Uber's strong quarter could be a good sign for the economy

Strong earnings from Uber may say more about the state of the economy than just Uber’s dominance of the ride-share market. It signals an important shift in how Americans are spending their money.

Uber released its fourth quarter earnings on Wednesday that beat analyst expectations for revenue. Sales grew 49% year-over-year, helping to lift Uber’s stock by 11% for the week.

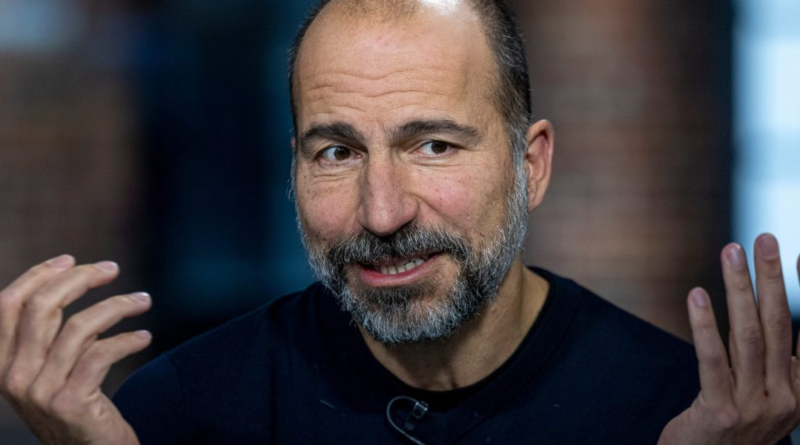

“We delivered our strongest quarter ever in Q4, capping off our strongest year,” Uber CEO Dara Khosrowshahi said in a statement, adding that the pandemic’s impact on Uber’s business is now “well and truly behind us.”

The ride-sharing company was especially hard-hit by the pandemic after growing explosively in the decade prior. At the height of pandemic-induced lockdowns in spring of 2020, Uber’s business contracted by as much as 80% in some cities, while between April and June of that year, the company averaged only 55 million customers a month, down from 99 million in 2019.

But Uber’s return to growth also tells another story, as Khosrowshahi pointed out that the company’s good fortunes stem from a bigger change in how Americans spend their money: After years of primarily spending on durable goods, a pandemic-induced effect that contributed to some of the soaring inflation over the past year, people are finally spending money on services again.

While Khosrowshahi said Uber is cautiously evaluating the economic landscape as recession risks loom large, he is also “more confident than ever in our prospects. We continue to benefit from the shift of consumer spending from goods to services.”

America’s spending shift

The reorientation of U.S. consumer spending in 2020 towards goods rather than services may have been one of the most lasting economic effects from the pandemic’s early days, when many people were forced and then voluntarily decided to forgo vacations, working out at the gym, and eating out at restaurants.

At the same time, American households did well financially because of stimulus money, which in 2020 led to a national increase in disposable income of $1.8 trillion, according to a 2021 Fed study. The reduced spending on services was replaced by a surge in purchases of durable goods, as people outfitted their home gyms and remodeled their homes.

But surging demand for goods had some nasty side-effects, as it created supply bottlenecks that, combined with pandemic-induced lockdowns in manufacturing plants and shipping hubs globally, contributed to rising U.S. inflation beginning in 2021, which Americans are still dealing with.

A return to more balanced spending between goods and services could help ease inflationary pressures by reducing stress on supply chains, and Uber’s strong earnings are the latest signal that spending is returning to an equilibrium. Service spending in the U.S. increased 2.6% during the fourth quarter of last year, according to the Bureau of Economic Analysis’ latest GDP reading, as Americans resumed spending money on trips and other services despite rising inflation.

Uber CEO Khosrowshahi said he sees the spending shift away from retail and back to services as still having momentum in an interview with CNBC Wednesday.

“During the pandemic you saw a huge shift to spend in retail, and now coming out of the pandemic you’re seeing the shift come out of retail and into services, and by the way that shift isn’t over. We’re not back to pre-pandemic levels in terms of spend on services” he said. “We’re not seeing any signs of consumer weakness at this point.”

Learn how to navigate and strengthen trust in your business with The Trust Factor, a weekly newsletter examining what leaders need to succeed. Sign up here.