the Bayesian yacht he was on sank after running into storms on the Mediterranean Sea. His passing left an unconcluded civil suit with HPE over the $11.7 billion acquisition of Autonomy in 2011 and helped resurface questions aimed at Darktrace.

Early in September, Darktrace co-founder and CEO Poppy Gustafsson then unexpectedly resigned from the company weeks before the takeover would complete.

Gustafsson co-founded Darktrace in 2013 after departing Lynch’s controversial Autonomy Group, where she was a corporate controller. In her statement announcing her resignation, Gustafsson said she was looking forward to continuing at Darktrace as a non-executive director after the transaction completes.

“Darktrace has been a huge part of my life and my identity for over a decade, and I am immensely proud of everything we have achieved in that time,” Gustafsson said in a statement.

In its statement, Darktrace said all non-executive directors of the company had tendered their resignations and stepped down from the board.

A representative for Darktrace didn’t immediately respond to Fortune’s request for clarification as to whether this included Gustafsson.

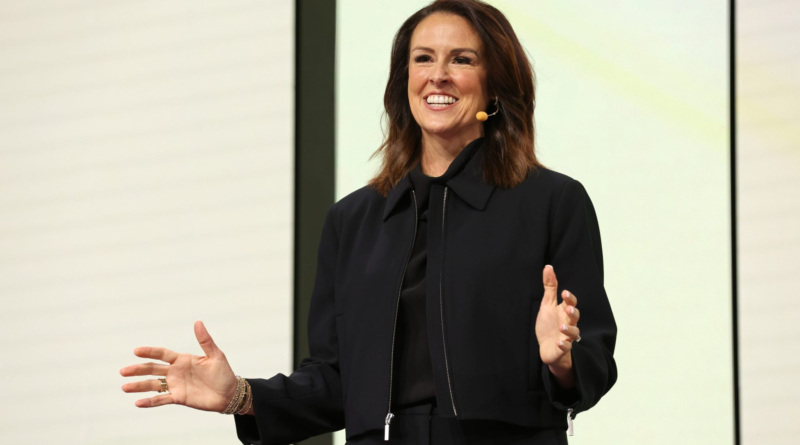

Gustafsson was replaced by COO Jill Popelka, who only joined the cybersecurity group in January as a non-executive director. Popelka previously worked at Snap, Accenture, and SAP SuccessFactors.

“Protecting businesses and organisations with best-in-class AI-powered, proactive cybersecurity will remain at the absolute core of what we do,” Popelka said in a statement. Together, we can take this even further, investing in our people to enhance our technical capabilities and delivering exceptional service and value for our customers.”

Thoma Bravo’s acquisition was regarded as a major blow to the London Stock Exchange, which has watched several large companies withdraw from the exchange in recent months to opt for rival exchanges or to go private.

“Darktrace holds a unique position at the forefront of cybersecurity technology,” said Seth Boro, managing partner at Thoma Bravo.

“As one of the early adopters of AI, the value of its capabilities is evident to businesses, governments and society across the world. We are excited to work alongside Jill and the Darktrace team to build on their success, supporting their ambitions to protect the world from the most advanced cyber threats.”

Mike Lynch links

Lynch was a major early backer of Darktrace through his venture capital firm Invoke Capital. He helped set up his private equity fund with the reported £500 million he bagged from the HPE acquisition. Lynch installed several key players from Autonomy at the helm of Darktrace, including his former protégé Gustafsson.

Lynch held about a 3% stake in the company at the time of his passing.

Stephen Chamberlain, his co-accused in a criminal trial in the U.S. in June and a former COO of Darktrace, died after being struck by a car while on a run in Cambridgeshire. He would pass away on the same day that the Bayesian sank.

Darktrace was the target of short-sellers last year after U.S. hedge fund Quintessential Capital Management questioned the company’s financial statements.

An independent probe by EY found no need for Darktrace to amend previous financial statements, and the matter evidently did not serve to put Thoma Bravo off its now-completed acquisition.

Data Sheet: Stay on top of the business of tech with thoughtful analysis on the industry’s biggest names.

Sign up here.