Exclusive: Lorikeet, an AI customer service platform, comes out of stealth with $5 million in seed funding

A lorikeet is a feathered rainbow of a parrot, native to Australia’s coasts, and it’s not all that big—but it’s nearly impossible to miss.

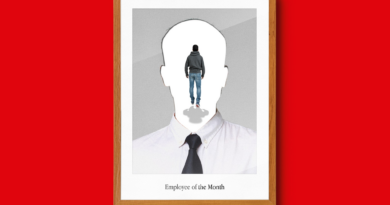

It’s a jungle out there for AI startups. Just yesterday, OpenAI closed the largest round of VC funding ever, raising $6.6 billion at a valuation of $157 billion. It somehow makes the $500 million that AI coding startup Poolside raised and revealed yesterday comparatively look quiet, demonstrating how competitive AI has become. This is especially true of AI agents, a space that’s been crowding as deal count has been soaring. But an AI customer service agent startup emerging from stealth today is betting they’ll be impossible to miss—and like the bird, the company’s called Lorikeet.

Lorikeet has raised $5 million in seed funding from Square Peg and angel investors, Fortune can exclusively report. Founded by Australians Steve Hind and Jamie Hall less than a year ago, Lorikeet hopes it will be able to challenge the likes of OpenAI and direct competitor Sierra, cofounded by Bret Taylor and Clay Bavor. In a dense market, Hind and Hall (from Stripe and Google respectively) know they only have one option if they want to compete—they have to stand out by being the best at solving hard problems.

“The thing that I see from demoing the product a lot involves people saying, ‘I’ve never seen an AI agent do that before,’” Hind told Fortune. “That’s the core thing that we’re able to do. You know, if we’re going to succeed it’s going to be off the back of that.”

Lorikeet’s hallmark is that, from the beginning, Hind and Hall ran towards untangling customer service processes in highly regulated and famously complex industries. This isn’t AI that reads and writes emails, but rather AI that’s built to automate workflows and run internal mini-projects. As Square Peg partner (and Stripe’s first-ever Asia-Pacific employee) Pirize Sabuncu said via email, Lorikeet is “not selling process improvements, they are promising a new way to truly solve their users’ complex problems.” Or, put another way:

“If you’re quitting your fancy jobs at fancy companies, there’s a sense of really wanting to give something a run,” said Hind. “You don’t want to look at your friends, wife, or kids and be like, ‘I built a chat for your help box.’”

Hind and Hall showed me a demo, in which I watched a handful of interactions simulate canceling a lost debit card and “sending” a new one. It was the livest of live demos, and I will say, it works. As we were finishing up, I involuntarily said: “Thank you, Lorikeet.” I half-apologized and Hall, who was previously on pioneering AI team Google Brain, laughed.

“When you have personalized responses that actually solve somebody’s problems—the number of times people wish the AI a good weekend or say ‘enjoy the rest of your day’ is crazy,” Hall told Fortune. “It’s branded in the app as AI, with a robot icon, so it’s not like it’s faking or anything. But once you’re in the chat and something or someone who understands the situation is solving your problem, it’s just natural for people signing off to say ‘thank you so much.’”

Lorikeet currently works with dozens of companies, from financial services to healthcare. But Eucalyptus, a telehealth platform for digital health clinics, has the distinction of being Lorikeet’s very first customer. Hall and Hind spent months encamped in Eucalyptus’s Sydney, Australia offices, learning how the company’s customer support systems worked. Today, Eucalyptus uses Lorikeet to manage ticket surges, improve customer resolutions, prioritize requests, and generate personalized responses. Eucalyptus operations lead Estelle Berton says she’s surprised by just how sticky the tech has been.

“It would be very hard to walk away from them,” said Berton. “Not that I’d want to do that anyway, but it’s a very symbiotic relationship. The other big thing is that we’ve been able to change the shape of our frontline team: I’m no longer hiring any more headcount, but we’re scaling our tickets. I didn’t think that would happen this fast.”

Last week, I wrote that I wasn’t sure that I was comfortable outsourcing credit card-related tasks to an AI agent. But after spending some time with Lorikeet, I just might be coming around.

Until further notice, I stand corrected.

See you tomorrow,

Allie Garfinkle

Twitter: @agarfinks

Email: alexandra.garfinkle@fortune.com

Submit a deal for the Term Sheet newsletter here.

Nina Ajemian curated the deals section of today’s newsletter.

VENTURE DEALS

– OpenAI, a San Francisco.-based AI company, raised $6.6 billion in funding at a total valuation of $157 billion. Thrive Capital led the round and was joined by Khosla Ventures, Altimeter Capital, Fidelity, existing investors Nvidia and Microsoft, and others.

– poolside, a San Francisco.-based AI developer for software development, raised $500 million in Series B funding. Bain Capital Ventures led the round and was joined by DST Global, StepStone Group, Schroders Capital, NVIDIA, Citi Ventures, Capital One Ventures, existing investors Felicis Ventures and Redpoint Ventures, and others.

– Triveni Bio, a Watertown, Mass.-based antibody-based therapies developer for immunological and inflammatory disorders, raised $115 million in Series B funding. Goldman Sachs Alternatives led the round and was joined by Fidelity Management & Research Company, Deep Track Capital, and existing investors Atlas Venture, Cormorant Asset Management, OrbiMed, Viking Global Investors, and Invus.

– Resolve AI, a San Francisco-based AI software operations automation developer, raised $35 million in seed funding. Greylock led the round and was joined by Unusual and angel investors.

– Mstack Chemicals, a Houston-based chemical manufacturing platform, raised $25 million in Series A funding. Lightspeed and Alpha Wave led the round and were joined by angel investors.

– Rippl, a Seattle.-based virtual dementia care platform, raised $23 million in Series A funding. Tina Hoang-To led the round and was joined by existing investors ARCH Ventures, General Catalyst, GV, and others.

– xtype, a Covina, Calif.-based multi-instance management provider for the ServiceNow platform, raised $21 million in Series A funding. Norwest Venture Partners led the round and was joined by ServiceNow Ventures and existing investors Columbia Capital, Inner Loop Capital, and others.

– Pallet, a San Francisco-based transportation and warehouse management system provider, raised $18 million in Series A funding. Bain Capital Ventures led the round and was joined by Bessemer Venture Partners, Activant Capital, and angel investors.

– Integrated Biosciences, a San Carlos, Calif.-based therapeutics developer for age-related diseases, raised $17.2 million in seed funding. Sutter Hill Ventures led the round and was joined by Root Ventures, Civilization Ventures, Illumina Ventures Labs, and others.

– MarqVision, a Los Angeles.-based online brand protection solution, raised $16 million in funding from Altos Ventures, Y Combinator, and Quantum Light.

– Vieu, a Seattle.-based AI-powered business network for enterprise sales, raised $11 million in seed funding. Trilogy Equity Partners led the round and was joined by Incubate Fund and Vela Partners.

– Zitcha, a Windsor, Australia-based retail media platform, raised $10 million in Series A funding. VMG Partners led the round and was joined by existing investor OIF Ventures.

– Reducto, a San Francisco-based AI document processing solution provider, raised $8.4 million in seed funding. First Round Capital led the round and was joined by YCombinator, BoxGroup, SVAngel, and others.

– Ameba, a London-based AI supply chain platform, raised $7.1 million in seed funding. Hedosphia led the round and was joined by Anamcara Capital and existing investor Visionaries Club.

– iAsk, a Chicago-based AI search engine, raised $4.2 million in seed funding. Corazon Capital led the round and was joined by Chingona Ventures, Starting Line VC, Alumni Ventures, angel investors, and others.

– Billables AI, a San Francisco-based AI platform for professional service providers, raised $3.9 million in seed funding. Wing VC led the round and was joined by F7, SignalFire, Darkmode, Alumni Ventures, angel investors, and others.

– Permanent, a San Juan Islands, Washington-based wholesale food marketplace and distributor, raised $3.7 million in seed funding. Better Tomorrow Ventures led the round and was joined by Atman Capital, Autopilot, Gaingels, Progression, Sugar Mountain, and others.

– Truely, a Singapore-based travel eSIM provider, raised $3.5 million in funding. 1982 Ventures led the round and was joined by Beenext, Kopital Ventures, angel investors, and others.

PRIVATE EQUITY

– Accel-KKR acquired VisiQuate, a Santa Rosa, Calif.-based revenue cycle analytics, AI-powered workflow, and automation provider. Financial terms were not disclosed.

– Altor Equity Partners agreed to acquire a majority stake in CCM Hockey, a Montreal-based hockey brand. Financial terms were not disclosed.

– Bessemer acquired a majority stake in W Services Group, a Hauppauge, N.Y.-based vendor-managed facility maintenance services provider. Financial terms were not disclosed.

– Castle Harlan acquired Alumni Educational Solutions, a Waterloo, Canada-based educational furniture manufacturer. Financial terms were not disclosed.

– General Atlantic acquired Actis, a Luxembourg-based sustainable infrastructure investor. Financial terms were not disclosed.

– Mercer Global Advisors, backed by Oak Hill Capital, Genstar Capital, and Altas Partners, acquired Kades & Cheifetz, a Philadelphia-based RIA. Financial terms were not disclosed.

– New Engen, a portfolio company of Insignia Capital Group, acquired Donut Digital, a Manhattan Beach, Calif.-based performance marketing agency. Financial terms were not disclosed.

– New Mountain Capital acquired a minority stake in Portage Point Partners, a Chicago-based business advisory, interim management, and investment banking firm serving the middle market. Financial terms were not disclosed.

– Solero Technologies, an affiliate company of Atar Capital, acquired the United States and Europe automotive business of Kendrion, an Amsterdam, Netherlands-based intelligent actuator technology company. Financial terms were not disclosed.

– Spreetail, backed by McCarthy Capital, acquired Echo, a Bangalore, India-based AI-powered customer insights platform. Financial terms were not disclosed.

– TPG Capital acquired a minority stake in Creative Planning, a Overland Park, Kan.-based wealth management firm. Financial terms were not disclosed.

– Turnspire Capital Partners acquired GHP Group, a Niles, Ill.-based consumer outdoor living and indoor heating products designer and supplier. Financial terms were not disclosed.

EXITS

– TPG Rise Climate and GIC agreed to acquire Techem, a Eschborn, Germany-based digital energy services platform for the building sector and real estate industry, from Partners Group for approximately €6.7 billion ($7.4 billion).

– GIC agreed to acquire a 25% minority stake in Reworld, a Morristown, N.J.-based sustainable waste management solutions company, from EQT. Financial terms were not disclosed.

– Qatar Airways agreed to acquire a minority 25% stake in Virgin Australia, from Bain Capital. Financial terms were not disclosed.

OTHER

– Toyota agreed to invest $500 million in Joby Aviation, a Santa Cruz, Calif.-based electric air taxis developer for commercial passenger service.

– Altor Solutions, backed by Compass Diversified, acquired Lifoam Industries, a Greer, S.C.-based temperature-controlled packaging products manufacturer for $137 million.

– Janus Henderson Group acquired Victory Park Capital Advisors, a Chicago, Ill.-based global private credit manager. Financial terms were not disclosed.

– Podimo acquired Podads, a Copenhagen-based podcast agency and advertising platform. Financial terms were not disclosed.

IPOS

– FrontView REIT, a Dallas-based outparcel properties acquisition, ownership, and management company, raised $251 million in an offering of 13.2 million shares at $19 on the NYSE.

PEOPLE

– Epiris, a London-based private equity firm, promoted Owen Wilson as chief investment partner and Ian Wood as head of the investment team.

– FTW Ventures, a San Francisco-based venture capital firm, named Rob Wilder a partner. He co-founded José Andrés Group.

– IVP, a San Francisco-based venture capital firm, added Zeya Yang as a partner. Previously, Yang was at Andreessen Horowitz.

– Kian Capital Partners, an Atlanta-based private equity firm, promoted Carter Fields to vice president and Thomas Bullock and Doyle Silvia to senior associate.

– Vector Capital, a San Francisco-based private equity firm, added Amish Mehta as a managing director. Previously, he was at SQN Investors and Vector Capital.