These 5 misconceptions about China's slowing economy could lead to U.S. complacency, expert warns

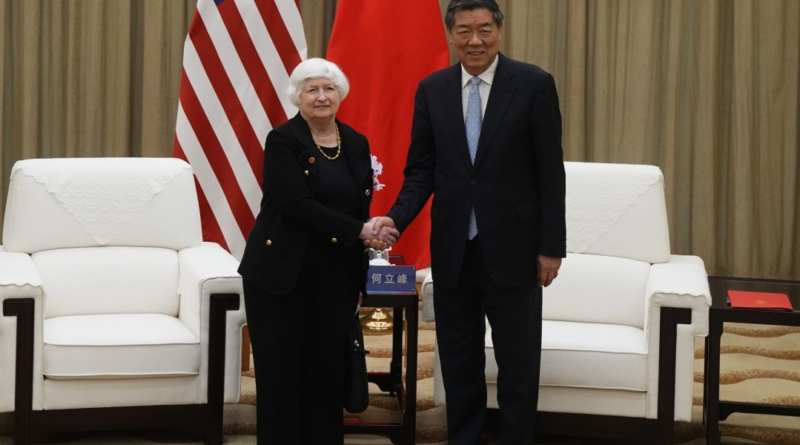

U.S.-China economic relations are in focus as Treasury Secretary Janet Yellen visited Beijing on Sunday, seeking to ease tensions amid mounting disagreements.

The push to improve cooperation comes as China’s economy suffers from slowing growth, a real estate crisis, high youth unemployment, and U.S. restrictions on key technologies, such chips critical to artificial intelligence.

That has led to predictions that the decades-long growth story is coming to an end or even a so-called lost decade of stagnation. Pointing to China’s aging population, veteran strategist Ed Yardeni last year said the country could become “the world’s largest nursing home.”

But a top China expert warned against such pessimism, saying it could lead the U.S. to grow complacent and put its economic and security priorities in Asia at risk.

“While its growth has slowed in recent years, China is likely to expand at twice the rate of the United States in the years ahead,” wrote Nicholas Lardy, a senior fellow at the Peterson Institute for International Economics, in Foreign Affairs on Tuesday.

He pointed to five misconceptions about China’s economy.

The first one relates to the view that China is no longer gaining ground on the U.S. economy. While China’s GDP did drop from 76% of U.S. GDP in 2021 to 67% in 2023, Lardy attributed that to “transitory” factors such as the outflow of foreign capital and the weakened exchange rate.

“The International Monetary Fund forecasts that Chinese prices will pick up this year, which would boost China’s GDP measured in renminbi,” he added. “Its nominal GDP measured in U.S. dollars will almost certainly resume converging toward that of the United States this year and is likely to surpass it in about a decade.”

The second misconception is that income, spending, and consumer confidence in China are weak, which Lardy said aren’t supported by the data. Instead, he said real per capita income rose 6% last year, with growth in consumption outpacing that rate.

The third misconception he highlighted is that deflation in China is entrenched. While consumer prices largely stagnated last year, Lardy said core prices, which exclude food and energy, rose 0.7%. To be sure, prices of tools and certain raw materials fell in 2023, but that was due to lower prices for energy and other commodities, which have since rebounded this year.

The fourth relates to lower property investment, which has traditionally been an outsized driver on China’s economy. To be sure, housing starts in 2023 were half what they were in 2021, Lardy acknowledged.

“But one has to look at the context. In that same two-year period, real estate investment fell by only 20%, as developers allocated a greater share of such outlays to completing housing projects they had started in earlier years,” he explained. “Completions expanded to 7.8 billion square feet in 2023, eclipsing housing starts for the first time.”

The fifth misconception is that Chinese entrepreneurs are fleeing the country as Beijing cracks down on businesses, especially on the tech sector. While the private sector’s share of total investment fell after 2014, Lardy said that was due mostly to the property market. Excluding real estate, private investment rose almost 10% last year, he added. He also pointed to data that show the number of family businesses grew by 23 million in 2023 to 124 million enterprises.

“Although China is beset by many problems, including those resulting from Xi’s efforts to exert greater control over the economy, exaggerating these problems serves no one,” Lardy warned. “It could even lead to complacency in the face of the very real challenges that China presents to the West. That is particularly true for the United States.”

He predicted China will continue to account for a third of global growth and expand its economic footprint. “If U.S. policymakers under-appreciate this, they are likely to overestimate their own ability to sustain the deepening of economic and security ties with Asian partners.”

Among U.S. and European executives, however, views on China have turned gloomier. Standard Chartered CEO Bill Winters said in February that the recent slide in the world’s second largest economy is the result of a lack of confidence, with both foreign investors and Chinese consumers reluctant to put their money into the country.

In addition, Beijing’s raids on local offices of Western companies operating in China have sent a chill through the hundreds of U.S. companies doing business there.

The U.S. and China have ramped up trade tensions, while Beijing’s data privacy law and counterespionage law have prompted warning from the State Department that U.S. companies could be at risk for doing business there.

“The vast majority of companies are trying to figure out how to reduce their supply chain from there, manufacturing there—everything that has to do with coming out of China, they’re trying to reduce or eliminate as fast as they can,” a recently retired CEO told Fortune earlier this year.