JPMorgan's head of research says immigration is undeniably a ‘good thing’ for the economy, as the bank forecasts even higher US GDP growth this year

The growth prospects for the U.S. economy in 2024 are bright. After a few years of concerns that the economy might be thrust into a recession, forecasts predict a healthier growth rate that implies the soft landing is really under way. That promising news could be due to an unexpected and overlooked part of the U.S. economy, but one that’s long been critical to its success throughout history: immigration.

Many of the recent economic forecasts underestimated the economic boost people moving to America would bring to the economy, according to JPMorgan head of global head Joyce Chang.

Immigration is a “good thing,” Chang said on CNBC Thursday.

Its benefits to the economy remain underreported, she argues. “One thing that was really underestimated in the U.S. was the immigration story,” Chang told CNBC.

Nonetheless Chang isn’t oblivious to the fact immigration remains a hot button issue. “Now it is a political issue, not just here in the U.S. but [also] in Europe, it’s probably the number one issue right now, but when you look at the unemployment numbers and the strength of consumption, the immigration was a big part of that,” she said.

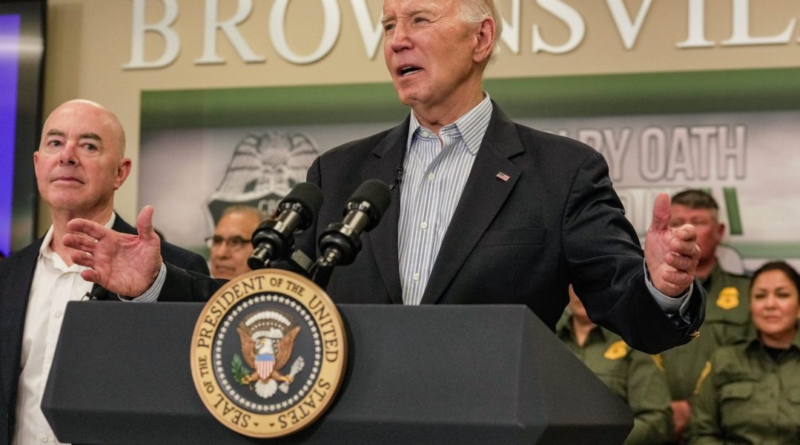

Immigration has long been seen as one of the most contentious issues in U.S. politics. The ongoing presidential election will almost certainly center heavily on immigration. During his tenure in office, former President Donald Trump curbed immigration policies, making it harder for people from other countries to come to the U.S. Trump has vowed to renew those policies should he win. Meanwhile, President Biden has already reversed his predecessor’s policies, opening the door to millions of immigrants and asylum seekers.

While the politics are contentious, economics are clear, according to Chang. “From everything that we have seen, the revenues that are generated exceed the expenses,” she said.

That’s led JPMorgan to be more optimistic about the U.S. economy’s growth rate for the year. The bank recently revised its full year forecast for the U.S. GDP growth rate by a “one full percentage point,” according to Chang. JPMorgan now expects the U.S. GDP to grow 1.3% in 2024 as opposed to the 0.3% it had previously expected.

That number is still much lower than the Federal Reserve’s though. Although the bank and the Fed did find common ground that things were trending up for the U.S. economy. Last week the Fed also raised its forecast for GDP growth from 1.4% to 2.1%.

Government organizations backed up Chang’s claims. The Congressional Budget Office released a report that estimated immigration would contribute an additional $7 trillion to the U.S. GDP over the next ten years.

A big portion of the growth JPMorgan’s increased optimism through comes after realizing it had undercounted the value of immigration. Especially now that the unemployment rate is relatively low. Although it did creep up to 3.9% in February after hovering around 3.5% for almost a year. Immigration is important for the job market during low unemployment because it helps businesses looking for workers find people to fill open jobs.

“The U.S. population is almost 6 million higher than it was two years ago or so, and so that has accounted for a lot of the increase in consumption, when you see the very low unemployment numbers as well.”

A JPMorgan analysis, which combines CBO data with its own, estimates that immigration added about 3.3 million people to the U.S. last year and expects a similar number this year. When all those new people come into the U.S. they participate in the economy—getting jobs, spending money, building savings accounts—all of which serves as motor oil for the U.S’s economic engine.

The U.S. economy is heavily dependent on consumer spending so the more people who live, work, and spend money the better the U.S. economy is able to keep chugging along. Juicing consumer spending is a critical component to pulling off the rare soft landing the Fed hoped to achieve in its efforts to tame inflation.

Immigrants also help fill jobs in the U.S., which was vital during a time of record high employment, which made it harder for businesses to fill job openings they had.

Moody’s chief economist Mark Zandi said immigration was “taking pressure off the economy” by keeping the workforce strong throughout the country.

In an analyst note from JPMorgan Chase, chief U.S. economist Michael Feroli expanded on the importance of immigration to the job market. “It’s been important to the surprising pace of job growth, even alongside a modestly increasing unemployment rate,” Feroli wrote earlier this week.

Keeping the unemployment rate low in recent months has been a triumph of the U.S. economy. As the Fed, lawmakers, and the White House all fought to lower inflation all the conventional wisdom said that for that to happen unemployment would have to rise. Instead it has stayed below 4% throughout the almost two-year fight against inflation.