Remember, you don’t have to wait for election results to profit from presidential bets

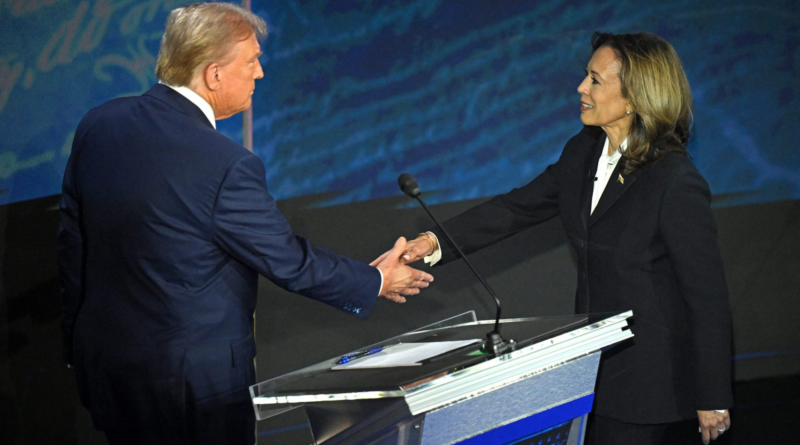

Interest in election prediction markets has surged as presidential polls show a tightening race, with recent momentum tilting toward Donald Trump and away from Kamala Harris.

Bettors can use the markets for a range of potential outcomes, not just who will secure the White House, and they get paid once the winners are declared.

But it’s also worth noting that the bets placed on the election work like shares on financial markets, meaning that traders can also sell them and lock in profits—even before election results are determined.

Kalshi points out that traders can close their positions by holding them until settlement or cashing them in early. Of course, that sets up Kenny Rogers’ eternal dilemma: You’ve got to know when to hold ’em; know when to fold ’em.

“If you believe the market has reached its peak or is starting to move against your prediction, you can sell your position early to secure your profits,” Kalshi says on its site. “This can be a strategic move to avoid potential losses, but it also means forgoing any additional gains that might have occurred if you had held the position.”

Kalshi also notes that because prediction markets are now legal, the platform works with market makers like Susquehanna International Group to provide millions of dollars in liquidity, enabling traders to buy or sell as needed.

Similarly, PredictIt points out that users can sell shares early as prices go up and down.

“The value of your shares will change over time,” it says on the site. “You may decide to sell your shares later on, either to take some profit or stop a loss. Or, you can hold onto your shares until the market closes.”

Like other financial markets, presidential predictions can also be skewed by a so-called whale making massive bets.

That was the case with Polymarket, which said one trader in France was responsible for the lion’s share of bets on a Trump win, to the tune of $28 million worth of crypto.

Polymarket said it made contact with the trader and found no evidence of market manipulation, saying the trader was “taking a directional position based on personal views of the election.” The site added the French trader agreed “not to open further accounts without notice.”

Still, some experts praise prediction markets for their accuracy under the premise that since real money is on the line, it serves as a better indicator of voter sentiment.

Kalshi cofounder and CEO Tarek Mansour recently echoed that sentiment, telling Fortune that the betting market is more reliable than polling.

“People don’t lie with money,” he said.