Veteran market watcher Komal Sri Kumar warns of a ‘cloud of uncertainty’ and makes a bold call: 'My base case is something breaking…in the next 3 months'

After the Federal Reserve started raising interest rates to fight the rise of inflation in March 2022, Wall Street’s top minds released a steady stream of recession predictions. Surely, they warned, rising borrowing costs, sky-high consumer prices, and geopolitical tensions would combine to slow the economy to a standstill—or worse. Some even argued that a “major recession,” an economic “hurricane,” or “another variant of a Great Depression” could be on the way.

But it’s been more than 20 months since the Fed’s first rate hike and we’re all still waiting for the experts’ nightmare scenarios to become reality. The labor market has remained relatively robust; GDP continues to grow; and inflation is falling back towards the 2% target rate.

The economy’s resilience has led some forecasters to revise or retract their pessimistic predictions. There’s even a growing group of experts who believe a “soft landing”—where interest rate hikes reduce inflation without sparking a recession—is now the most likely outcome for the U.S. in 2024.

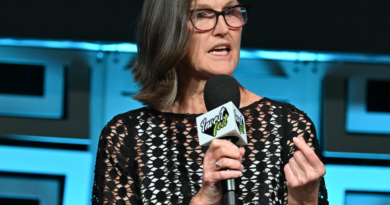

But Komal Sri-Kumar, founder and president of the macroeconomic consulting firm Sri-Kumar Global Strategies, isn’t buying the optimism. “My base case is something breaking,” he bluntly told CNBC Tuesday.

A veteran market watcher who spent years at the asset manager TCW Group as a chief global strategist before starting his own consulting firm, Sri-Kumar said he doesn’t foresee “anything specific” breaking, but there are so many fragile areas of the economy after 20 months of interest rate hikes that he’s sure something will crack—and soon. “I think you’re going to see a decisive moment come within the next three months,” he warned.

What might ‘break’

Sri-Kumar’s top areas of concern include the ailing commercial real estate market and banking sector, among many others. The commercial real estate sector has famously struggled due to rising borrowing costs over the past two years, with the office space segment being particularly affected as the persistence of the work-from-home trend leads to rising vacancies. Sri-Kumar warned that there could be more fallout to come in this sector in 2024, as office owners attempt to refinance their loans with interest rates at their current high levels.

Commercial real estate’s issues also play into Sri-Kumar’s biggest concern—“troubled loans” at banks. The veteran market watcher pointed to a recent study from the Kansas City Federal Reserve which found that U.S. banks have $550 billion in unrealized losses on their securities holdings. Unrealized losses were a major contributor to the panicked bank run that took down Silicon Valley Bank in March, making them a big concern for banks, especially if the economy begins to crack and loan defaults rise.

“At some point, it breaks,” Sri-Kumar said of banks’ rising unrealized losses, adding: “I don’t know whether it is this morning or a morning three months from now. And that’s the reason why you’re operating perennially in a cloud of uncertainty.”

The bulls are still on parade—for now

Sri-Kumar is one of many economists who have warned—and continue to warn—of impending economic doom over the past few years. But so far, in 2023, bulls have been rewarded for their faith in the U.S. economy.

The S&P 500 has returned roughly 19% to investors year to date, nearly making up for the losses it suffered in 2022 during the first phase of the Fed’s interest-rate-hiking campaign. At the same time, GDP grew 4.9% in the third quarter, surprising economists, and inflation has fallen from its 9.1% peak in June 2022 to an annual rate of just 3.2% in October.

For Jan Hatzius, chief economist at Goldman Sachs, the solid data is a sign that we’re headed for a soft landing. “We’ve already gotten through the biggest hit from the tightening without the economy having entered a recession,” he said on the latest episode of Bloomberg’s Odd Lots podcast.

Hatzius sees just a 15% chance of a U.S. recession over the next 12 months, which matches the average historical odds. It’s a stance that clashes with many of his Wall Street peers, however.

A number of top economists believe that the Fed won’t be able to truly tame inflation with interest rate hikes unless there is a significant rise in unemployment—owing to the Phillips Curve, an economic construct that argues that inflation and unemployment have an inverse relationship.

But Hatzius believes the old Phillips Curve model just doesn’t work. “Look at the scoreboard all around the world, and it’s really not just the U.S., we’ve seen this decline in inflation without much labor market weakness. It is possible,” he said.

The famed economist said he’s feeling more confident that the hard part of the Fed’s inflation fight is over and the economy has room to run. However, he cautioned that, in this uncertain economic environment, it’s important for forecasters to have “humility.” No one really has a crystal ball.