China’s chip advances stall as U.S. curbs hit Huawei AI Product

Huawei’s ambitions to create more powerful chips for AI and smartphones have hit major snags because of U.S. sanctions, stalling a major Chinese effort to match American technology.

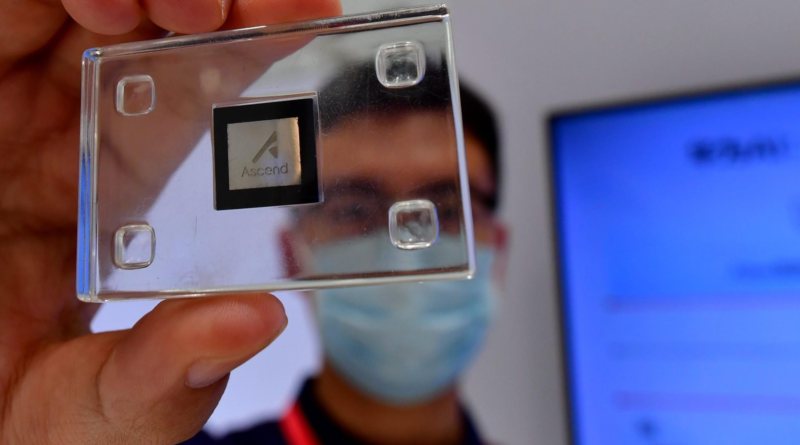

Huawei is designing its next two Ascend processors, its answer to Nvidia’s dominant accelerators, around the same 7-nanometer architecture that’s been mainstream for years, people familiar with the matter said. That’s because U.S.-led restrictions prevent Huawei’s chipmaking partners from procuring state-of-the-art extreme ultraviolet lithography systems from ASML.

That means its marquee chips will be stuck at aging technology till at least 2026, the people said, asking to remain unidentified discussing a sensitive project. Huawei’s smartphone processors, for the Mate lineup, face similar constraints, one of the people said.

Huawei’s stall has implications not just for its business, but also for China’s broader AI ambitions. Its struggles suggest the country will lag further behind the U.S. in 2025, when Taiwan Semiconductor Manufacturing Co. — chipmaker to Apple and Nvidia — begins to crank out 2nm chips about three generations ahead.

Worse, Huawei’s main production partner, Semiconductor Manufacturing International Corp., is struggling to churn out even 7nm chips at steady volumes. The Shanghai-based firm’s 7nm production lines have been plagued by poor yield and reliability issues, according to another person. There’s little guarantee that Huawei will be able to secure enough smartphone processors and AI chips in coming years, the person added.

Representatives for Huawei and SMIC didn’t respond to messages and calls seeking comment.

Huawei’s struggles reflect how years of U.S. sanctions have scored initial success at freezing Chinese technology advancements at current levels, and deprived its national champions of the chance to graduate to the next level.

Huawei in recent years has assumed a pivotal role in China’s efforts to pursue self-sufficiency in critical areas including semiconductors and AI. But the Shenzhen-based firm’s stumble — despite heavy R&D investment and the nation’s backing — highlights the sheer difficulty Beijing faces in trying to build a world-class supply chain and catch up with the US in emerging technologies.

One of the biggest bottlenecks is the inferior quality of Chinese equipment. Beijing wants local chipmakers to deploy more machines from domestic suppliers, to galvanize a domestic ecosystem. But the moratorium on EUVs — a must-have for modern chipmaking — is snarling that campaign.

In response, Huawei and its partners are resorting to rather novel methods to try and scale the tech ladder.

State-backed chipmakers have been trying to push the limit of ASML’s older deep ultraviolet lithography machines, the Dutch supplier’s second-best lineup (after EUVs), with the so-called quadruple patterning technique.

That requires lithographic machines to perform up to four exposures on a silicon wafer, with a total margin of error of no wider than hundredths the diameter of a human hair. Compared to EUV lithography, the multi-patterning technique with DUVs is not only resource-intensive but also prone to alignment errors and yield losses, according to Ying-Wu Liu, an analyst at research firm Yole Group.

That effort isn’t going well because of subpar local gear used in conjunction with ASML’s DUV systems, according to one of the people. On at least one trial production line, engineers have been forced to replace Chinese gear with foreign equipment to ensure reasonable output, the person said.

“Multi-patterning inherently introduces more process steps, increasing the risk of defects and variability,” Liu said. “Additionally, the higher complexity and cost of multi-patterning make it less economically viable for high-volume production of advanced nodes like 5nm.”

The Biden administration has restricted China from buying the most sophisticated equipment from American suppliers including Applied Materials and Lam Research and Nvidia’s most powerful AI chips, a red-hot commodity coveted by major tech firms and governments.

Huawei needs tens of millions of Kirin-branded processors for its own smartphones every year, and aims to make hundreds of thousands of Ascend AI chips, according to a person familiar with the Shenzhen firm’s business. This year, Beijing urged Chinese companies to avoid using Nvidia and instead adopt domestic alternatives such as Huawei’s, Bloomberg News has reported.

In 2023, it famously unveiled the Mate 60 Pro smartphone with a self-designed 7nm chip made by SMIC — right when Commerce Secretary Gina Raimondo, Biden’s chief sanctions enforcer, was touring Beijing. That cemented its tech credentials in the eyes of the Chinese public. Sales grew seven consecutive quarters on strong demand for that device.

One sign of Huawei’s woes is its silence in 2024 on the processor powering its upcoming flagship smartphones, which are emerging later than the Mate 60 Pro did.

Huawei is set to unveil its next-generation Mate 70 on Nov. 26. But it didn’t advertise any hardware specifications when it began taking orders this week. In past months, Huawei has instead touted progress with its Harmony mobile operating system.

“Whether through improved multi-patterning or the creation of domestic EUV tools, China still faces significant challenges in achieving 5nm production with profitable yields and sufficient volume,” Yole’s Liu said.