British firms are being forced into ‘damage control’ mode as tax hikes leave CEOs questioning whether to invest in U.K., industry chief warns

Since the U.K.’s Labour government released its budget last month, the resounding tone within businesses has been of panic and concern over a steep tax increase worth £40 billion, largely funded by hikes in employers’ contributions to national insurance.

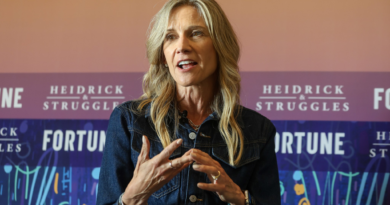

Higher business charges will leave firms scrambling to control costs while ensuring profits remain unharmed and put them in “damage control” mode, according to the CEO of the Confederation of British Industry (CBI), the country’s most influential lobby group.

“Tax rises like this must never again be simply done to business,” said CBI’s Rain Newton-Smith at the group’s annual conference held on Monday. ”Too many businesses are having to compromise on their plans for growth.”

In a survey conducted after the budget, CBI found that half the 266 firms that responded are considering slashing headcounts while nearly two-thirds might halt hiring plans.

Businesses were considering shutting shop and moving to other countries with tax-friendly policies even in anticipation of the budget—a sentiment that seems to have deepened since Chancellor of the Exchequer Rachel Reeves announced the exact measures.

High-profile CEOs have commented on how new fundraising policies are hurting the U.K.’s already waning investment appeal. For instance, McVitie’s biscuit maker Pladis’s chief, Salman Amin, lauded Britain for being the group’s “greatest investment” around the world.

Yet, given the new policies that are likely to hurt every aspect of business, he lamented how it was “becoming harder to understand what the case for investment is” at the CBI conference.

Other retailers have also flagged similar concerns around increased costs, particularly the increase in the minimum wage, which was also announced as part of the budget. Sainsbury’s chief, Simon Roberts, cautioned that higher costs for employers would push inflation up just when it’s been brought to normal levels.

Since the autumn budget was announced in October, tensions between businesses and the incumbent government have increased. Although Reeves has defended the measures as necessary to improve public services and undo the damage done by predecessors to the state of public finances, they will squeeze margins for businesses and leave them gasping for breath.

This could hurt the U.K. economy’s growth prospects, which it has been parched for as it struggles to expand and compete with rivals like the U.S. meaningfully.

Academics argue that while the government needs to find ways to raise money, that could come from taxing excess profits rather than a single tax that applies to all employers, big and small.

“When you hit profits, you hit competitiveness, you hit investment. You hit growth,” Newton-Smith said.

The CBI boss praised the government’s efforts to increase capital spending and said that the lobby group would launch a “Blueprint for Competitiveness” highlighting the areas of work that would improve the U.K.’s business environment.